Abacus | Post-coronavirus, expect manufacturing to make a mass exodus from China

- Firms across the world are rethinking their supply chains as they discover that links to the world’s factory are more fragile than they bargained for

- Drugs are a particularly sensitive area: no nation wants to depend on supplies from a potential adversary that can use delivery as a strategic weapon

Second, the mobility scooter I planned to buy with my dad was out of stock at the wholesaler. Although many models are made in the European Union and the UK, all the electric motors and clutches are imported from China and had run out.

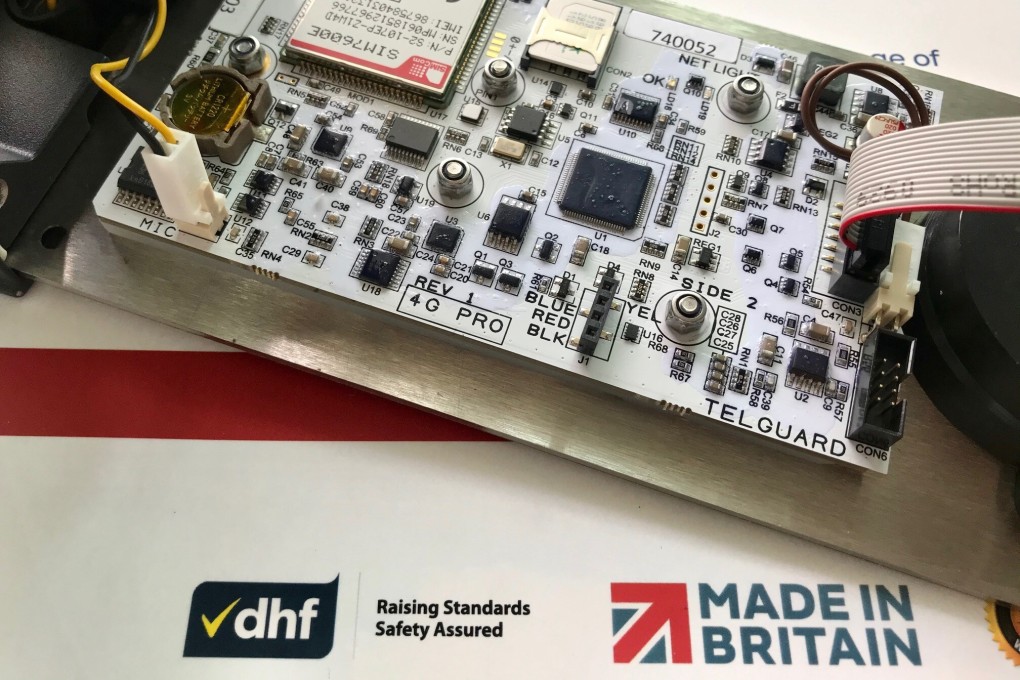

Third, on a visit to a small 4G intercom firm eyeing Hong Kong and Asia as new markets, I was greeted by a CEO tearing out what was left of his hair trying to source a critical, but common, component to keep the assembly line going. The firm’s supply had run out – as had the local supermarket’s stock of paracetamol to deal with his headache.

Three diverse British businesses in distress was not a coincidence. And it soon became apparent that the problem was far more widespread, highlighting critical weaknesses in modern manufacturing: the fragility of supply chains and the reliance on logistics to bring in components and deliver finished products. It was clear that it did not matter which part was missing from the parts shipment, whether hi-tech electronics, common electric motors or a humble HDPE spray bottle; a broad systemic failure was taking place.

NOT JUST SMES AT RISK