Advertisement

Advertisement

TOPIC

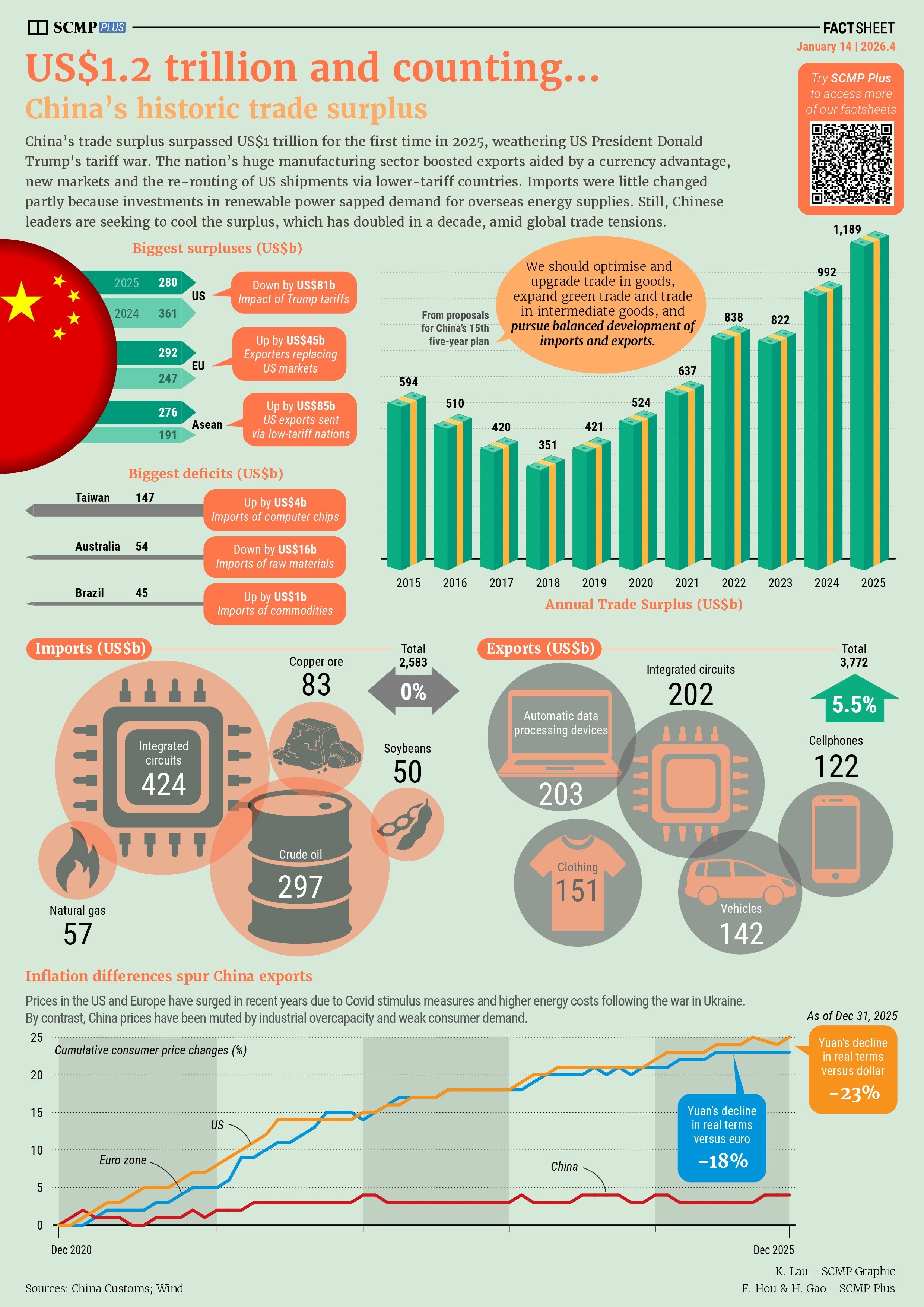

Yuan

Yuan

The Chinese yuan, also known as the renminbi, is already convertible under the current account - the broadest measure of trade in goods and services. However, the capital account, which covers portfolio investment and borrowing, is still closely managed by Beijing because of worries about abrupt capital flows.

Advertisement

Advertisement

Advertisement

Help preserve 120 years of quality journalism.

SUPPORT NOWAdvertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement