China must end its monetary policy easing cycle and raise interest rates to stabilise the yuan

- Beijing needs to allow fiscal stimulus to carry the burden of economic regeneration to stay on its 5.5 per cent growth track

- Rather than reckless expansion, China needs an intensive investment spending campaign to boost domestic growth and ease market fears

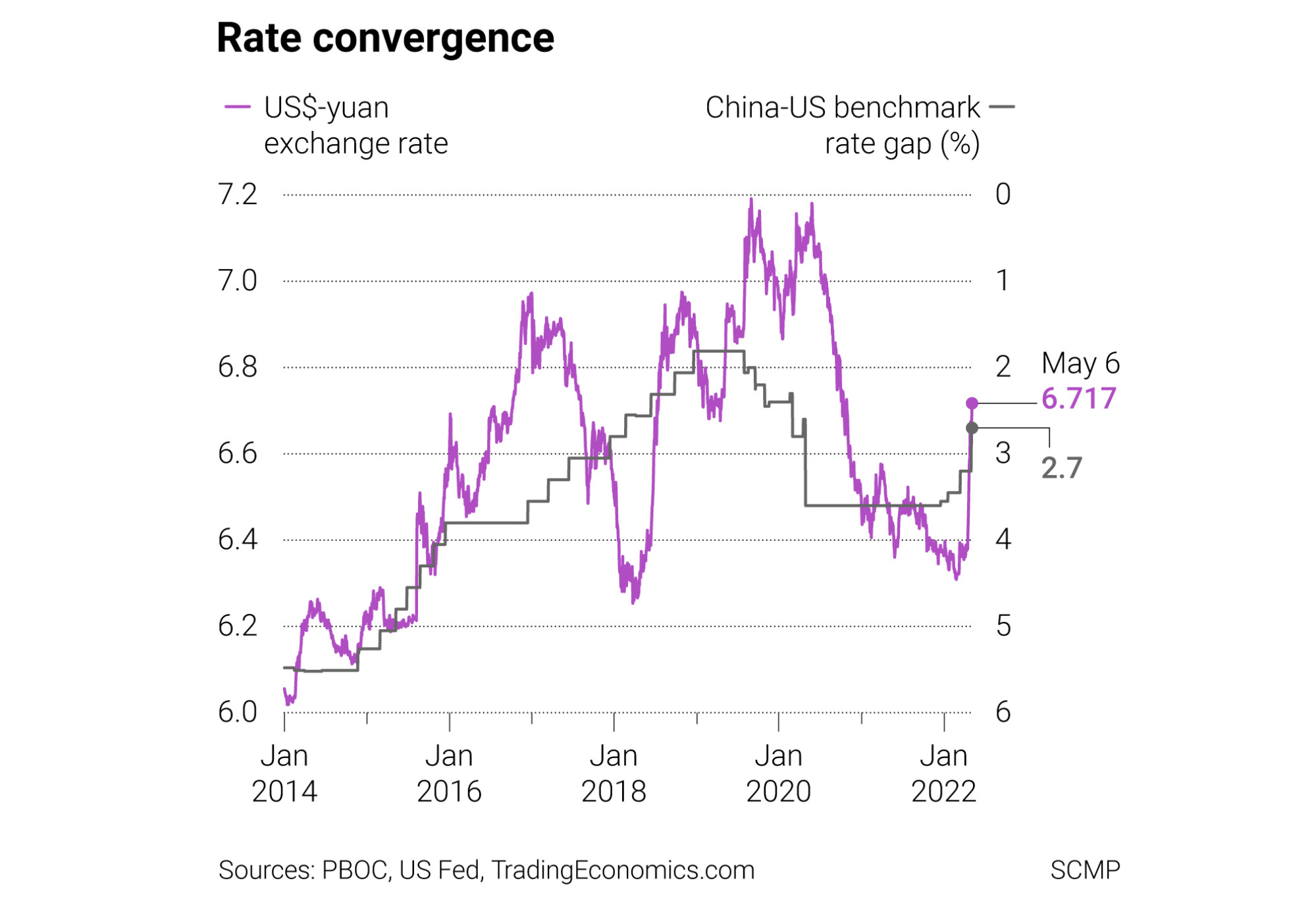

In the past few weeks, the renminbi has lost about 5 per cent of its face value against the US dollar. Global investors are weighing the relative risks of China easing interest rates again while the Fed has stepped up its tightening campaign by signalling its intention to move more aggressively against inflation.

After last week’s half a point increase, the benchmark Fed funds rate has moved to 1 per cent. The general perception is that it could be heading towards 3 per cent or higher in this tightening cycle.

The perception that China’s interest rate differential over the United States will continue to narrow is worrying investors, especially when global risk assets are under pressure and the US dollar is in such strong demand as a safe haven.

Headline inflation still has some way to go before it hits Beijing’s 3 per cent target, but monetary policymakers cannot afford to be seen lagging behind while inflation risks are surging around the world.

Any semblance of benign neglect will not go down well with currency markets. It will become an uphill struggle for Beijing to keep monetary policy on an easing trajectory while US interest rates are heading higher, the relative rate gap is converging, and the renminbi is under increasing pressure.

With the US dollar-renminbi exchange rate already back beyond 6.7, the last thing Beijing needs is for dollar bears to set their sights on a return to the pre-pandemic peak of close to 7.2 in September 2019. That could effectively blow the government’s 3 per cent inflation target out of the water.

China’s interest rates need to go up, not down. It would mean a bigger government deficit, possibly approaching 5 per cent of GDP this year from the expected 2.8 per cent, but the benefits for faster growth would be worth the effort.

David Brown is the chief executive of New View Economics