Rich Chinese say no to WeChat for luxury - here's why

Survey reveals where consumers working in senior executive roles in China read about luxury brands and their offerings – and the findings are surprising

This article was written by Yiling Pan and originally published in Jing Daily

According to a new report by Chinese media outlet Fortune, marketing on WeChat for luxury brands could be a bust for the country’s highest earners. A survey was sent to 32,900 consumers working in senior executive roles in China, with 831 of them submitting responses – and most don’t use WeChat to keep track of luxury brands.

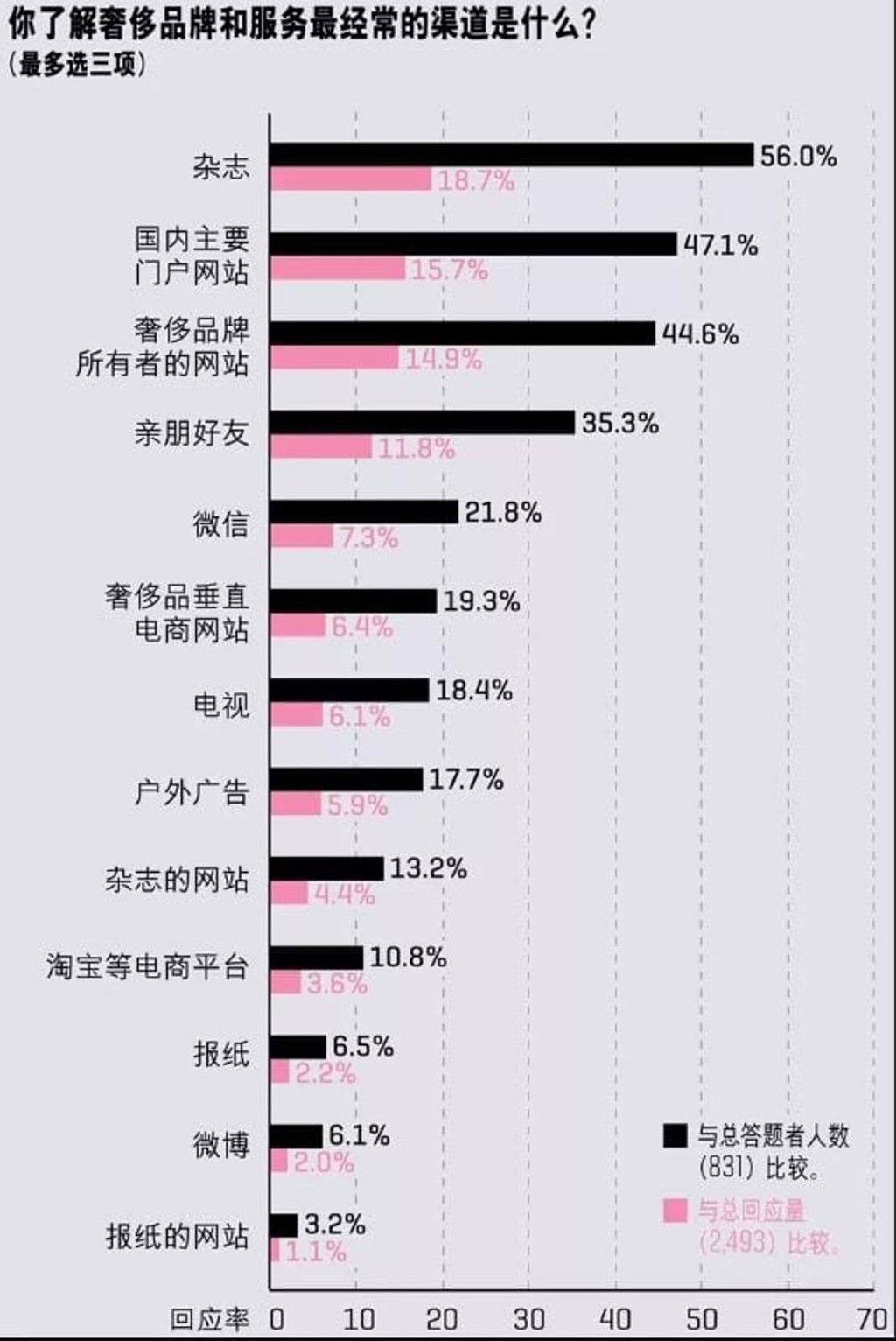

When asked where they usually read about luxury brands and their offerings, magazines surprisingly topped the list of options for respondents – ahead of WeChat, Weibo and e-commerce sites.

For this high-earning demographic, 56 per cent of respondents regularly use magazines as a way of receiving information on luxury brands, followed by 47.1 per cent using major media outlets, 44.6 per cent going straight to a brand’s website, and 35.3 per cent taking information from family and friends. Only 21.8 per cent of those surveyed followed luxury information accounts on WeChat, and a measly 6.1 per cent used Weibo for luxury.

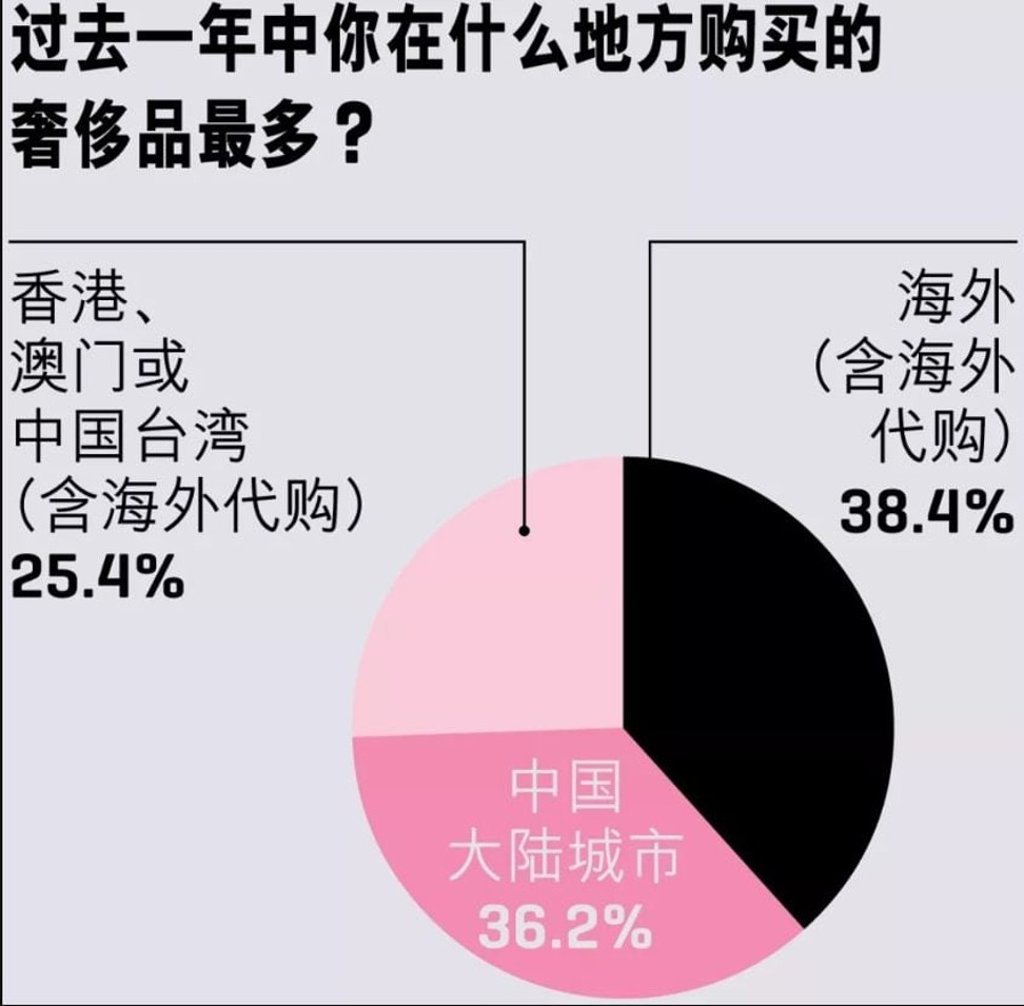

Additionally, travelling and shopping has become increasingly separate for the country’s upper-middle class, according to the report. Around 62 per cent of those surveyed indicated they bought most of their luxury goods in China in 2017 (including Hong Kong and Macau), up from 55 per cent the year before. Only 38 per cent of participants bought luxury items when travelling abroad during the same period, a figure that fell around six per cent from the year before.

Not too long ago, Chinese luxury consumers were known to flock to international fashion capitals like Milan, Paris, New York, and London to purchase luxury products. This was in part due to the huge retail price difference between the mainland and overseas markets, as well as a fear of buying fake items at home. These two factors continue to have a part to play for survey respondents who prefer to buy abroad, but the impact has lessened greatly over time.