Inside Out | As war in Ukraine emboldens US protectionists, free trade is losing its ability to hold the peace

- Biden is pushing his protectionist agenda as raging shortages and rising prices are made worse by the war, amid US worries over its dependency on China

- If a wedge is driven against China, then the consensus over the value of free trade weakens further – along with its power to foster peaceful cooperation

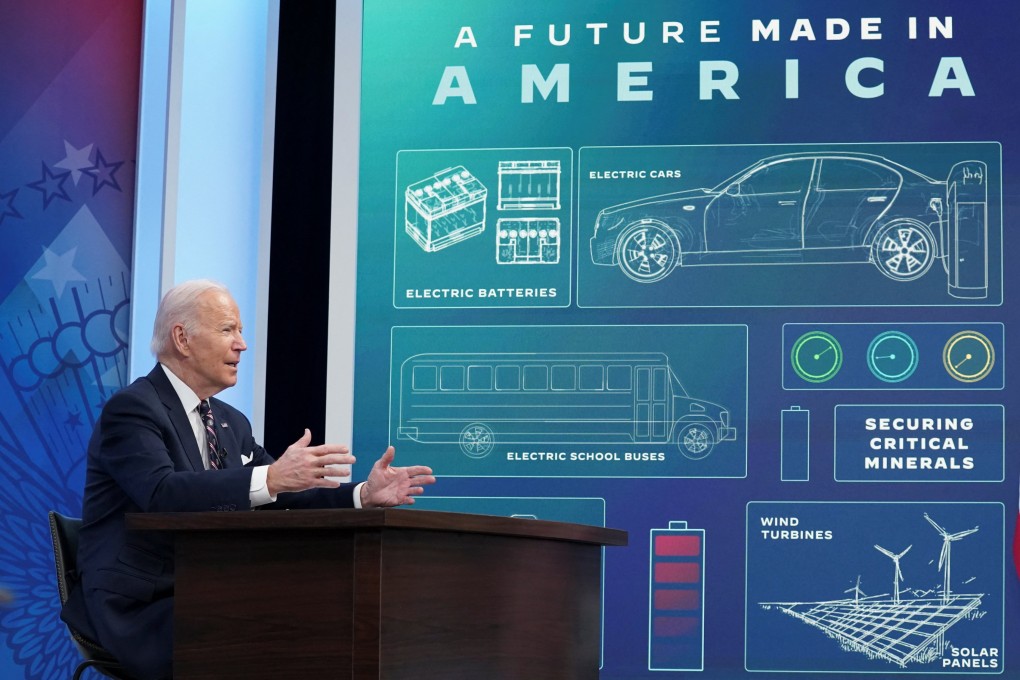

“When we use taxpayers’ dollars to rebuild America, we’re going to do it by buying American. Buy American products. Support American jobs [ …] We’ll buy American to make sure everything from the deck of an aircraft carrier to the steel on highway guardrails is made in America,” he said.

He promised to “make more cars and semiconductors in America, more infrastructure and innovation in America, more goods moving faster and cheaper in America, more jobs where you can earn a good living in America. Instead of relying on foreign supply chains, let’s make it in America.”

Biden’s election may have restored civility and an openness to multilateral cooperation to US foreign policy, but the espousal of protectionism has also moved firmly to the heart of US foreign and trade policies.