Warren Buffett prefers Berkshire Hathaway invest in Japan than Taiwan due to US-China rivalry, faults US for bank crisis

- Warren Buffett said he is more comfortable deploying capital in Japan than Taiwan, reflecting the growing tensions between the US and mainland China

- Buffett also said messaging from US government over the regional banking crisis had been ‘poor’, suggesting that is why confidence has not returned among consumers

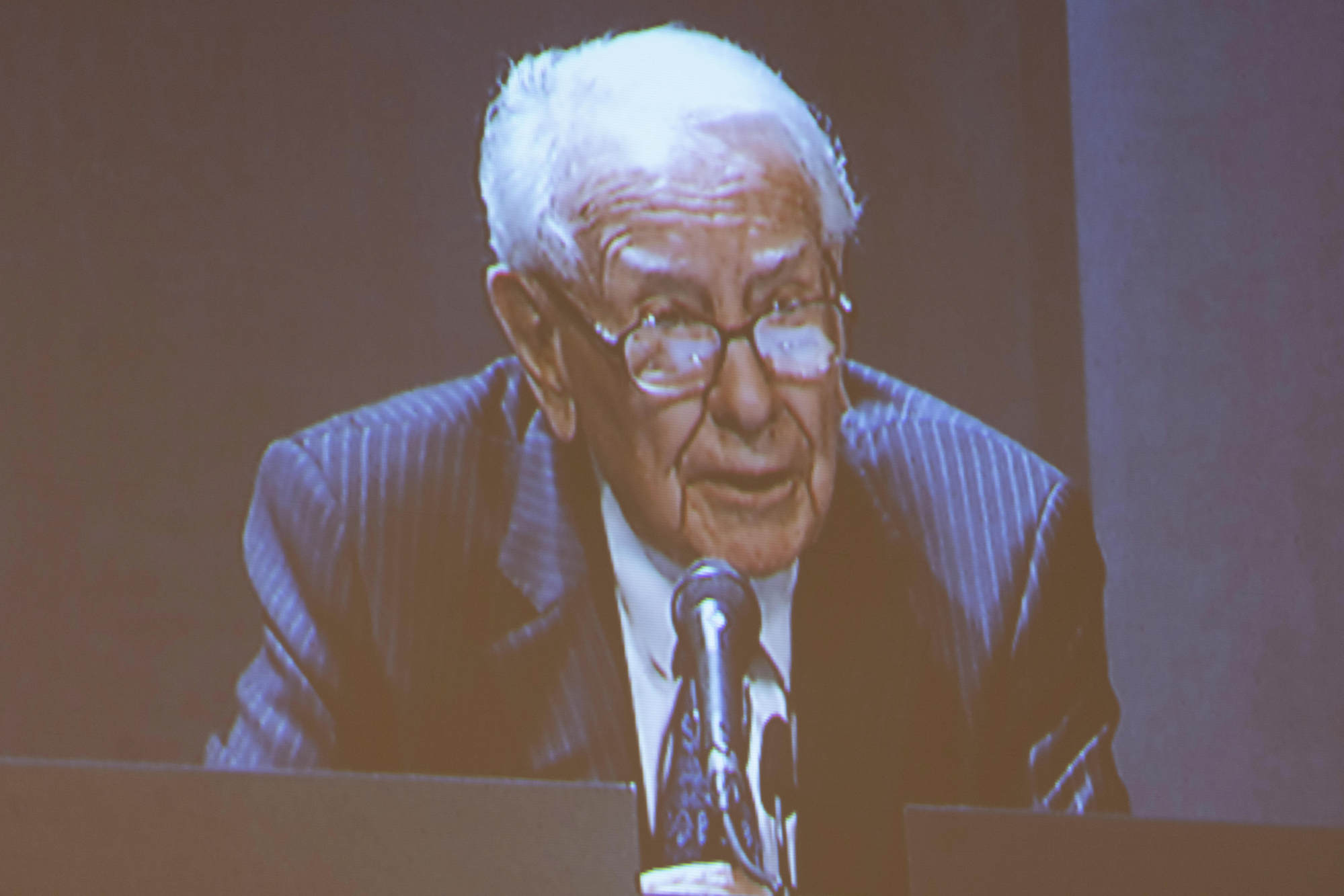

Investment tycoon Warren Buffett on Saturday said he is more comfortable with Berkshire Hathaway Inc deploying capital in Japan than Taiwan, reflecting the growing tensions between the United States and mainland China.

The billionaire investor contrasted Berkshire’s recently increased investments in five Japanese trading houses with its recent U-turn on a multibillion-dollar investment in Taiwan Semiconductor Manufacturing Co, or TSMC.

“It’s a marvellous company,” Buffett said at Berkshire’s annual meeting, referring to Taiwan Semiconductor. But “I would feel better about capital that we’ve got deployed in Japan than in Taiwan … That’s the reality.”

Berkshire invested more than US$4 billion in TSMC last year, only to sell most of it within three months. Tensions between the US and China have simmered in recent months, with some investors worried that mainland China might invade Taiwan.

Meanwhile, Berkshire revealed last month it had increased its stakes in Itochu Corp, Marubeni Corp, Mitsubishi Corp, Mitsui & Co and Sumitomo Corp to 7.4 per cent, and Buffett said his company might buy more.

Berkshire in August 2020 had first disclosed owning 5 per cent stakes in each, in investments then worth more than US$6 billion, and reported increasing the stakes to more than 6 per cent in November.

Buffett said the investment reflected their similarities to his own conglomerate Berkshire Hathaway Inc.

“The Japanese thing was simple,” Buffett said. “There were five very very substantial companies, understandable companies” paying decent dividends and repurchasing their shares, and where Berkshire could manage the currency risk by selling yen-denominated debt to finance the sale, he added.

If there’s one thing we should do it’s get along with China and we should have a lot of free trade with China, in our mutual interest

Berkshire does not pay a dividend.

Buffett’s long-time business partner Charlie Munger took a different view, pointing to Apple Inc’s success in using China as a major supplier, which he said has been good for both the company and the country.

“I think we’re equally guilty of being stupid,” Munger said, referring to the US and China. “If there’s one thing we should do it’s get along with China and we should have a lot of free trade with China, in our mutual interest,” he said.

Buffett blames US government for banking crisis

Buffett also said on Saturday that messaging from the US government over the regional banking crisis had been “poor,” suggesting that is why confidence has not returned among consumers.

Four regional banks have been caught up in crisis since the beginning of March in the United States, three of them subsequently taken over by other institutions with the help of authorities.

For two of them – Silicon Valley Bank (SVB) and Signature Bank – the Federal Deposit Insurance Corporation (FDIC) took the controversial decision to support their uninsured deposits, citing fears of contagion.

By law, the FDIC insures up to US$250,000 of customers’ deposits in eligible banks, but for SVB and Signature the body insured all deposits, including those above the legal limit.

Yet, despite that extraordinary step, consumers are still worried, Buffett said at a shareholder meeting of his Berkshire Hathaway holding company.

“That just shouldn’t happen. The messaging has been very poor,” said the billionaire, who continues to run his group at the age of 92.

“It’s been poor by the politicians who sometimes have an interest in having it poor, it’s been poor by the agencies. And I’d say it’s been poor by the press.”

What happened with SVB demonstrated a government takeover completed with an expanded deposit guarantee, “and the public is still confused,” he said.

While the emergency takeover of regional bank First Republic by the giant JPMorgan Chase on Monday seemed likely to ease anxiety about the banks, it has been a turbulent week.

Several mid-sized banks were targeted on Wall Street, in particular PacWest, which fell 68 per cent before recovering 82 per cent in Friday’s session alone.

On Saturday, Berkshire Hathaway reported a monster $35.5 billion profit for the first quarter alone, largely due to strong financial markets.

In the first three months of 2023, the group sold US$13.2 billion worth of equities from its investment portfolio, while only buying US$2.8 billion, drastically reducing its exposure to stocks.

Buffett transformed Berkshire Hathaway from a small textile company bought in the mid-1960s into a gigantic conglomerate now valued at more than US$700 billion.

.png?itok=arIb17P0)