Advertisement

Advertisement

TOPIC

/ company

Taiwan Semiconductor Manufacturing Company (TSMC)

Taiwan Semiconductor Manufacturing Company (TSMC)

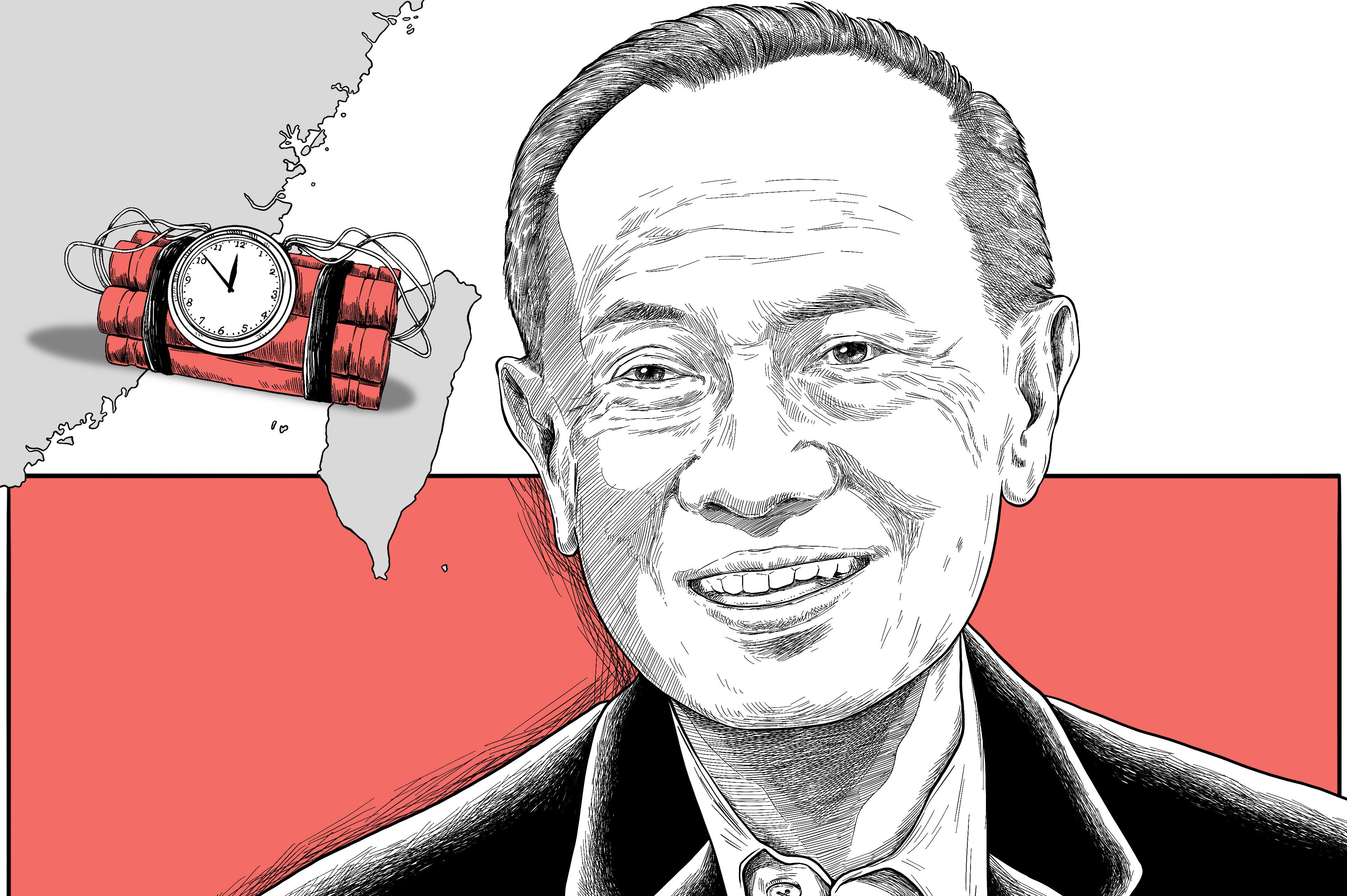

Taiwan Semiconductor Manufacturing originated the “fabless” business model. Before Morris Chang set up the company in Taiwan in the 1980s, most integrated circuits were designed and manufactured in house. Chang, who previously worked at US tech companies including Texas Instruments and General Instrument Corporation, founded TSMC to take orders for semiconductors from IC designers who would no longer need their own fabs, thus creating the new business model and resulting in the world's largest independent semiconductor foundry. The company is often referred to in Taiwan as the “sacred mountain” because of its global economic importance.

Chairman / President

Mark Liu

CEO / Managing Director

C.C. Wei

CFO / Finance Director

Wendell Huang

Industry

Semiconductor

Website

tsmc.com

Headquarters address

Taiwan Semiconductor Manufacturing Company, Limited,No. 8, Li-Hsin Rd. 6,Hsinchu Science Park,Hsinchu, Taiwan

Stock Code

NYSE:TSM TWSE:2330

Year founded

1987

Help preserve 120 years of quality journalism.

SUPPORT NOWAdvertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement