China’s forex reserves fall by US$26 billion amid ongoing capital outflows following Russian invasion of Ukraine

- China’s foreign exchange reserves fell by US$25.8 billion to US$3.188 trillion at the end of March, according to the State Administration of Foreign Exchange (SAFE)

- Officials attributed the 0.8 per cent drop to price changes in the global financial market and volatility in the foreign exchange market

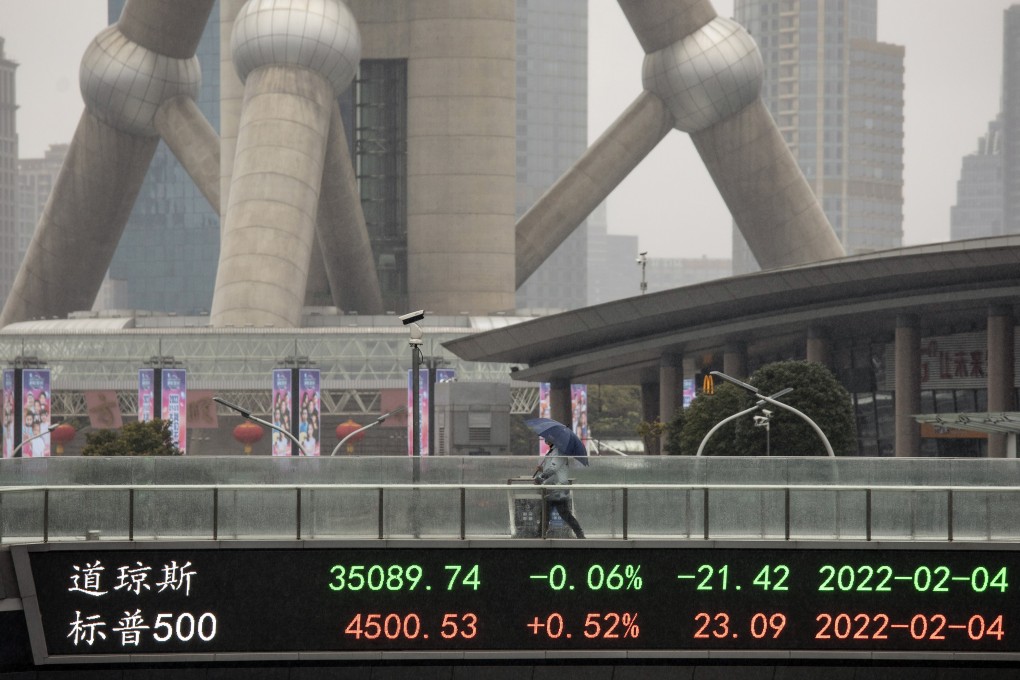

China’s foreign exchange reserves fell by US$25.8 billion at the end of March amid ongoing large outflows from equities and bonds following Russia’s invasion of Ukraine.

Officials attributed the 0.8 per cent drop to US$3.188 trillion to price changes in the global financial market and volatility in the foreign exchange market.

“In the international financial market, affected by the monetary policies of major countries, the geopolitical situation, the resurgence of the coronavirus and other factors, the US dollar index rose, and the bond prices of major countries fell in general,” State Administration of Foreign Exchange (SAFE) spokeswoman Wang Chunying said on Thursday.

“The foreign exchange reserves are denominated in US dollars, and the value of the assets denominated in currencies other than the US dollar declined after being converted into US dollars, along with changes in asset prices that caused the decline of the reserves.”

Short-term fluctuations in cross-border securities investment do not represent a reversal of the long-term trend of foreign investment in China’s capital market

Chinese financial magazine Caixin on Thursday quoted an unnamed SAFE official who said that the exchange regulator still expects foreign investments in yuan-denominated assets to increase over the long run, despite recent volatility.

“Short-term fluctuations in cross-border securities investment do not represent a reversal of the long-term trend of foreign investment in China’s capital market,” the official said.