China must respond to Biden’s new tariffs with an eye on Europe

- China has a much better chance of nudging the European Union on free trade. Beijing should hit US cars with stiff tariffs to send a warning signal to Brussels

China’s main interest is preserving the system of world trade. It is the largest trading economy by far and its future depends on its trade success. A tit-for-tat trade war with the United States spiralling out of control brings no advantage to China.

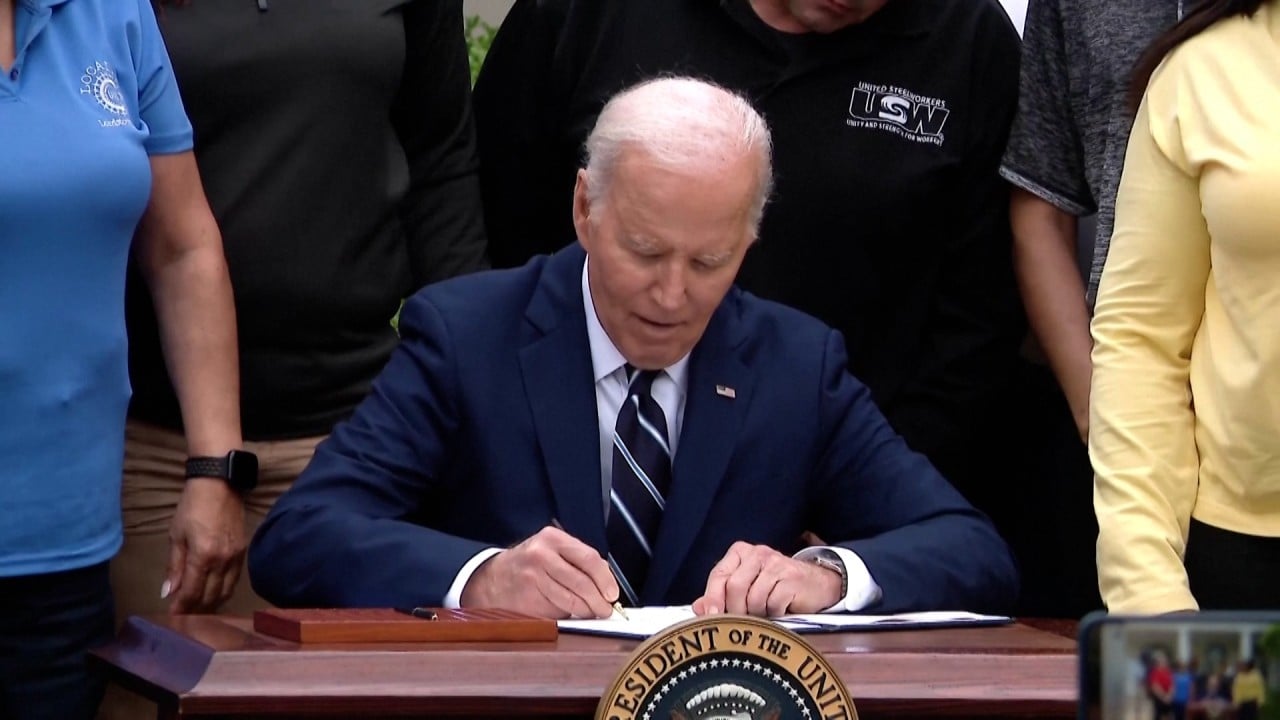

The Biden administration announced stiff tariffs on Chinese semiconductors, solar cells and electric vehicles, even though the US hardly imports EVs from China. Clearly, Biden intends to win support among unions and voters in swing states such as Michigan and Pennsylvania, which are closely associated with the car industry, ahead of the US presidential election in November. At the same time, the new tariffs don’t apply to the internal-combustion-engine cars that US companies manufacture and import from China; evidently, Biden wouldn’t want to upset the carmakers either.

To put it another way: Washington doesn’t have a problem with cars produced in Chinese plants for the US market if they are being imported by American carmakers. When the day comes that US companies want to import EVs from China too, you can bet the US government will find a way to accommodate that.

The tax credits for US solar manufacturing are not enough to incentivise long-term investment, and the tariffs on Chinese solar cells, which will double to 50 per cent, are meant to protect the industry in the meantime. Even so, it is not clear that they are high enough; the US is quite likely to raise them again.

In effect, the United States is withdrawing from global competition. Driven by industrial decline, which is reflected in its large trade deficit, the US is abandoning the global trading system whose establishment it oversaw after World War II.

The US has plenty of natural resources and can keep its industrial sector going behind a protective wall, even if this leads to inflation, tighter monetary conditions and serious resistance. Washington’s thinking is that the US can’t remain a superpower without a strong industrial sector, and thus protectionism is the only way to revive manufacturing fortunes.

At about US$5 billion a year, the US’ car exports to China are not large. American carmakers have been losing market share in China and elsewhere. They are just not competitive. Their car exports to China are dwindling anyway; higher tariffs would merely accelerate an unstoppable long-term trend.

On the other hand, Europe exports tens of billions of dollars in luxury cars to China. European car brands have high profit margins and are important to manufacturing sectors in many countries. With the sustainability of Europe’s manufacturing base at stake, an implied threat of the imposition of tariffs on European cars would be a power move. China can live without European luxury cars, never mind the grumbling of a few rich people.

However, China should not respond to Biden’s tariffs by restricting exports of materials or equipment that the US green tech industry needs. Sure, this would hamper the Inflation Reduction Act. But slowing the green transition is in no one’s interest. Rather, it is in China’s interests to supply US green tech because it adds to the scale of Chinese green tech.

China’s tariffs on US cars would have an immediate impact, whereas Biden’s tariffs on Chinese EVs are largely psychological. They might make an meaningful difference in November, when Pennsylvania and a handful of battleground states could decide the election.

However, although Donald Trump might have spoken wildly in office, the world has become more chaotic on Biden’s watch. The prospect of Trump returning to the Oval Office might not be so bad.

Andy Xie is an independent economist