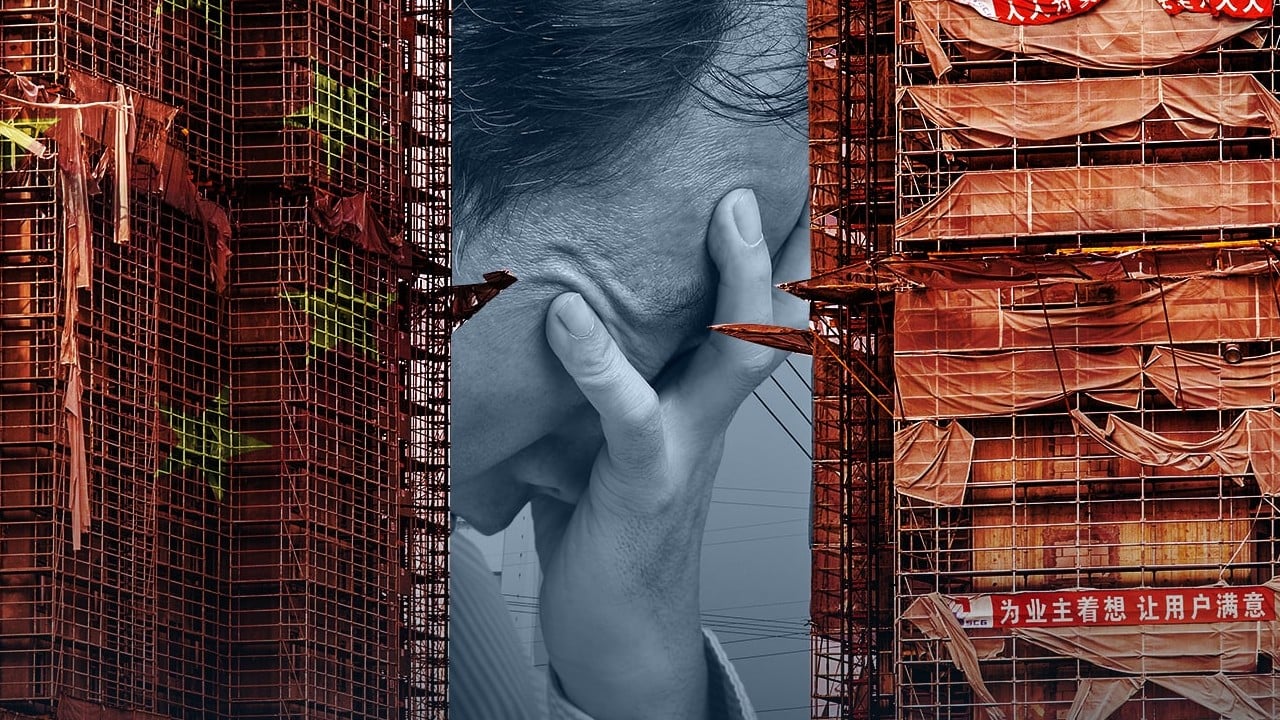

Australia’s property price surge stems from domestic issues, not Chinese buyers

- The market impact of foreign buyers has been exaggerated

- Pointing the finger at foreigners is a distraction from the main problem bedevilling Australia’s housing market – a severe shortage exacerbated by the lack of needed planning reform

This makes the swift recovery in Australia’s property market following the sharpest and fastest fall in house prices on record all the more remarkable. Having plunged 9.1 per cent between April 2022 and February 2023, home values have since risen 4.9 per cent.

The rebound is sharpest in Sydney – the largest and most expensive market – where prices fell 13.8 per cent between January 2022 and January 2023 but have since surged 8.8 per cent, according to data from CoreLogic.

The Reserve Bank of Australia (RBA) has increased rates by almost 4 per cent since May last year. Given the dramatic rise in borrowing costs and the decline in consumer confidence to levels last seen during a recession, few expected Sydney to recover so quickly. “It’s surprising in the sense that consumer sentiment is signalling recessionary conditions, lending is tight and Sydney was unaffordable to begin with,” said Tim Lawless, executive research director, Asia-Pacific, at CoreLogic.

Not so fast. Aside from the fact that the data on foreign investment must be put into context, pointing the finger at overseas buyers is a distraction from the underlying problems bedevilling Australia’s housing market.

“Most of the transactions are no longer foreign transactions, they’re local ones [often involving] the same group of people who bought in the past,” said Peter Li, general manager at Plus Agency in Sydney.

Moreover, the sharp rise in rates and the crisis in China’s own housing market have hit Chinese buyers of Australian luxury properties hard. “It has flushed out the high-end penthouse buyers,” Li said.

Fourth, if any group of investors is to be blamed for driving up Australian house prices, it is local ones who continue to benefit from tax concessions – notably the negative gearing of investment properties that allow landlords to offset losses incurred from renting against their taxable income – that disproportionately benefit higher income earners, many of whom own multiple properties.

Yet, the decisive factor in the sharp recovery in home values in Sydney is the severe shortage of housing which has become more acute since the borders reopened. The rebound in prices “is a good case study of simple supply and demand”, Lawless said.

Foreign investors, in particular Chinese buyers, will remain a convenient scapegoat for the housing affordability crisis, not just in Australia. But even a cursory examination of the main determinants of house prices shows domestic factors are far more consequential. Sydney’s rapidly recovering property market is no exception.

Nicholas Spiro is a partner at Lauressa Advisory