Macroscope | Russian invasion of Ukraine could send the battered global economy into recession

- A Russian invasion of Ukraine and the sanctions such a move would elicit could destabilise global trade, causing untold economic damage

- After two years of economic downturn and supply-chain disruptions, the world needs a chance at crisis-free recovery, which means peace is essential

The world economy is still in a state of fragile recovery from the Covid-19 pandemic and the last thing it needs is the shock of a serious conflict in Ukraine. The stakes are high, tensions are increasing and the damage to global economic confidence would be incalculable.

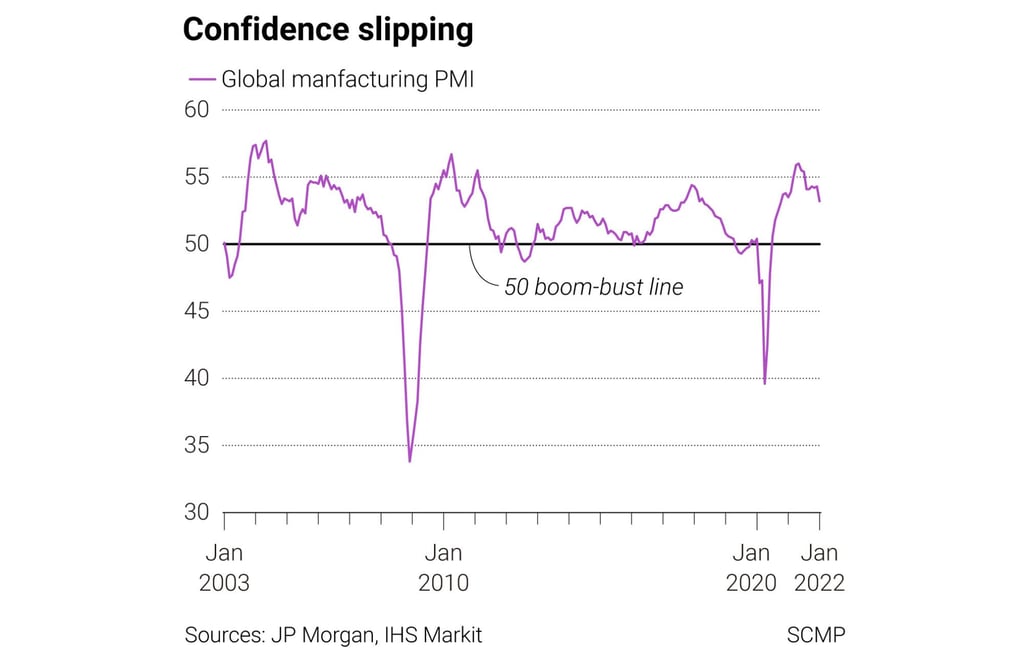

The world needs every opportunity for crisis-free recovery at the moment. After the pandemic-driven downturn in 2020 and the related supply-chain shortages last year, the global outlook is still under a cloud. Economic morale is slipping, with the J.P. Morgan/IHS Markit global manufacturing purchasing managers’ index edging back to 53.2 in January, a 15-month low for factory activity.

The global PMI has signalled growth for 19 successive months but the outlook is less settled. The US and Europe are seeing continued expansion but at a weaker pace, while manufacturing activity in China is on the verge of contraction.