Caught between an iPhone and Alipay: Will Apple’s gamble on China pay off as Apple Pay reaches mainland tomorrow?

Alibaba’s Alipay and Tencent’s Tenpay dominate the mobile payments market in China, with Alipay accounting for 70 per cent of the mainland market

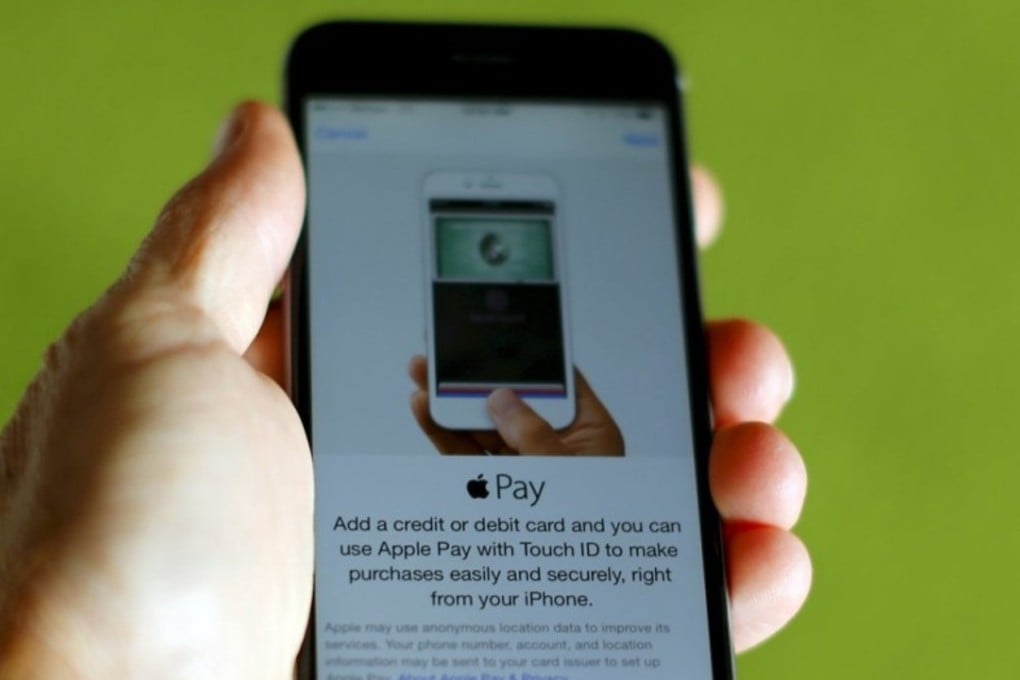

The most ambitious launch to date of Apple’s mobile payment system is expected to start on Thursday in mainland China, where the US technology giant faces an uphill battle against the widely adopted payment platforms of Alibaba Group and Tencent Holdings.

Apple Pay will commence service in the world’s second-biggest economy with the backing of 19 Chinese banks and China UnionPay, which supports mobile payment for its hundred of millions of cardholders and a vast network of merchant partners.

READ MORE: Tencent’s WeChat Wallet lands in Hong Kong, beating Apple Pay as public migrates to mobile payments

News that Apple Pay was slated to go live this week spread fast on Tuesday, following social media posts by representatives of the state-owned Industrial and Commercial Bank of China that stated the date at which the service would become available.

Apple’s spokeswoman in Beijing did not respond to inquiries. No information was shared by the 18 other mainland banks supporting Apple Pay.

The service was initially launched in the United States in October 2014. That was followed by its introduction in Britain, Canada and Australia last year.