Abacus | US dollar vs yuan: why China’s threat against HSBC rings hollow – for now

- The bank is accused of colluding with the US to take down Huawei, fuelling speculation it could lose its business in mainland China

- But with China’s efforts to internationalise the renminbi stalling, Beijing still needs HSBC to provide international access

THE MIGHTY DOLLAR

The US dollar has had no serious contender for the role of global reserve currency: i.e., the pricing and trading mechanism for essential commodities and the fallback currency for developing nations.

The mainstay of the dollar’s dominance in the global economy has been the fact that the two most important global commodities, oil and gold, trade in US dollars. As China has become the biggest importer of oil – with about 10 per cent of global consumption – and one of the largest buyers of gold, it made sense for policymakers to make an aggressive push to internationalise the renminbi and thus reduce the country’s reliance on the greenback.

Russia and China are ‘working together to reduce the world’s reliance on US dollars’

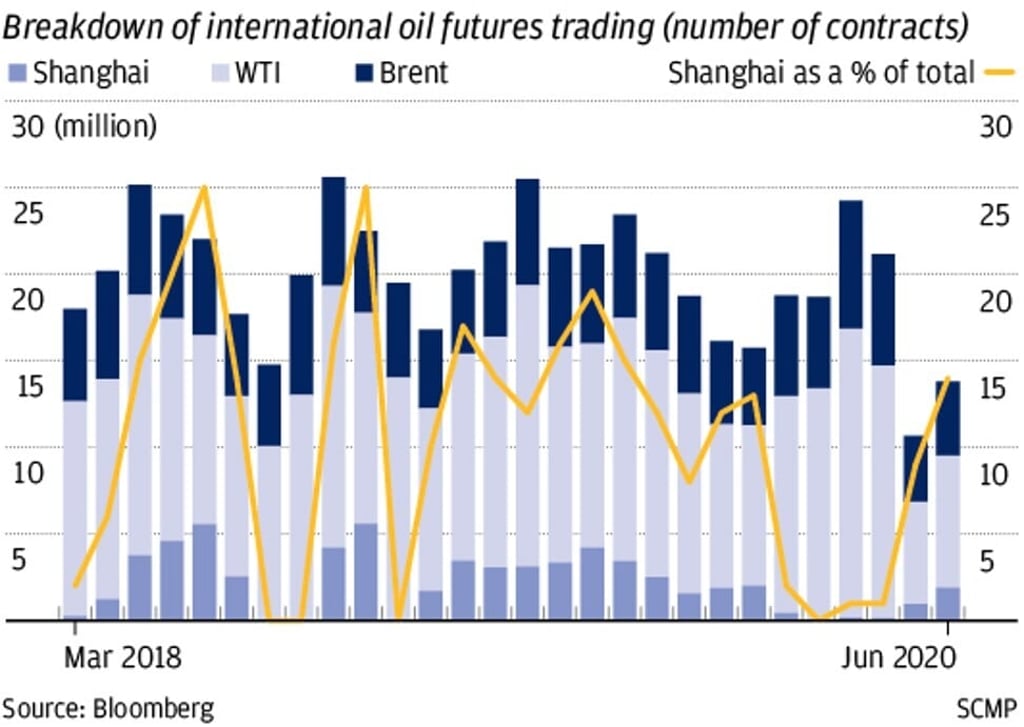

A major step towards internationalisation of the renminbi was taken in 2018 when the Shanghai International Energy Exchange started to offer crude oil futures contracts priced in renminbi, successfully attracting traders from around the world and taking volume away from the two most popular contracts traded elsewhere: Brent and WTI. This move made a lot of sense, given that although a third of the world’s oil is consumed in Asia, it’s primarily traded elsewhere. However, the trade has seen intermittent spikes in volume, and has yet to demonstrate long-term popularity. Still, it has been much more successful than oil traded in yen on the Tokyo Commodity Exchange.

DOLLARS ON THE STREET