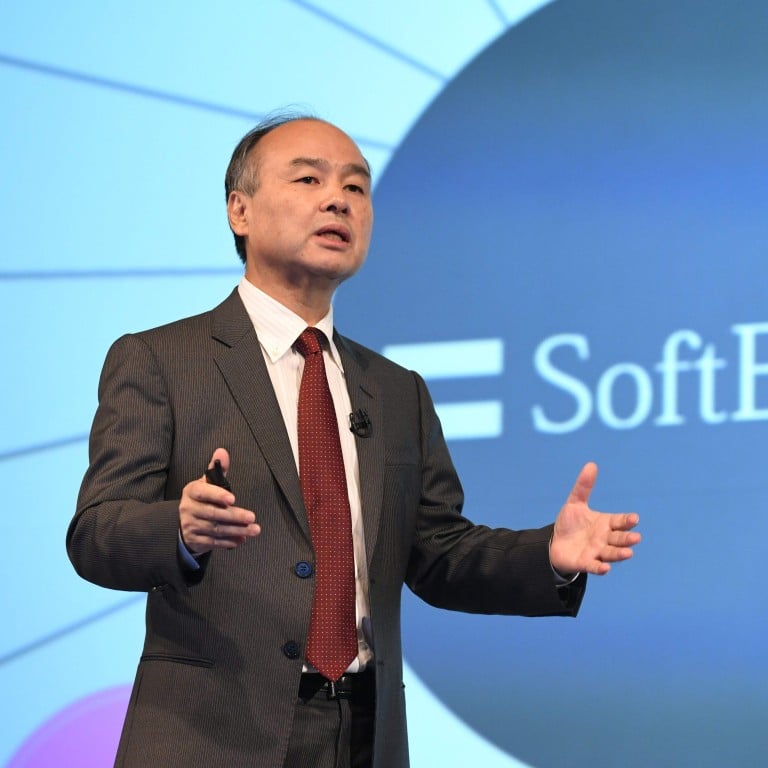

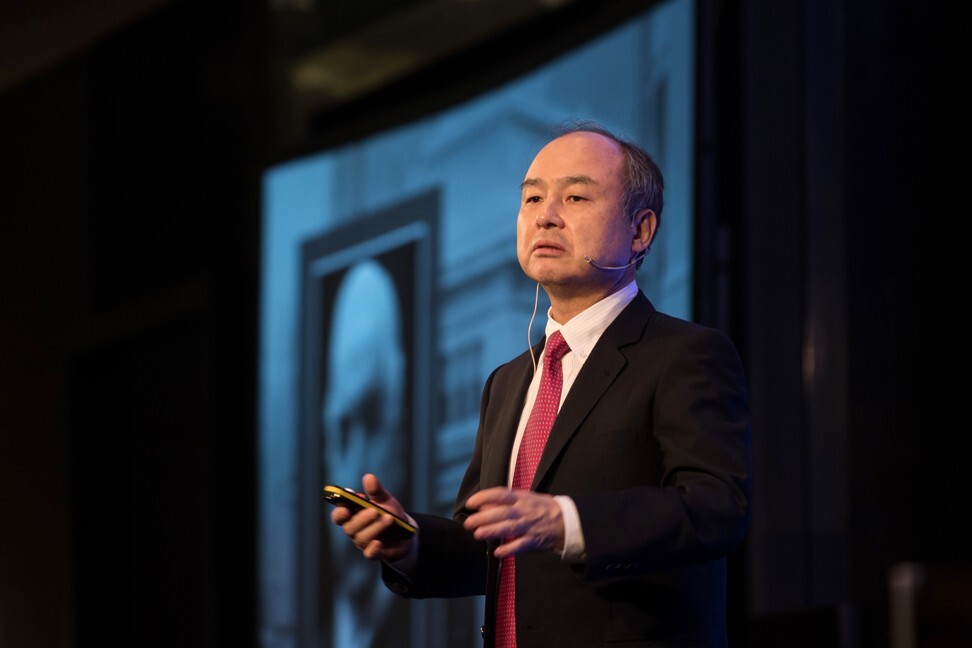

Amazon, Netflix, Uber and Tesla were all backed by Softbank founder Masayoshi Son, but is the Japanese billionaire falling on harder times since the pandemic and WeWork’s failed IPO?

SoftBank’s market value dropped by US$10 billion this week after The Wall Street Journal reported that the company has been placing huge bets on risky tech investments.

And while SoftBank’s founder and CEO Masayoshi Son is the third-richest person in Japan with a US$20.6 billion personal fortune and millions of dollars of real estate in Tokyo and Silicon Valley, this must have hurt.

Through SoftBank and his first US$100 billion Vision Fund, Son has invested millions in some of Silicon Valley’s biggest tech companies in recent years, including Uber, Slack, Amazon, Tesla and Netflix.

Zuckerberg, Gates or Musk – who became a billionaire at the youngest age?

But Softbank was also the biggest investor in WeWork, losing more than US$4.7 billion after the co-working company’s failed IPO.

Most of Son’s wealth comes from his 27 per cent stake in Softbank, which makes him the largest shareholder, according to Bloomberg. However in recent months, SoftBank has been suffering – not least because of the coronavirus pandemic. In April, SoftBank announced that its Vision Fund would suffer a whopping US$17 billion annual operating loss.

So just who is this incredibly wealthy individual with the fate of the world’s biggest companies in his hands – and is it actually the other way around?

He had humble beginnings

Son was born in 1957 to Korean immigrants on the Japanese island of Kyushu. The 63-year-old CEO was one of four brothers, and his father worked at a number of restaurants, farms and fisheries.

Why does PAL’s billionaire CEO Lucio Tan still use an old Nokia phone?

In 1972, when he was 16, something happened that may have changed everything: Son met one of his idols, McDonald’s Japan founder Den Fujita, who encouraged him to study in the United States. Son took his advice and moved to San Francisco the next year to continue senior school. He later went on to study computer science and economics at the University of California at Berkeley.

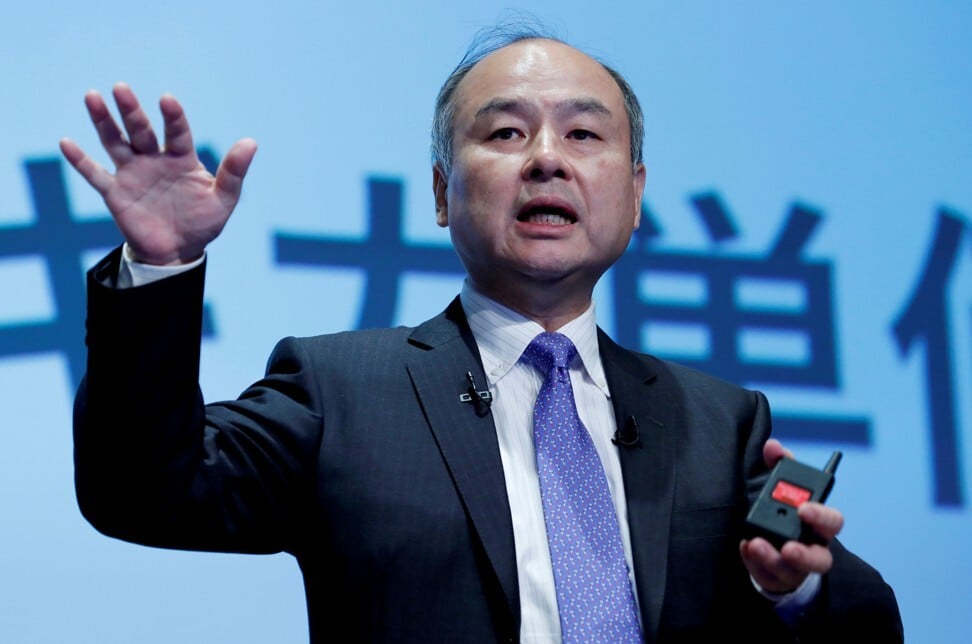

His investment strategies are highly unusual

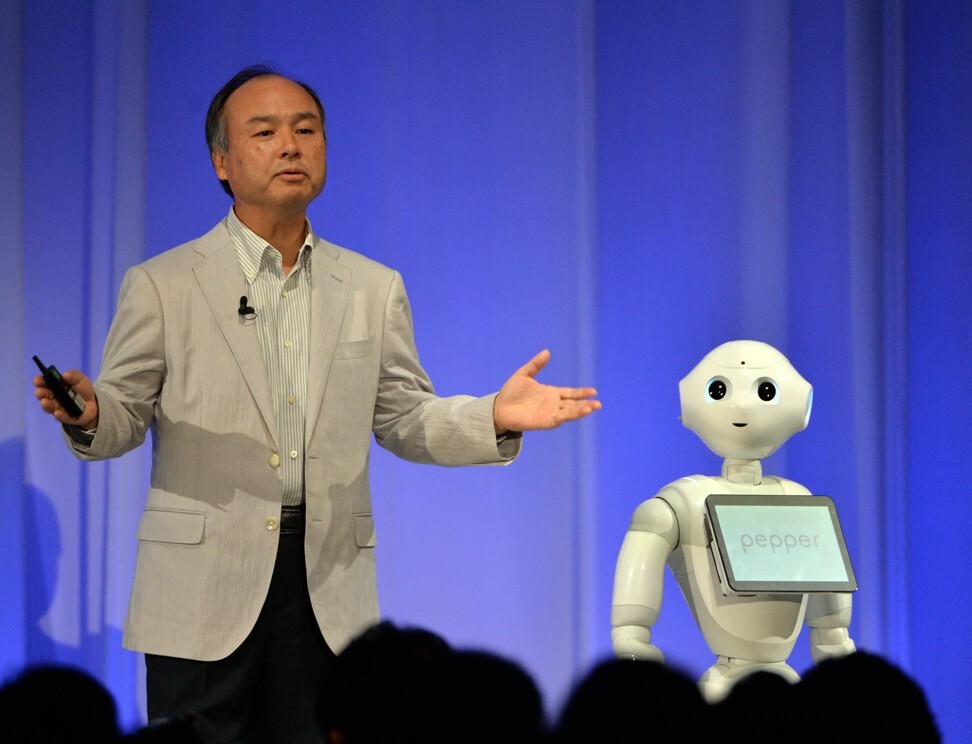

In the 1980s, Son founded SoftBank, the company that today pours billions of dollars of capital into tech start-ups, including through its US$100 billion Vision Fund. Take note, however: Son’s investment strategies are considered unconventional in Silicon Valley.

According to Bloomberg, the sheer size of Son’s US$100 billion Vision Fund shocked Silicon Valley investors.

“The standard VC playbook involves making small, speculative investments in early-stage start-ups and adding funds in follow-on rounds as those start-ups grow”, Sarah McBride, Selina Wing and Peter Elstrom wrote for Bloomberg. “SoftBank’s strategy has been to put enormous sums – its smallest deals are US$100 million or so, its biggest are in the billions – into the most successful tech start-ups in a given category.”

Elon Musk is now the 5th-wealthiest person in the world, so who’s richer?

In early 2019, Fast Company’s Katrina Booker called Son “the most powerful person in Silicon Valley” for his ambitious vision – and financial means – to transform whole industries through his investments in artificial intelligence and machine learning, from real estate to food to transport.

His first Vision Fund would have been half the size without Saudi Arabia’s contributions

Like the rest of Silicon Valley, Son has had to reckon with the presence of Saudi Arabia in the US tech world. “Saudi Arabia’s presence in Silicon Valley is greater than it’s ever been”, Alexei Oreskovic pointed out on Business Insider in 2019.

The SoftBank CEO has direct ties to the controversial country, which has been embroiled in human rights scandals and blamed for the killing of journalist Jamal Khashoggi. In fact, Saudi Arabia’s Public Investment Fund is the SoftBank Vision Fund’s largest backer, having contributed US$45 billion of the fund’s total $100 billion bankroll.

His employees earn a lot more than him

The SoftBank CEO is known for paying his executives handsomely – and he’s far from the highest-paid person at the company.

In 2019, the head of SoftBank’s Vision Fund made US$15 million and its COO made more than US$19 million, according to Reuters. The year before, six of SoftBank’s top executives made US$83 million combined (9.1 billion yen) in compensation in 2018. Meanwhile, Son’s salary rose to just $2.1 million (229 million yen), according to Bloomberg.

Who tops our chart of the 15 richest people in Asia?

His family gets to live in some spectacular properties

The SoftBank CEO owns about US$45 million worth of residential property in Tokyo, according to Bloomberg. And in 2013, he spent US$326 million on Tokyo’s landmark Tiffany Building in the Ginza luxury shopping district.

He also owns a US$117.5 million Silicon Valley estate that comes with a 9,000-square-foot house, a 1,117-square-foot pool house, a detached library, a swimming pool, a tennis court and formal gardens. Son bought the Woodside, California, property in 2012 from private equity investor Tully Friedman, according to Forbes.

How Mukesh Ambani’s family became India’s very own national icons

Son is married and has two children, but he keeps his family life private – so private that we think he has two daughters, but cannot be sure. The CEO married Masami Ohno, the daughter of a prominent Japanese doctor, while they were both students at UC Berkeley, The Seoul Times reported.

He has friends in high places, but will distance himself from them if they mess up

The SoftBank CEO reportedly has personal relationships with billionaire CEOs and entrepreneurs such as Bill Gates, Oracle co-founder Larry Ellison, Rupert Murdoch and Uniqlo boss Tadashi Yanai. In fact it was at Larry Ellison’s Silicon Valley home where Son reportedly first met Steve Jobs.

Son reportedly once had a close relationship with Adam Neumann, the co-founder and former CEO of WeWork, in which SoftBank was once the biggest investor.

WeWork’s valuation has plummeted since September 2019 after its failed IPO attempt in September 2019. Son reportedly “lost faith” in Neumann and wanted him demoted, the Financial Times reported at the time. Just two days later, Neumann stepped down as CEO.

We Work romance: Aengers star Claudia Kim is getting married

SoftBank eventually took control of WeWork in a deal that gave Neumann almost US$1.7 billion and required him to step down as chairman of the board. In May, Son said on an earnings call that he felt “foolish” for investing US$18.5 billion into WeWork.

His second Vision Fund is part-backed by Microsoft, but this time, Saudi Arabia have been left out

In July 2019, the company announced a financial commitment of US$108 billion to its second Vision Fund.

SoftBank confirmed that Apple, Foxconn and others will invest, as well as Microsoft for the first time. However Saudi Arabia is missing from the new list of backers.

The year 2020 is shaping up to be tough, but Son has been careful to keep championing businesses

SoftBank-backed companies including Oyo, Uber, Zume and WeWork have laid off more than 8,000 people since January this year. In a Forbes interview, Son said he predicts that 15 of the companies that the Vision Fund has backed will go bankrupt.

Covid-19 made Jeff Bezos twice as rich as space rival Elon Musk

And in early September this year, SoftBank’s market value took a roughly US$10 billion hit after The Wall Street Journal reported the extent of its large investments in risky tech stocks.

However in June, as protests over racial injustice and the death of George Floyd swept the globe, SoftBank announced the launch of a US$100 million fund to invest in entrepreneurs of colour.

“When it comes to diversity, SoftBank absolutely has to do better as an employer, investor, and partner. But we cannot just talk – we have to put money behind it, set plans, and hold ourselves accountable”, COO Marcelo Claure wrote in an email to employees. “This fund will only invest in companies led by founders and entrepreneurs of colour.”

This article originally appeared on Business Insider

Want more stories like this? Sign up here. Follow STYLE on Facebook, Instagram, YouTube and Twitter .

The numbers and rapid changes of fortune are dizzying, but par for the course for SoftBank CEO Masayoshi Son, whose upbringing as the son of Korean immigrants couldn’t be further from his current life – but is he worried after SoftBank’s market value suddenly dropped by US$10 billion this month?