TOPIC

/ company

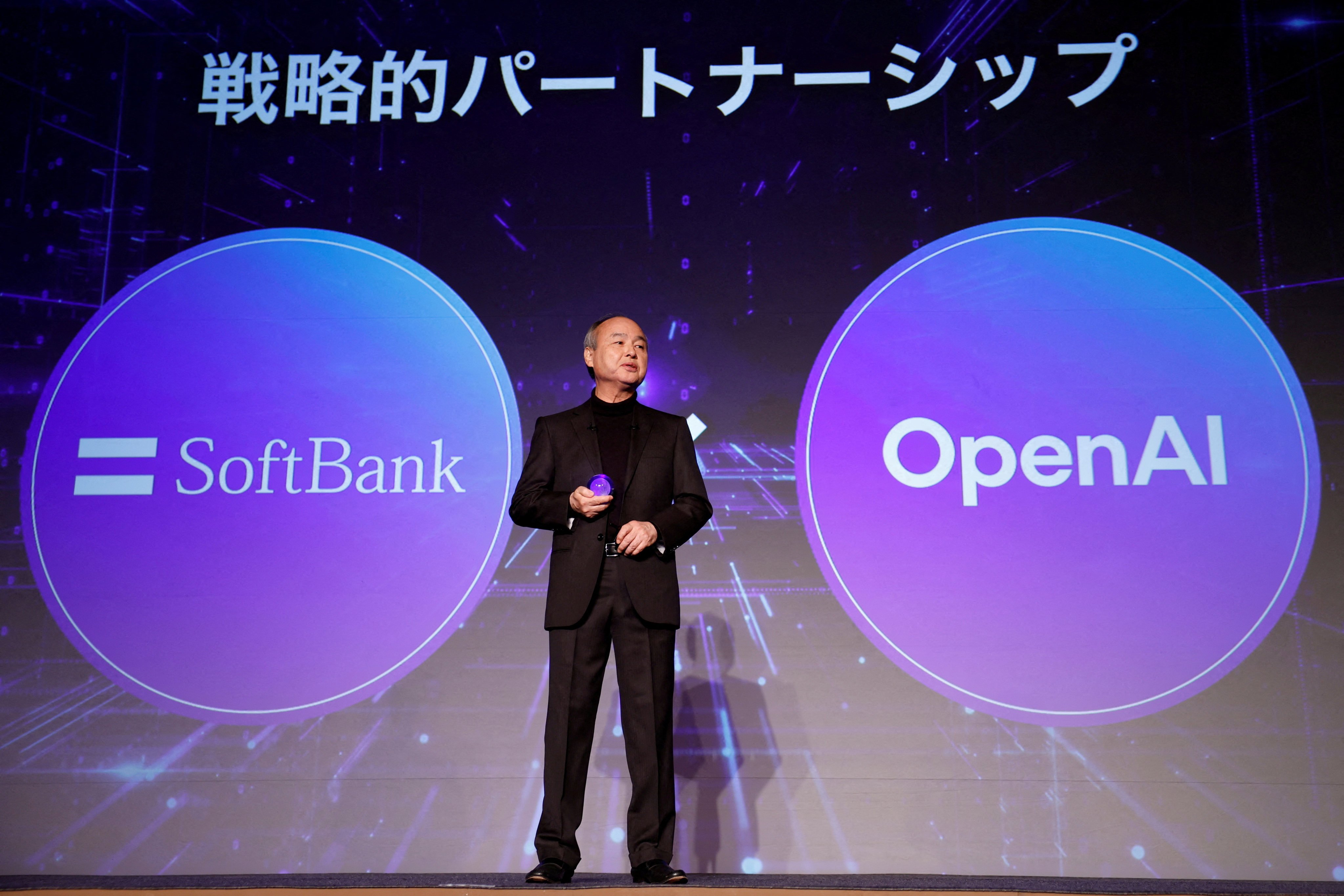

Softbank

Softbank

SoftBank is a Japanese telecommunications and internet company with operations spanning broadband, fixed-line telecommunications, e-commerce, the internet, finance, media and marketing, and other businesses.<br />

Chairman / President

Masayoshi Son

CEO / Managing Director

Masayoshi Son

CFO / Finance Director

Yoshimitsu Goto

Industry

Conglomerate

Website

softbank.jp

Headquarters address

SoftBank Group Corp.,1-9-1 Higashi-Shimbashi,Minato-ku, Tokyo 105-7303,Japan

Stock Code

TSE:9984

Year founded

1981

Help preserve 120 years of quality journalism.

SUPPORT NOWAdvertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement