Advertisement

Macroscope | What it means for Hong Kong if the world turns against the US dollar

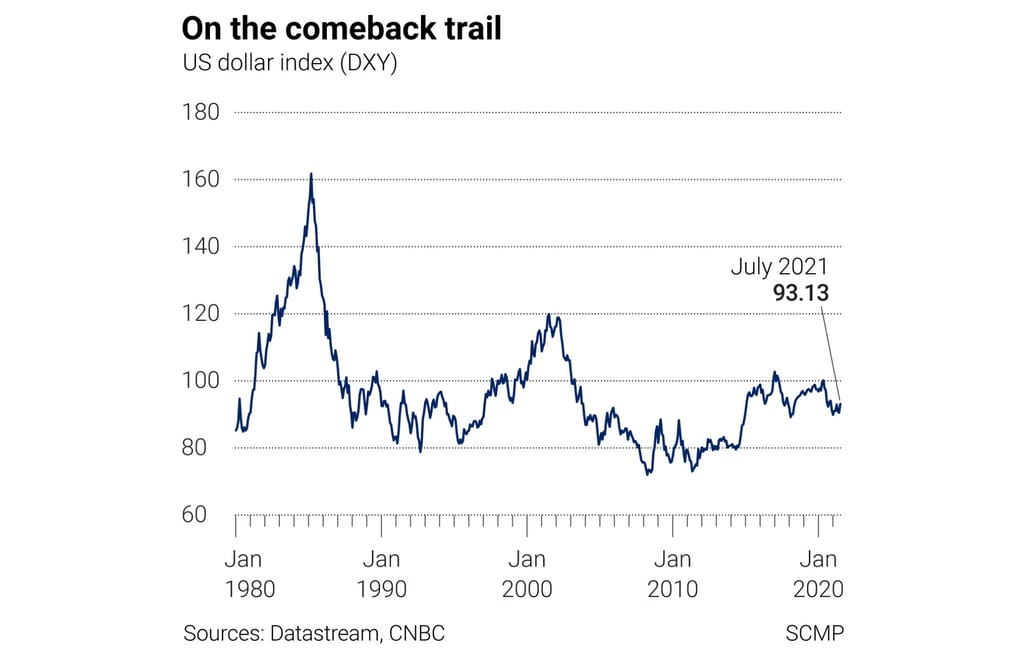

- The safe-haven buying propping up the US dollar will recede. As inflation worries grow, a lax Fed response could turn currency markets away – leaving the Hong Kong dollar at risk

Reading Time:3 minutes

Why you can trust SCMP

10

Could the US dollar lose some of its shine in the currency markets? It is possible. And that would have implications for the value of the Hong Kong dollar versus non-US currencies given that, via the linked exchange system, Hong Kong’s currency is pegged at between 7.75 and 7.85 to the US dollar.

It might seem odd to talk of possible US dollar weakness, when it is still the most dominant currency in the global economy and has been performing pretty well on the foreign exchanges, but what goes up invariably comes down.

Capital flows into the “safe haven” dollar were most pronounced in the first quarter of last year as Covid-19 spread across the world. In part, such flows are likely to continue to support the dollar’s value, with the pandemic still raging.

Advertisement

But the pandemic is becoming endemic. Covid-19 is not going away and the world will have to adapt to live with it.

Unless foreign exchanges see the widespread existence of Covid-19 as supportive of the US dollar in perpetuity, currency markets will necessarily reassess what are to be the key drivers of dollar value.

Recent rises in US inflation may trigger such a reassessment. With the Federal Reserve sticking to its ultra-accommodative monetary policy settings even as some other central banks are addressing local inflationary pressures, foreign exchanges may conclude that the US central bank is being too tolerant of rising prices.

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x