Advertisement

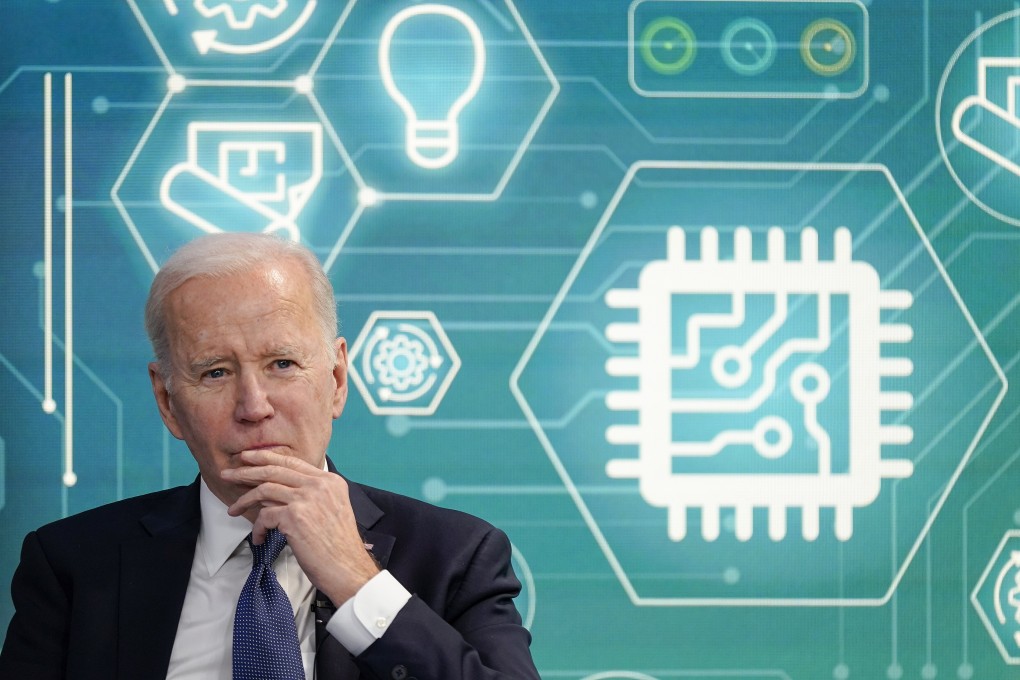

Inside Out | With its chip and battery wars, the US is no defender of free trade

- Biden has gone further than Trump in building a protectionist fence around key industries including advanced chips

- US support for free trade is increasingly in question and Washington should pause to consider how protectionism leads to lose-lose situations

Reading Time:3 minutes

Why you can trust SCMP

36

At a moment when the United States prepares to assume chairmanship of Apec – whose mantra for over three decades has been “free and open trade and investment” across the Asia-Pacific – there are many who fear 2023 is set to see final nails rammed into the coffin of free trade.

A bipartisan consensus in the US in support of free trade since 1958, when Dwight Eisenhower declared in his State of the Union address that free trade is both in the US’s national interest and in the interest of world peace, is crumbling before our eyes.

Some would argue that this process of retreat into protectionism dates back to the 1994 North American Free Trade Agreement (Nafta), with its blatant rules of origin intended to defend the beleaguered US auto industry. But even the most committed of free traders would recognise that US commitment to free trade has been in free fall since the election of Donald Trump in 2016. China’s trade surplus was, he claimed, “the greatest theft in the history of the world”.

Advertisement

For Trump, whether China was trading fairly or not, the trade deficit was justification enough to declare a multibillion tariff war that continues to this day. The priority was to create – and protect – US manufacturing jobs by whatever means necessary.

Two years after Trump’s (hopefully permanent) removal from the White House, his Democratic successor Joe Biden is doubling down, tightening measures to put a protectionist fence around key US industries. While formally targeting China as everyone’s bête noire, the moves have provoked anger and alarm across Europe, and even among strategic allies like South Korea.

Advertisement

The moves are embodied in the US$52.7 billion Chips Act, signed into law in August, and the US$700 billion Inflation Reduction Act. Neither bill bothers to disguise its protectionist intent, nor the contravention of World Trade Organization rules on state subsidies for favoured industries.

Advertisement

Select Voice

Select Speed

1.00x