Opinion / Why Chinese millennials are willing to max out their cards for luxury goods

As a group that desires instant gratification, young people are willing to embrace a life of debt in order to own high-profile luxury goods – from Gucci bags to Chanel jewellery – but is this a sustainable spending model?

This article was originally written by Yiling Pan for Jing Daily

The Chinese dream of luxury brands is largely dependent upon the nation’s millennial and Generation-Z shoppers, whom global management consultants Bain & Company estimated would account for 46 per cent of purchases in that market by 2025.

But what if this promising outlook is partially fuelled by debt?

A recent HSBC survey shows the debt-to-income ratio of China’s post-90s generation (typically born between 1990 and 1995) has reached a staggering 1,850 per cent.

Meanwhile, the average debt this group owes to a variety of lending and credit-issuing institutions is more than 120,000 yuan (US$17,433).

To make a comparison, that is nearly half the debt of US millennials, who on average owe US$36,000, according to latest figures from US financial services firm Northwestern Mutual’s 2018 Planning & Progress Study.

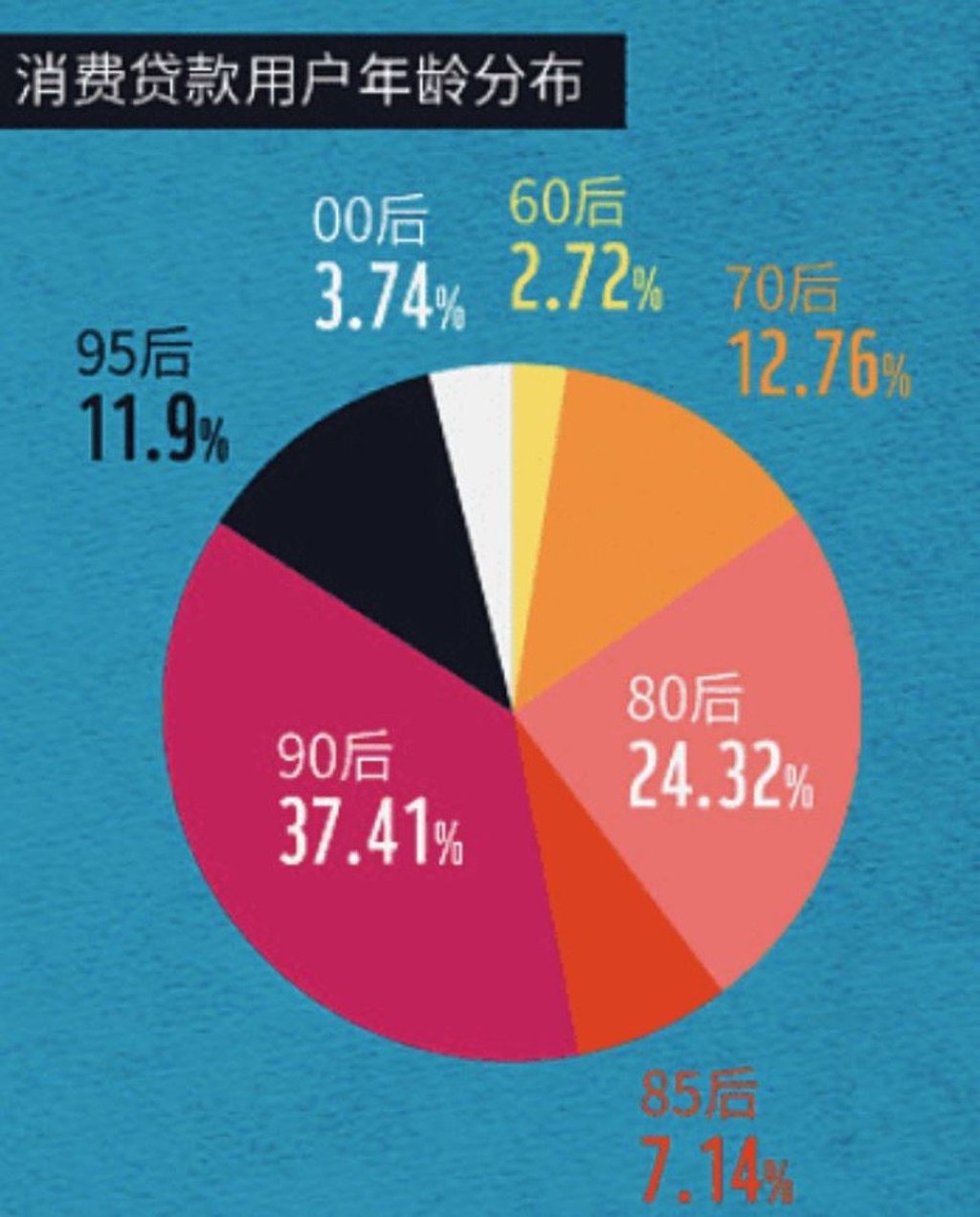

Data released by US-listed Chinese financial lending platform Rong360 indicates that about 85 per cent of applicants for consumer lending in China were born after 1980. A detailed breakdown of the survey shows that 24 per cent of lending applicants were born between 1980-84, 7 per cent in 1985-89, 37 per cent in 1990-94, 12 per cent in 1995-99, and 4 per cent after 2000.

Young Chinese may decide to embrace a life with debt for several reasons. As a group that desires instant gratification, running into debt to pre-own a high-profile luxury item that they will only be able to acquire in the future is certainly acceptable.

Yu Runting, a 26-year-old mainland woman working in a marketing and public relations firm in Shanghai, is one of them. Yu’s monthly net income is only RMB 9,000 (US$1,316) of which some 95 per cent goes on rent, basic necessities and other expenditures.