‘Revenge spending’ is the new fever, post-Covid-19: Hermès in Guangzhou pulls in the VIP crowds; stores across China see more foot traffic

Shopping-deprived consumers in China are embarking on huge spending sprees after being on lockdown, in quarantine, and observing months of social distancing

As Wuhan’s near three-month lockdown finally eases, China has started to show signs of recovery from the Covid-19 epidemic. How soon will it take for the much-awaited “revenge spending” to kick in and save the luxury market in China. The term, first coined in China, refers to a situation where shopping-deprived consumers embark on spending sprees after quarantines and social distancing.

While foot traffic begins to increase at physical stores, will the sentiment of spenders bounce back soon enough, or will the dampened desire to shop for luxury benefit more money-conscious, discount-driven items? STYLE looks at how various stakeholders are bracing themselves for resurrection post-coronavirus.

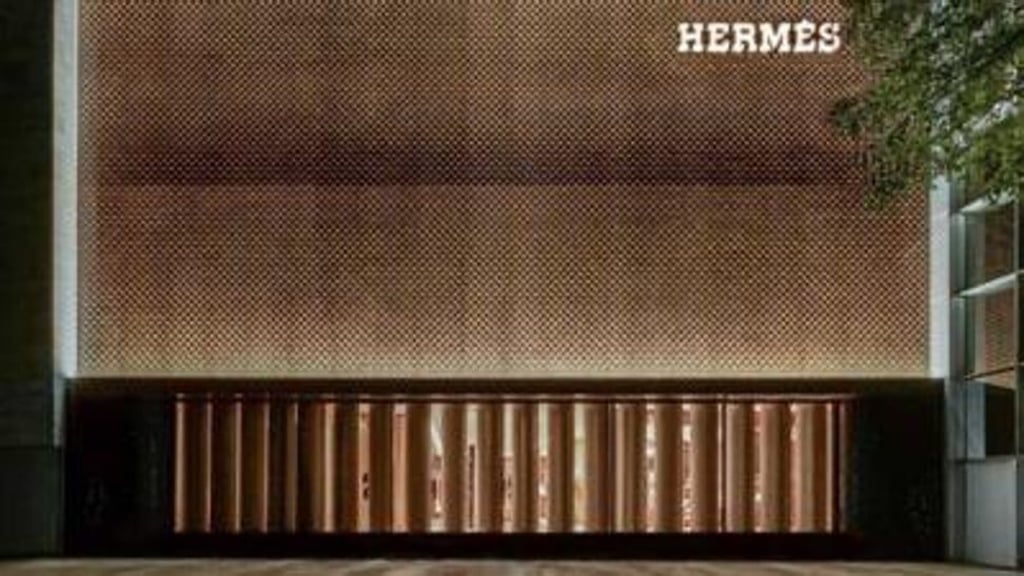

VIP crowd flock to Hermès in Guangzhou over Easter

Maison Hermès is benefiting from the rebound of desire to shop for luxury items in China. WWD reported that the maison’s Guangzhou flagship store made at least 19 million yuan (US$2.69 million) in sales when it reopened on Saturday, April 11 thanks to a strong VIP contingent eager to buy everything from Birkins to ready-to-wear and furniture. The 5,500 sq ft store was designed by Parisian architecture firm RDAI.

An embroidered Hermès Birkin bag was one of the few limited-edition items on offer to celebrate the reopening of the store.

Government, malls and stores give away vouchers to encourage spending

According to China Commerce Association for General Merchandise, 90 per cent of shopping mall counters surveyed are operating as usual, while almost 80 per cent of merchants observed customer foot traffic of 50 per cent or more than before the Covid-19 outbreak.