TOPIC

China's economic recovery

Related Topics:

China's economic recovery

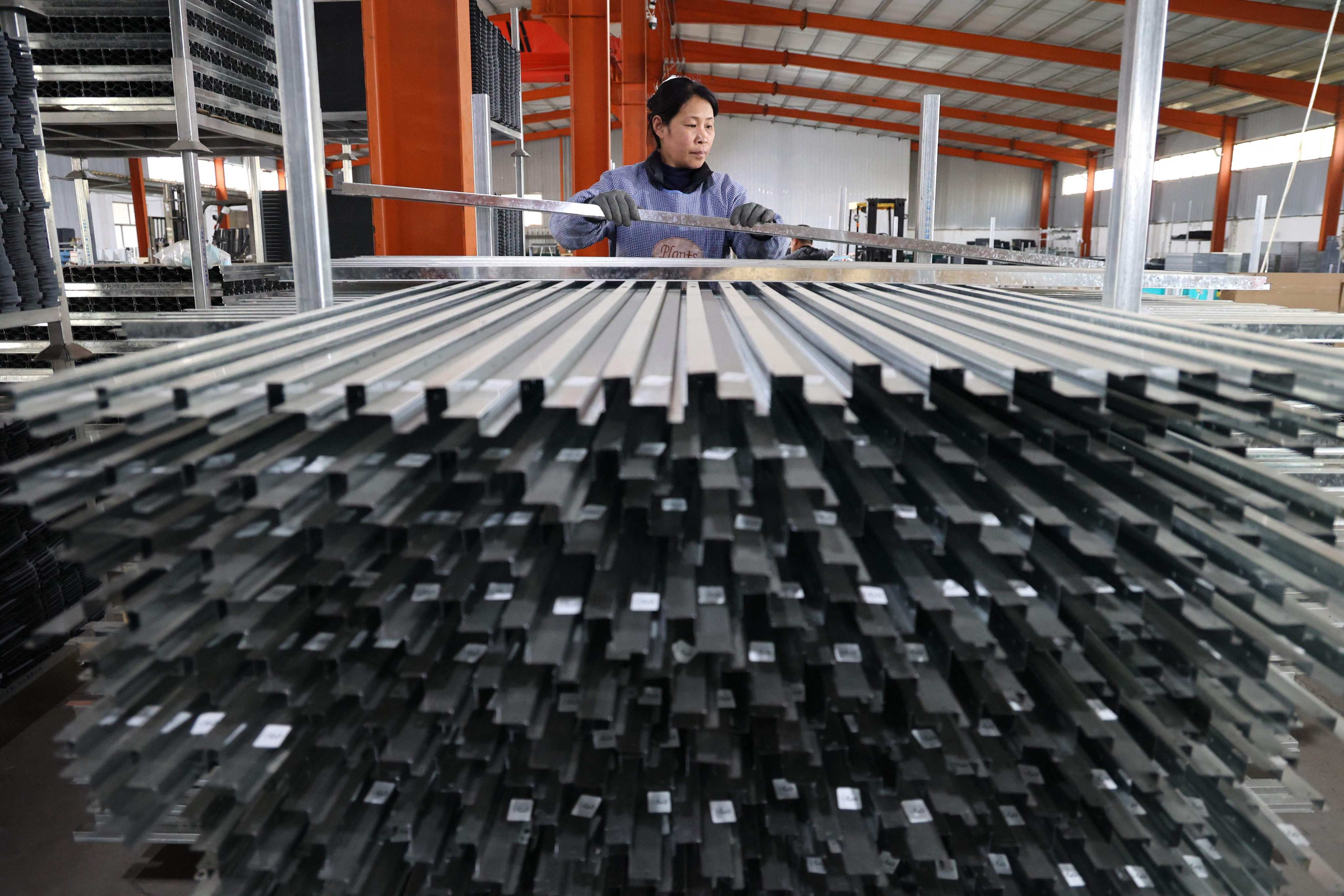

This topic charts China's economic recovery as it, in 2023, enters an era of slower growth, along with an ageing and shrinking workforce, weak consumer demand and a property market downturn.

Help preserve 120 years of quality journalism.

SUPPORT NOWAdvertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement