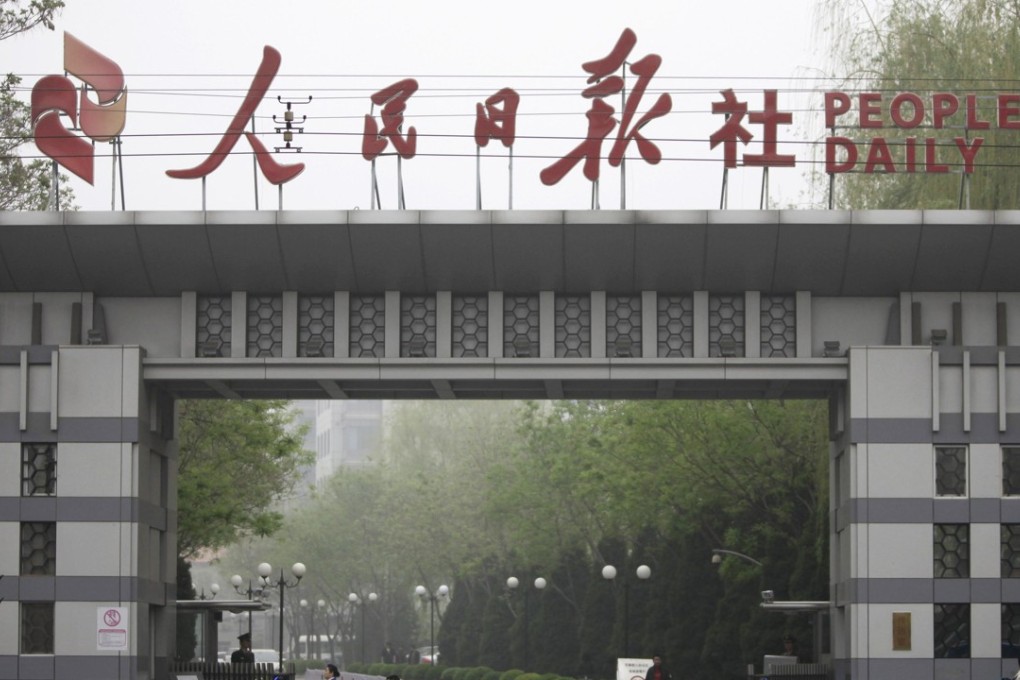

People’s Daily article calls for mobile payments companies to tighten consumer protection measures

People’s Daily, the ruling Communist Party’s mouthpiece, on Friday published an article calling for mobile payments providers to strengthen security measures to help users get back their funds if they mistakenly transfer money to the wrong account or send an incorrect sum.

“The cashless society has quietly arrived, and paying by QR code or transferring money via WeChat or Alipay, has brought great convenience to everyone,” the opinion piece said.

“But if users have ‘butter fingers’, ‘misclick’ or accidentally input the wrong information, then payment platforms need to have enough measures to help users rectify their mistake and recoup their losses. Payment platforms still have much to do in terms of tightening the ‘safety valve’ in the payments process.”

China has become a global leader in mobile payments, with an estimated 890 million users and a 92.4 per cent penetration rate among internet users in the country, according to a report on China’s third party mobile payments by market research firm Ipsos.

The mobile payments market is dominated by Tencent’s WeChat Pay and Alibaba-backed Alipay. Together, these two payments services have a combined market share of over 90 per cent, according to consultancy firm Analysys. Alipay and WeChat Pay users can make peer-to-peer transactions, send “virtual red packets” containing cash gifts, and make payment for services online as well as offline in retail stores and merchants.