Macroscope | Recession risk, inflation, energy crisis: Britain’s economy going from bad to worse

- Projections for the future of Britain’s economy outstrip even the usual winter gloom with recession and a debt crisis on the horizon

- If the government chooses to spend its way out of the current energy crisis, it could end up too much for the market to bear

Economic salvation is nowhere in sight, and the odds of a UK financial market meltdown are mounting. With deteriorating public finances and a worsening balance of payments, Britain could be heading into a major sovereign debt crisis not seen since the 1970s.

UK growth expectations are in retreat, and the odds are that the economy has already fallen into technical recession. Gross domestic product slipped by 0.1 per cent in the second quarter and the third quarter should have dipped even further into negative territory, judging by monthly GDP data showing a 0.6 per cent fall in June alone.

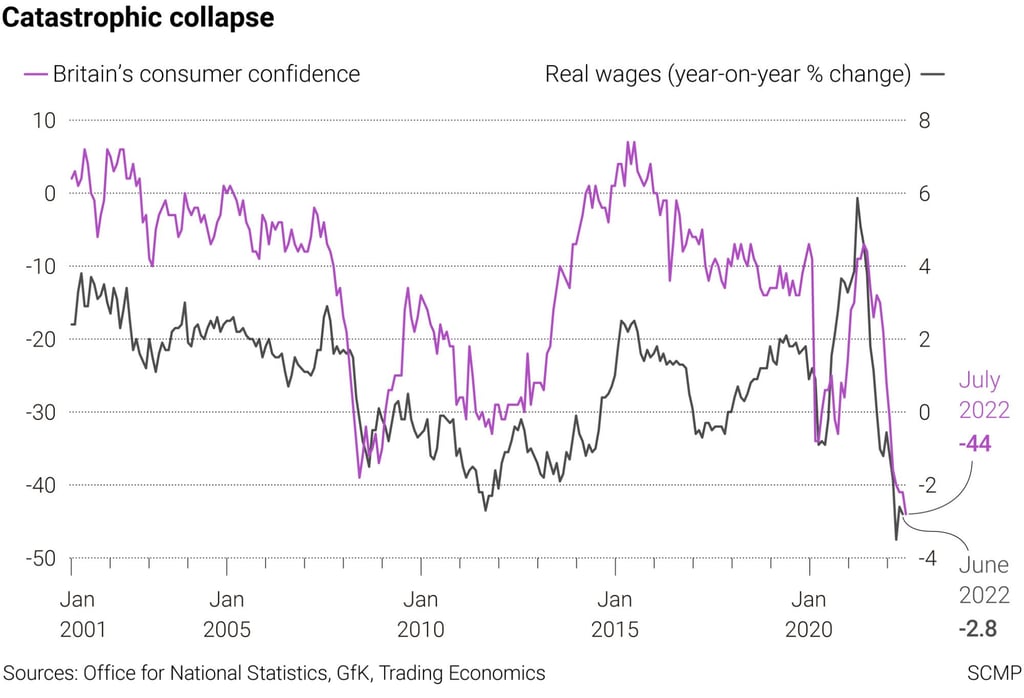

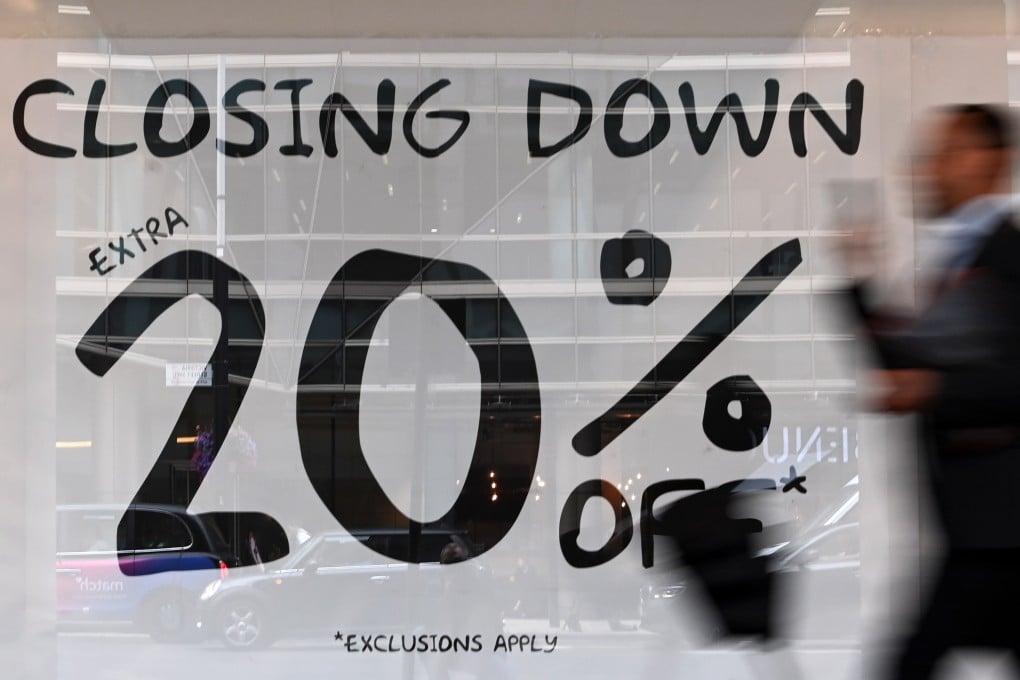

UK consumer confidence has suffered a catastrophic collapse. A debilitating surge in energy prices has caused headline inflation to jump to 10.1 per cent in July, its highest reading for more than 40 years. Rising prices are putting a major squeeze on UK living standards, with inflation-adjusted real wages falling at their fastest rate on record. Unfortunately, it looks like there is worse to come.