Singapore budget puts focus on young families, vulnerable households amid inflation, war worries

- There will also be changes to property stamp duty and vehicle taxes that will affect Singapore’s wealthiest the most

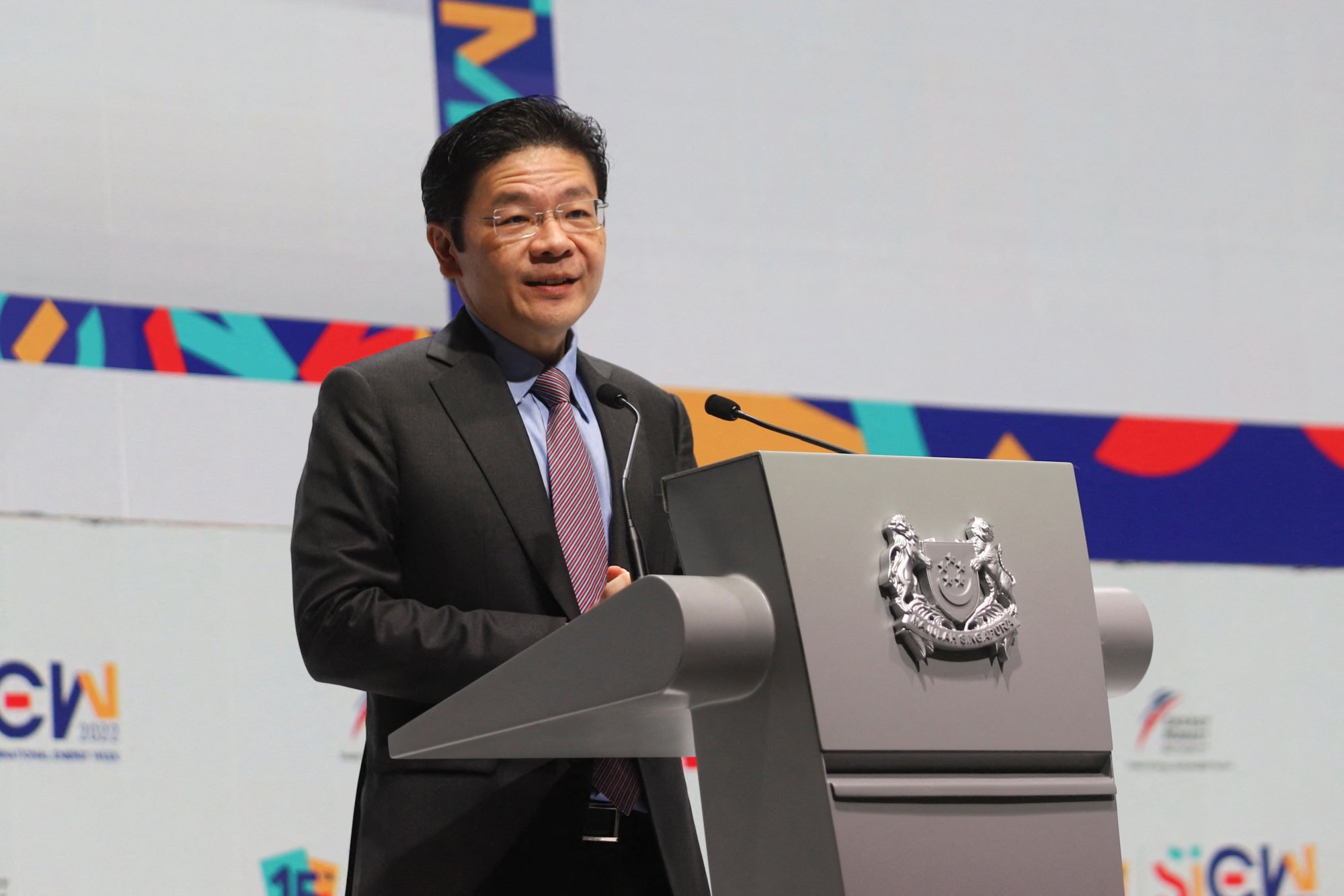

- Finance Minister Lawrence Wong expects Singapore’s headline inflation to remain high, at least for the first half of this year

As part of continuing refinements to the country’s overall tax regime – to make it more progressive and to fund widening welfare measures – the government also announced changes to property stamp duty for higher value properties and vehicle taxes that will affect Singapore’s wealthiest the most.

The country’s tobacco tax, already one of the world’s highest, will rise further.

These policy changes “are part of our overall efforts to strengthen our social compact and to build a fairer and more inclusive society”, Wong said.

A previously announced S$6.6 billion (US$4.98 billion) “Assurance Package” first unveiled in 2020 will be increased to S$9.6 billion to cover the increases in spending due to the GST hike and inflation. Separately, a permanent voucher scheme in place since 2012 to offset GST for lower- and middle-income households will also be enhanced, with recipients getting up to S$850 per year depending on the size of their homes.

Singapore approves GST hike as finance minister slams opposition calls for delay

The voucher scheme ensures that well-off residents, foreigners and tourists pay a higher effective GST rate compared to low-income groups, Wong said. The GST will increase to 9 per cent in January, following an increase from 7 to 8 per cent this year.

Wong also acknowledged a major gripe among younger Singaporean couples: the increasing difficulty in securing new public housing flats, where more than 80 per cent of the country’s 5.45 million people live.

The government will increase its housing subsidies for these young couples by S$10,000 for eligible families looking to purchase 5-room or larger resale flats and S$30,000 for 4-room or smaller resale flats.

To support parents with the costs of raising their children, Wong said the government would increase the Baby Bonus Cash Gift by S$3,000, from the previous S$8,000 for first- and second-born children.

For citizens working in platform companies – such as ride-hailing firm Grab – the finance minister said the government would press ahead with plans to strengthen their job security.

This will include special aid as they are made to contribute more to the Central Provident Fund. More details of the plan is expected to be discussed during deliberations on the budget, and Wong said it would improve their housing and retirement adequacy.

Apart from the property and car tax changes, Wong said Singapore planned to implement a top-up tax to bring the tax rate for large corporations to 15 per cent from 2025.

This is to meet pillar two of the OECD base erosion and profit shifting (BEPS) 2.0 framework. Wong said global developments on BEPS 2.0 are fluid and Singapore would monitor it. “If there are additional delays, we will adjust our implementation timeline,” said Wong.

Global headwinds

Balloon row a ‘surface wound’ for US-China ties: Singapore’s George Yeo

“We must expect to see greater contestation and fragmentation in the global economy. Countries are thinking less about mutual benefit and interdependence, and more about national gain and security,” he said. “An era of zero-sum thinking has begun.”

“We therefore have to brace ourselves for a period of relatively higher inflation, both globally and also in Singapore,” he said. “We cannot say how long this will last but we expect Singapore’s headline inflation to remain high, at least for the first half of this year.”

Song Seng Wun, an economist at CIMB Private Banking, described the budget as “pretty pragmatic”, benefiting different segments of the population.

He noted that social spending remained an important part of the Singapore budget even as it seemed relatively small compared to other expenditures. The veteran economist suggested that tackling high inflation was an urgent priority for the government ahead of a general election that must be held by 2025.

“It’s better to deal with the issue so there will be less lingering unhappiness should inflation stay high. They do not need this to become a distraction,” he said.

Chua Hak Bin, an economist at Maybank Investment Banking Group, said the S$3 billion top-up to the Assurance Package was “far larger than expected”. He added that the enhancements announced on Tuesday would dull the impact from the higher GST.

The government is expecting a budget deficit of 0.3 per cent of gross domestic product (GDP) in the current fiscal period, or about S$2 billion – smaller than the initially estimated deficit of S$3 billion, or 0.5 per cent of GDP. The republic is expected to record a S$400 million deficit in the coming financial year, amounting to 0.1 per cent of GDP.

Additional reporting by Reuters