Patience pays off for brands using Chinese KOLs to boost online sales

Data shows companies will not achieve quick returns on investment as costly mainland marketing campaigns tend to spark slow changes in consumer habits

This article was originally written by Jessica Rapp and was published on Jing Daily

Brands want to see results when they start working with key opinion leaders (KOLs), which is why it can be disheartening when expensive marketing efforts result in low sales generation – at least, at first glance.

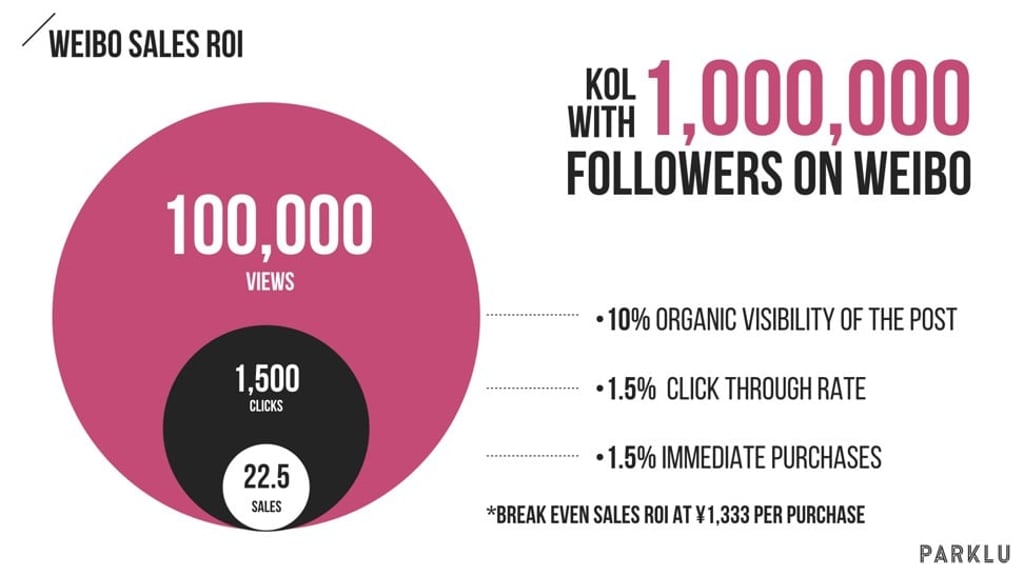

The statistics are gloomy: when a KOL with one million followers on the microblogging website Weibo blogs about a product, they, on average, are going to gain organic views from about 10 per cent of their followers.

About 1.5 per cent of them will click through and, out of this group, only 1.5 per cent will buy something right away, resulting in just 22.5 immediate sales.

For a brand to achieve a break-even return on investment (ROI) from immediate sales, the items sold must be priced at about 1,333 yuan (US$190).

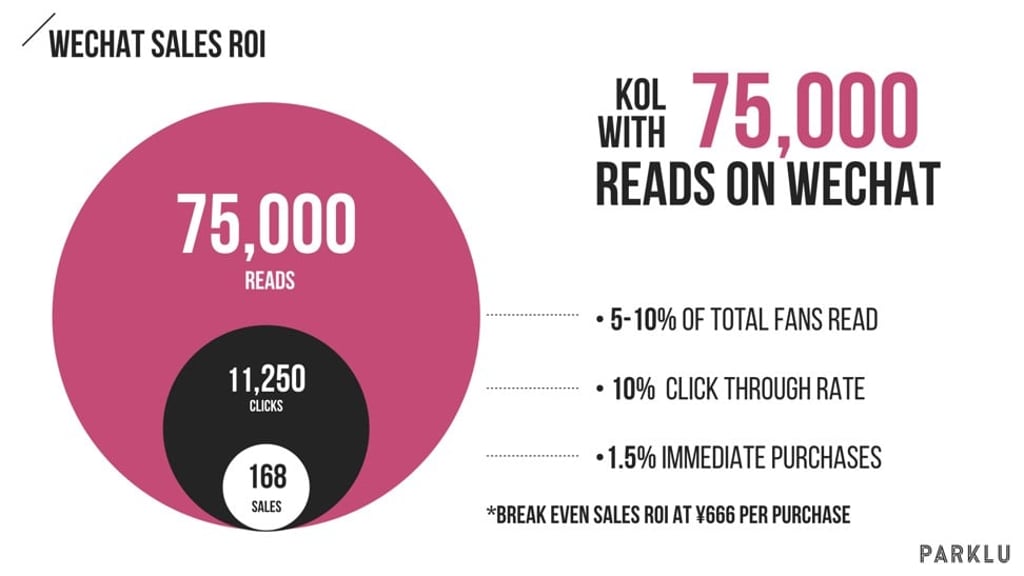

When a KOL with 75,000 average readers on WeChat posts about a product, about 10 per cent of them will click through, and out of this group, only 1.5 per cent will make a purchase right away, resulting in just 168 immediate sales.

For a brand to achieve break-even ROI from immediate sales, the items sold must be priced at 666 yuan.