Advertisement

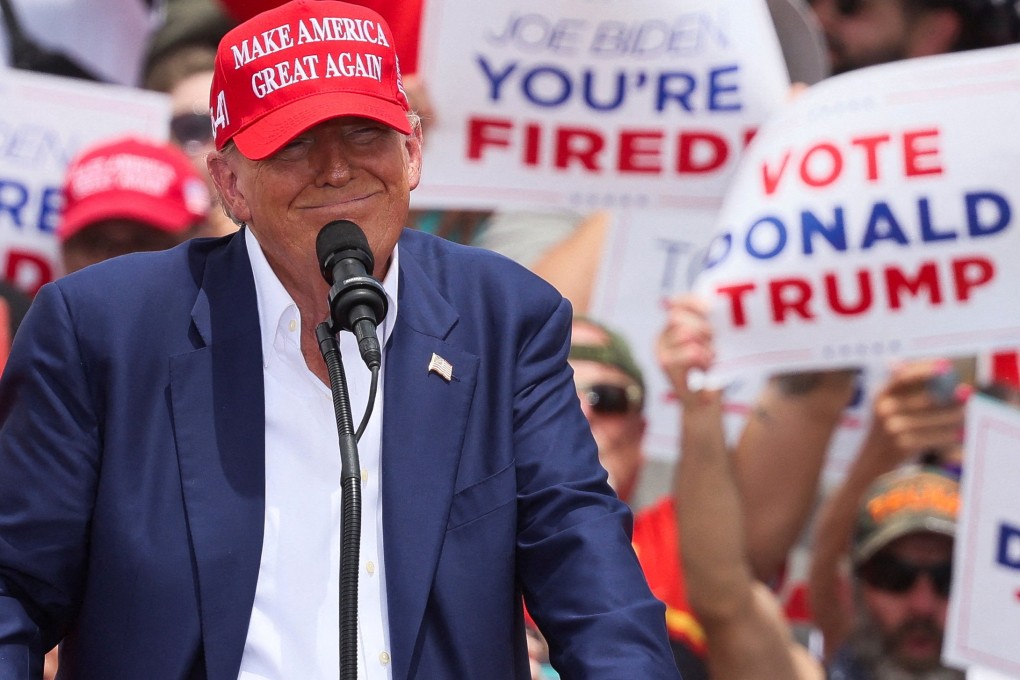

Macroscope | Why Trump’s brand of populism should worry investors most

- Political shocks during this year’s plethora of elections have roiled markets, but no source of political risk is greater than Donald Trump

4-MIN READ4-MIN

3

To say that 2024 is the year of elections is an understatement. By the end of this year, countries accounting for 40 per cent of the world’s population, 60 per cent of global economic output and 80 per cent of the value of global equity markets will have elected new leaders and governments. Experts in political risk assessment have never been busier.

Given the unprecedented scale of electoral contests around the world this year, it was only a matter of time before unexpected outcomes materialised. Since the beginning of this month, a succession of political shocks in both developing and developed economies have roiled financial markets.

While the causes and circumstances of the upsets differ, the common thread is acute social and economic grievances which make it difficult to implement much-needed structural and fiscal reforms, strengthening the appeal of populism and nationalism.

Advertisement

In India, Prime Minister Narendra Modi’s ruling Bharatiya Janata Party (BJP) surprised pundits by losing its outright parliamentary majority, forcing it to seek coalition partners to govern. While this allays concerns about his authoritarianism, it puts more pressure on the new government to increase spending on welfare and could impede progress in tackling contentious land and labour market reforms.

In Mexico, the larger-than-expected share of the vote won by the governing Morena party leaves it just short of the two-thirds majority needed to make controversial changes to the country’s constitution that would remove critical checks on power and entrench the party’s populist policies. While Indian stocks have recovered, the Mexican peso has fallen nearly 10 per cent versus the United States dollar since the end of May.

Advertisement

Yet it is the stronger-than-anticipated gains by far-right parties in France and Germany in the European Parliament elections that are likely to prove more consequential. Marine Le Pen’s Rassemblement National and the Alternative for Germany thrashed the centrist parties that form the current national governments in the two biggest economies in the European Union (EU). French President Emmanuel Macron even felt it necessary to dissolve parliament and call a snap election in a high-stakes gamble which could backfire.

Advertisement

Select Voice

Select Speed

1.00x