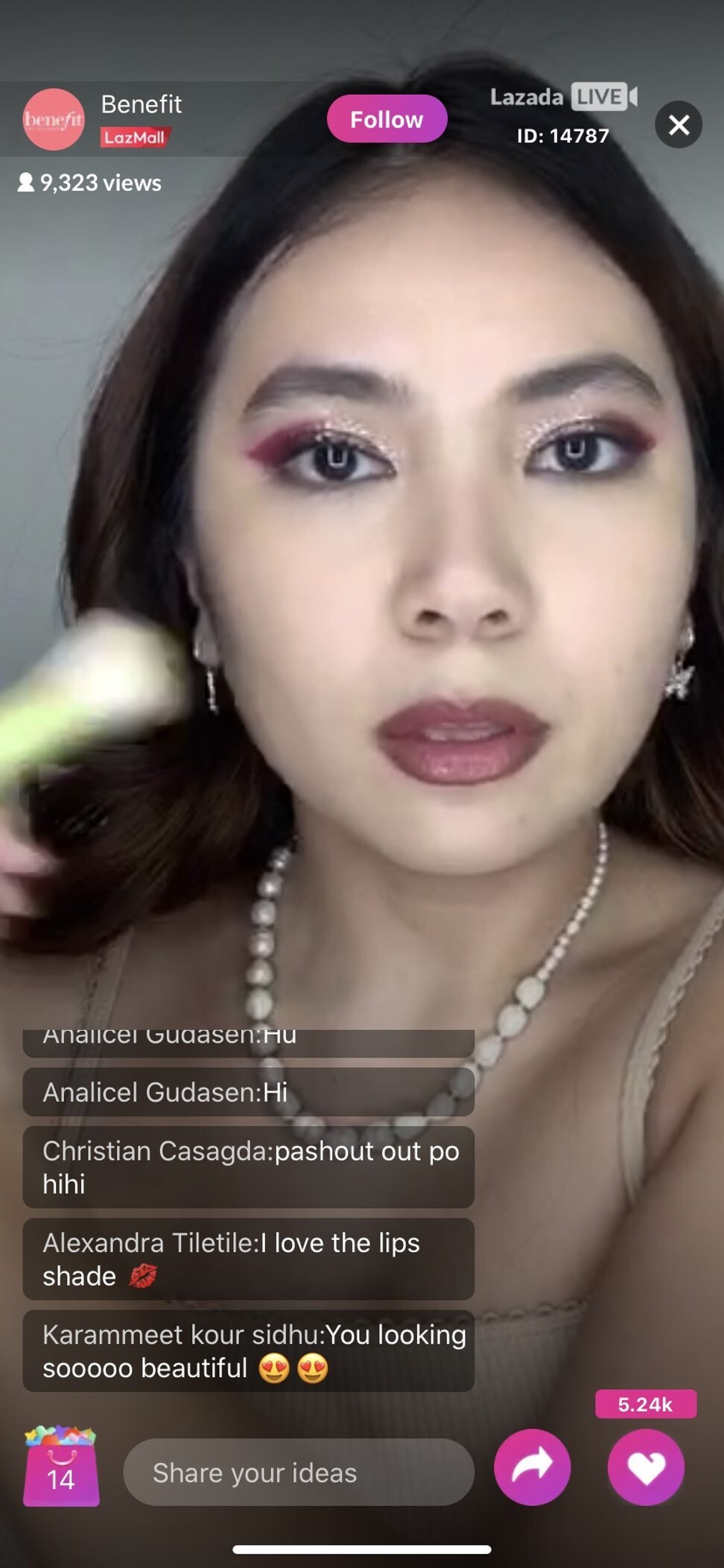

How coronavirus helped Shopee and Lazada bring China’s live-stream shopping craze to Southeast Asia

- A surge in popularity for firms like Shopee and Lazada raises hope that live-streaming in Southeast Asia will copy its multibillion-dollar success in China

- Audiences held captive by Covid-19 have boosted its popularity, but it is also a favourite with brands which see it as a way of connecting with customers

As a working mother of two toddlers, Rovi Calonge is always on the lookout for a good deal when shopping for her children. These days, that means tuning in to e-commerce platform Shopee’s noontime show on its app, in the hope of winning discount vouchers. “I don’t even shop for my baby’s essentials in the grocery store any more,” she said. “It’s cheaper to buy them online.”

E-commerce in Southeast Asia rides high on pandemic boom

In April, when many countries in the region were implementing their toughest coronavirus measures, Lazada recorded 27 million active users on its live-streams across all markets, helping to boost its gross merchandise value by 45 per cent month-on-month. In the same month, Shopee recorded 300 million live-stream views in Southeast Asia – quite a feat in a region with a total population of 650 million.

Live-streams are reminiscent of the live television shopping channels of the 1980s, only this time, the shopping is online and it doesn’t happen only at night but at all hours of the day and targets all demographics. The streams take various forms, from game shows to make-up tutorials, and tend to be produced by brands, small sellers and sometimes the e-commerce platforms themselves. Not only are the products demonstrated live, but viewers can also buy the items while watching the show.

The surge in popularity for companies like Shopee and Lazada has raised hopes that live-streaming could reach a similar level of popularity in Southeast Asia.

Philippines’ fashion-forward PPE, for coronavirus-wary office workers

User engagement for video apps, or the platforms that host them, has doubled in the region since 2016, according to Google and Temasek’s Southeast Asia Report last year. They are now the region’s second-most popular category of apps, while watching videos accounts for at least a fifth of people’s total time spent online.

But while the region’s live-stream scene owes much to its predecessor in China, it has taken on its own twist. In China, audiences tune in largely to see the human stars of the shows, many of whom have become household names. But in Southeast Asia, it is the brands that attract viewers. The medium is popular with brands because customers can buy products as soon as they see them. Consequently, 90 per cent of live-stream users on Lazada are brands.

“Every time we do a live-stream, the effect [on sales] is in multiples, like three to five times more,” said George Hartel, GQ’s chief marketing officer.

“Thais are a very visual, video-driven culture. They appreciate it if a product is shared with them very casually, or in a more entertaining way.”

It helps that GQ’s main product is a stain-resistant shirt, so every live-stream has a novelty factor as influencers try to spill drinks on what they’re wearing.

Philippine coronavirus lockdown boosts calls for a bike-friendly Manila

GQ has since adopted the technology for its new line of masks, the brand’s new bestselling item. “When you have two influencers demonstrating that, it can be hilarious,” Hartel added.

Consequently, despite having shut its 200 stores in Thailand earlier in the year, the brand is now expecting growth.

The market’s growing affinity for personalised shopping experiences is part of what market research firm IDC calls a “rethinking” of customer engagement.

“Research has found that 73 per cent of consumers say a differentiated experience, not just an acceptable experience, is what it takes for a customer to remain loyal … And loyal customers purchase five times more than a new one,” IDC said.

The beauty industry was among the first to realise this, having tapped bloggers and influencers long before the days of Instagram, so perhaps it is no surprise that it has fully embraced live-streaming too.

Kriska Ramos, e-commerce and PR manager of Benefit Cosmetics in Southeast Asia, said even before the pandemic the company had considered live-streaming a priority strategy for the year.

“Compared to other live-streaming on Instagram [for example], streaming on Lazada allows customers to ‘add to cart’ while you watch, instead of switching between apps which can cause customer fallout,” she said.

Still, Ramos said live-streaming should be only one tool in the marketer’s box.

“We see it more as another layer [for our marketing efforts],” she said.

Hartel added: “It is just one of the components for a brand to succeed on e-commerce platforms.” ■