Advertisement

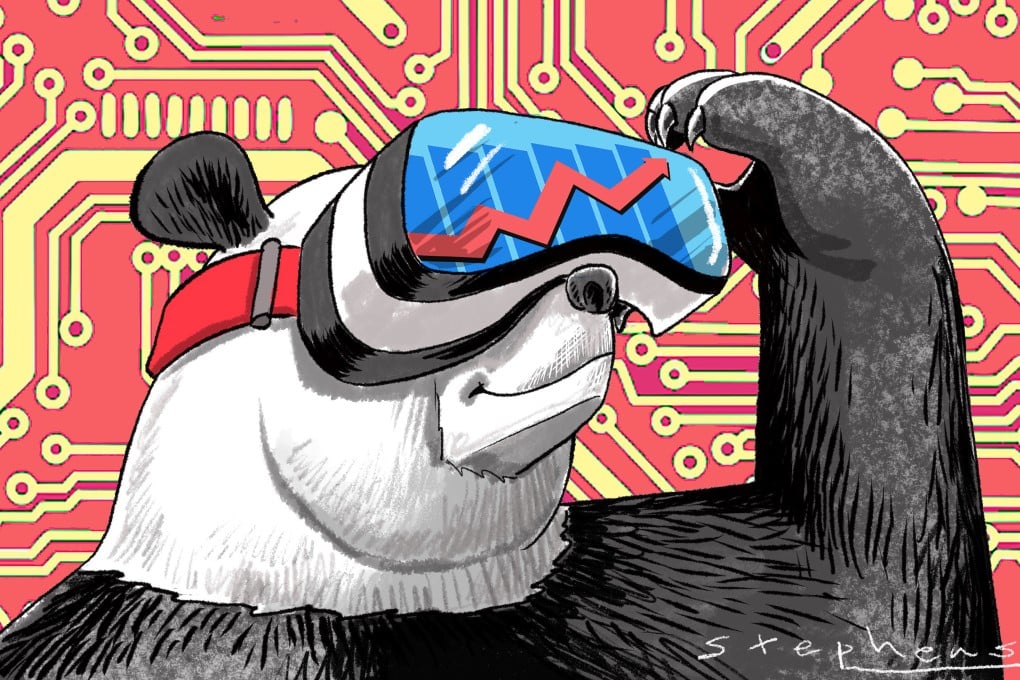

Opinion | Why China will focus on technology but muddle through on policy at NPC meeting

- Next month’s NPC meeting is unlikely to produce any dramatic changes in China’s monetary and fiscal policy or a return of massive stimulus

- Instead, policymakers are expected to continue focusing on technological development and attempts to make domestic firms the core of supply chains

Reading Time:4 minutes

Why you can trust SCMP

6

China is likely to stick to muddling through on its macroeconomic policy at the National People’s Congress meeting next month. Cautious monetary and fiscal policy will prevail. There will not be any large-scale bailouts of the struggling property industry, shadow banking system or distressed local governments.

The real focus will remain on technology for geopolitical competition. The GDP growth rate for this year is likely to be in the middle single digits, which is good enough. Rising competitiveness will eventually bring back healthy growth and a revaluation of the yuan.

The deflating property bubble is weighing down China’s growth. Some might blame the “three red lines” on corporate leverage that burst the bubble, but the real culprit is the bubble itself. The mainland began importing the Hong Kong model in the late 1980s, ramping up land prices to boost local government finances.

Advertisement

The resulting bubble created a massive vested interest group that hijacked government policy and public opinion for two decades. Bubble-backed GDP growth is dangerous – its demise could reduce the size of the country’s GDP, but it would also make the economy healthier in the long run. This is where China finds itself today.

Those who reminisce about the good old days cast envious eyes at the booming stock markets in the United States, Japan and elsewhere, but these are bubbles. Britain and Japan are in recession. The US is holding up the economy with vast and expanding fiscal deficits.

Advertisement

These bubbles float on a bigger bubble anchored on the US dollar-yuan peg, and this big bubble is now threatened by inflation.

Advertisement

Select Voice

Select Speed

1.00x