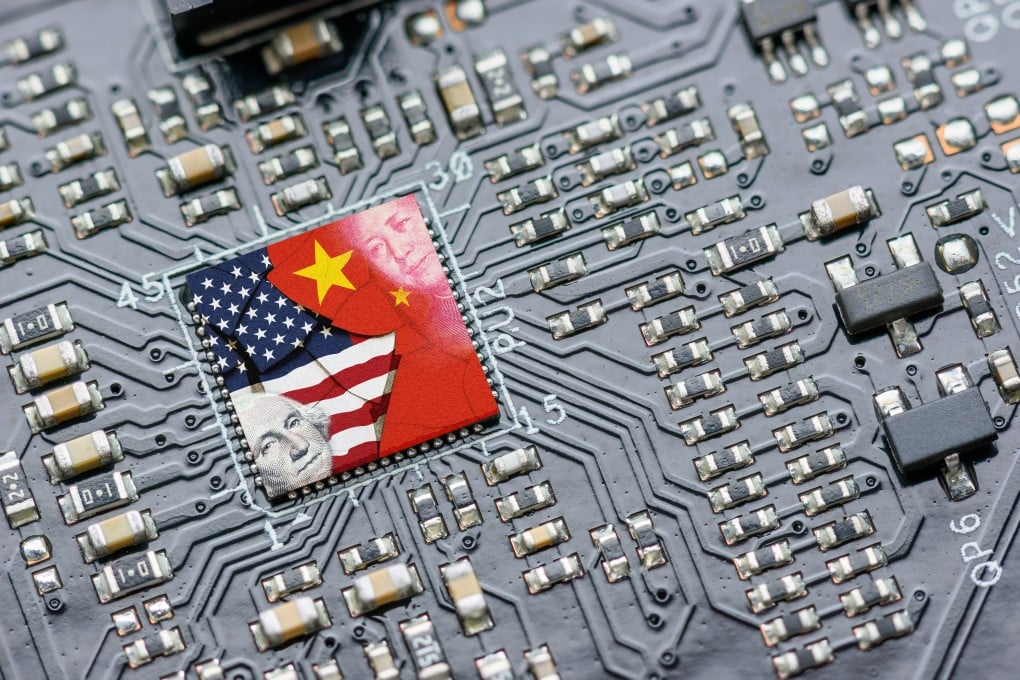

Macroscope | Why an accelerated US-China tech decoupling is truly worrying

- A blanket ban on products that use US technology being sold to China would not just affect China’s tech development and hurt US companies with Chinese business

- It would also rip up global tech supply chains, leaving the world economy with higher inflation and slower growth

The stated US intention is to prevent sensitive technology with military applications from being acquired by China. However, the latest move – which US officials said was necessary to stop China from becoming an economic and military menace – threatens a significant spillover into non-military applications.

Much uncertainty still surrounds the scale of implementation, but if strictly followed through, the announced measures could effectively sanction China’s access to critical inputs for its technological, economic and social development, with far-reaching ramifications.

For example, would other countries be liable if their products sold to China involve US technology? A blanket ban, enforced on a global scale, would have a significant impact on China’s tech development, with material ripple effects on its manufacturing and export sectors.