Advertisement

Advertisement

TOPIC

/ company

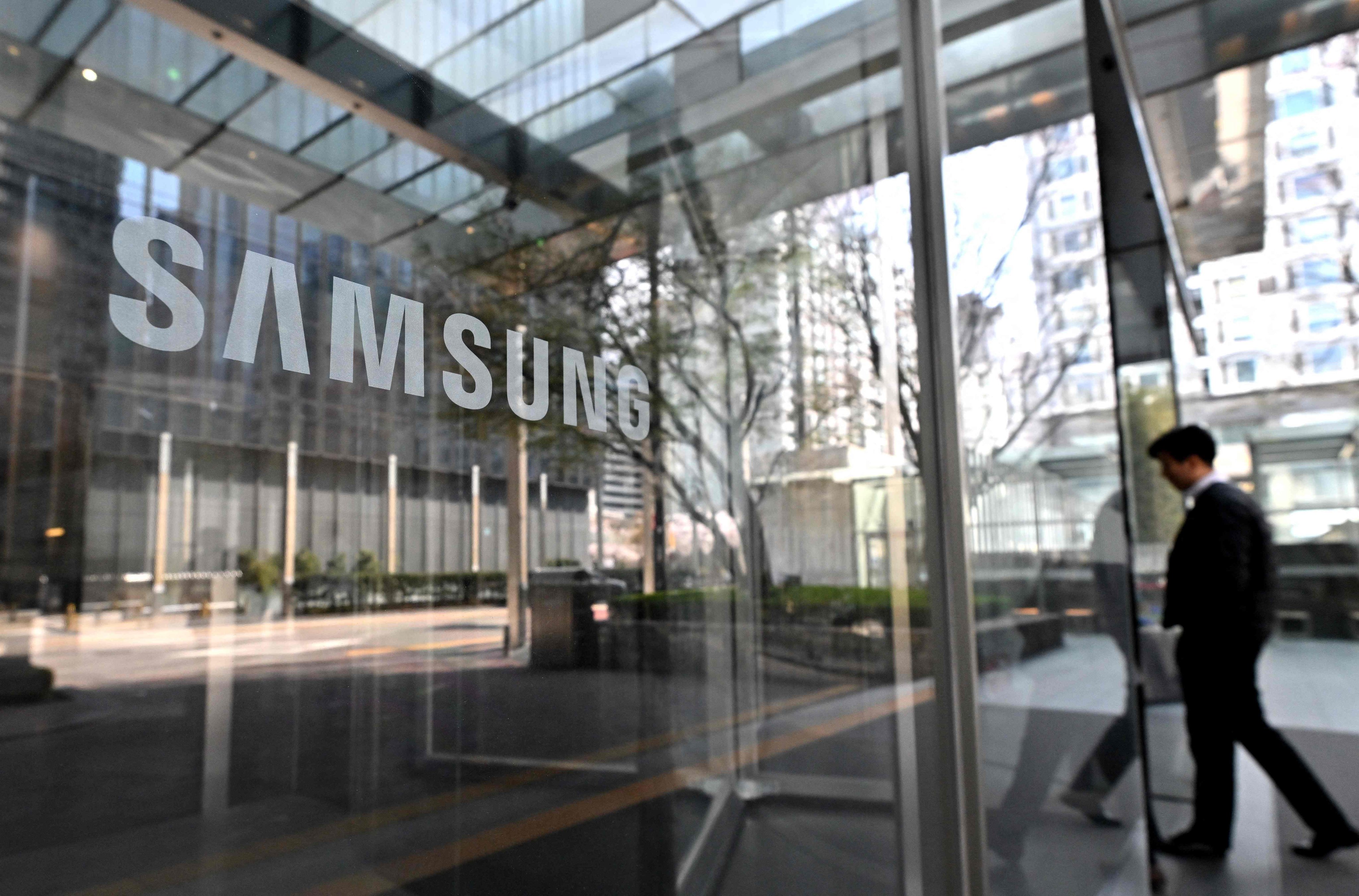

Samsung Electronics

Samsung Electronics

Samsung Electronics is a key subsidiary of Samsung Group, a South Korean multinational conglomerate company headquartered in Samsung Town, Seoul. It is the largest South Korean chaebol. Other key subsidiaries include Samsung Heavy Industries, Samsung Engineering and Samsung C&T.

Chairman / President

Lee Jae-yong

CEO / Managing Director

Han, Jong Hee

CFO / Finance Director

Park Hark Kyu

Industry

Electronics, Technology, Semiconductors

Website

samsung.com

Headquarters address

129 Samsung-ro, Yeongtong-gu, Suwon-si, Gyeonggi-do, South Korea

Stock Code

KRX:005930

Year founded

1969

Help preserve 120 years of quality journalism.

SUPPORT NOWAdvertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement