Explainer | What Bilibili is, how it makes money and what’s next for ‘China’s YouTube’

- First established as an online home for China’s young anime fans, Bilibili now hosts a variety of video, comic and mobile game content

- The platform is hoping to expand its user base to embrace older audiences beyond millennials and Gen Z

What is Bilibili?

Bilibili, which markets itself as the online home for fans of anime, comics and games (ACG), is one of China’s biggest video-sharing sites. Known affectionately to loyal users as the “B station”, it started in 2009 as a scrappy platform for teens to watch Japanese cartoons, mostly pirated and unlicensed.

In the beginning, one signature feature that set Bilbili apart from most other video-streaming sites is “bullet comments”: one-line viewer comments that float directly above a video. They can be in real-time or left by previous viewers pegged to specific moments in a video, but all of them fly across the screen simultaneously, silently screaming for attention.

The idea of bullet comments is to make users feel as if they are watching a video along with a bunch of friends.

While Bilibili is often credited with popularising the feature, it was Japanese video site Niconico that pioneered this format.

Bilibili was not even the first in China to do it: Bilibili founder Xu Yi was reportedly a fan of the Chinese site Acfun and thought he could make an even better platform. Thus, Bilibili was born.

Who uses Bilibili?

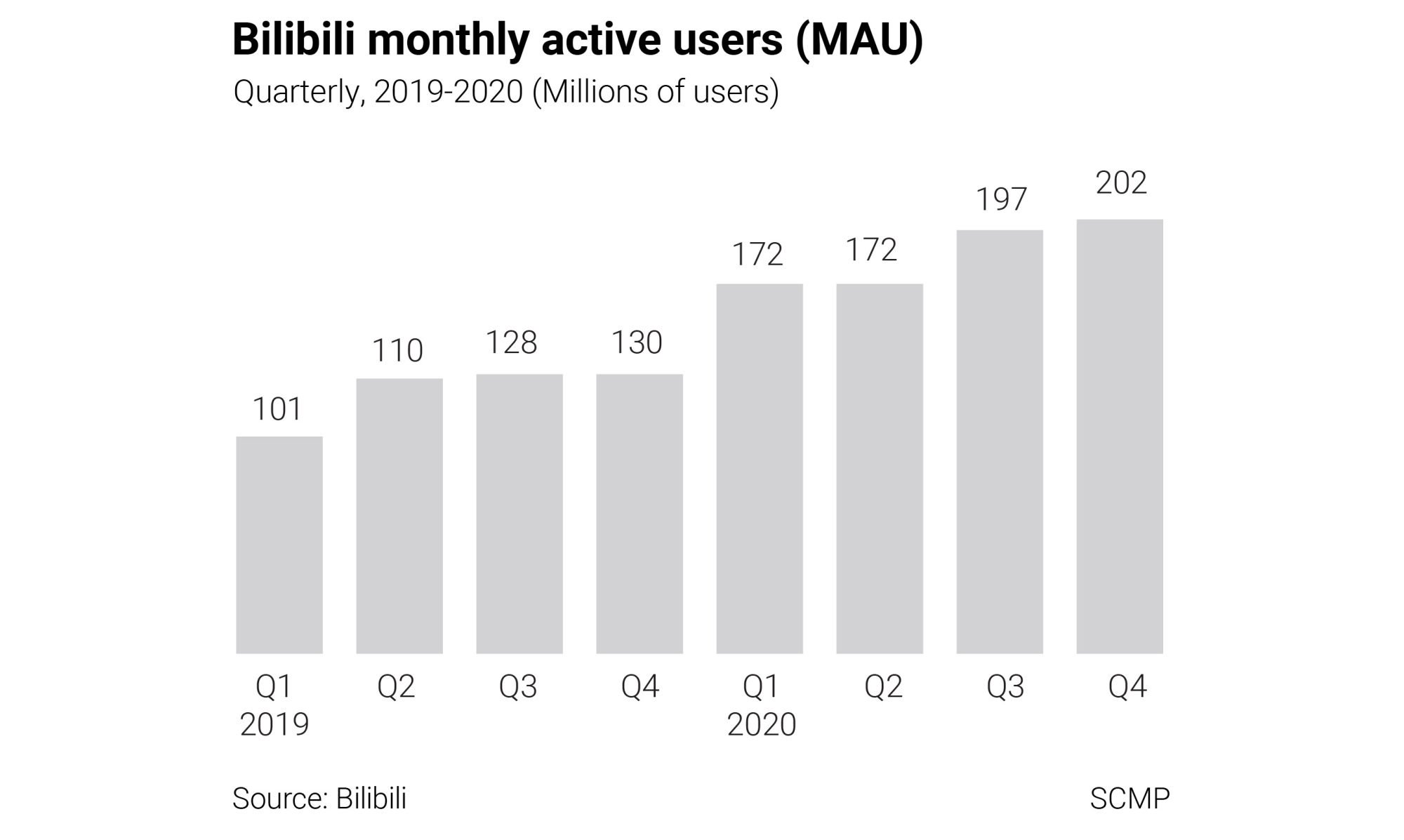

By the end of 2020, Bilibili boasted 202 million monthly active users and 54 million daily active users, who spent an average of 75 minutes on the platform each day. Most of them belong to what Bilibili calls Gen Z+, which the company defines as people born between 1985 and 2009.

Among these dedicated users are “up zhu”, or uploaders. Similar to YouTubers, they are video creators who cover a variety of topics spanning game commentaries, internet memes, science education, consumer electronics and more.

Bilibili said that by the end of last year, it had 1.9 million content creators who were contributing more than 5.9 million videos each month.

To differentiate itself from China’s three biggest video-streaming sites – Tencent Video, Baidu’s iQiyi and Alibaba’s Youku – Bilibili actively cultivates professional uploaders who are often supported by tight-knit communities of loyal fans.

Uploaders who sign on as exclusive content creators work closely with Bilibili on video pitches and receive daily insights on trending internet topics. They are key to the company’s strategy of ensuring user loyalty and enticing more users to pay for membership.

So it’s all about anime?

Far from it. While Bilibili has obtained broadcast rights to many big-name anime series, it also includes a wide mix of user-generated video content outside its core focus of ACG.

Uploaders regularly contribute original content ranging from film reviews and singing performances to comedy skits and cat videos (the site has a section called “animal circle” dedicated to pet and wildlife videos).

How ‘uploaders’ turned Bilibili from an anime site into China’s YouTube

The show is generally seen as a Gen Z-friendly alternative to CCTV’s annual New Year’s spectacle. The 2020 edition was hosted in partnership with state news agency Xinhua.

How does Bilibli make money?

Revenue from advertising, as well as e-commerce and content licensing, more than doubled from a year ago.

Bilibili continued to lose money in 2020, though. Its net losses widened from 1.3 billion yuan (US$200 million) in 2019 to 3.1 billion yuan last year.

What’s next for Bilibili?

By comparison, China’s leading video-streaming platforms Tencent Video and iQiyi surpassed 400 million MAUs in 2017. Bilibili is also up against Douyin and Kuaishou, China’s top two short-video platforms, with 600 million and 481 million MAUs, respectively.

To reach that goal, Bilibili is trying to expand its content offerings to cater to older age groups, although users below the age of 35 still make up its primary user base. Explanatory content like how-to videos was one of the platform’s fastest-growing categories last year, Chen said.

Diversifying revenue sources is also a top priority for Bilibili, according to analysts. Advertising earnings are expected to rise as the company expands to new content types and tries to attract more brands seeking to promote to China’s younger consumers, said Shawn Yang from Shenzhen-based Blue Lotus Capital Advisors.