The intense volatility of recent weeks has every chance of remaining the core underlying theme of activity. Investors are increasingly focused the broader question of how this episode might affect the wider economy.

The intense volatility of recent weeks has every chance of remaining the core underlying theme of activity. Investors are increasingly focused the broader question of how this episode might affect the wider economy.

The intense volatility of recent weeks has every chance of remaining the core underlying theme of activity. Investors are increasingly focused the broader question of how this episode might affect the wider economy.

The intense volatility of recent weeks has every chance of remaining the core underlying theme of activity. Investors are increasingly focused the broader question of how this episode might affect the wider economy.

The intense volatility of recent weeks has every chance of remaining the core underlying theme of activity. Investors are increasingly focused the broader question of how this episode might affect the wider economy.

The intense volatility of recent weeks has every chance of remaining the core underlying theme of activity. Investors are increasingly focused the broader question of how this episode might affect the wider economy.

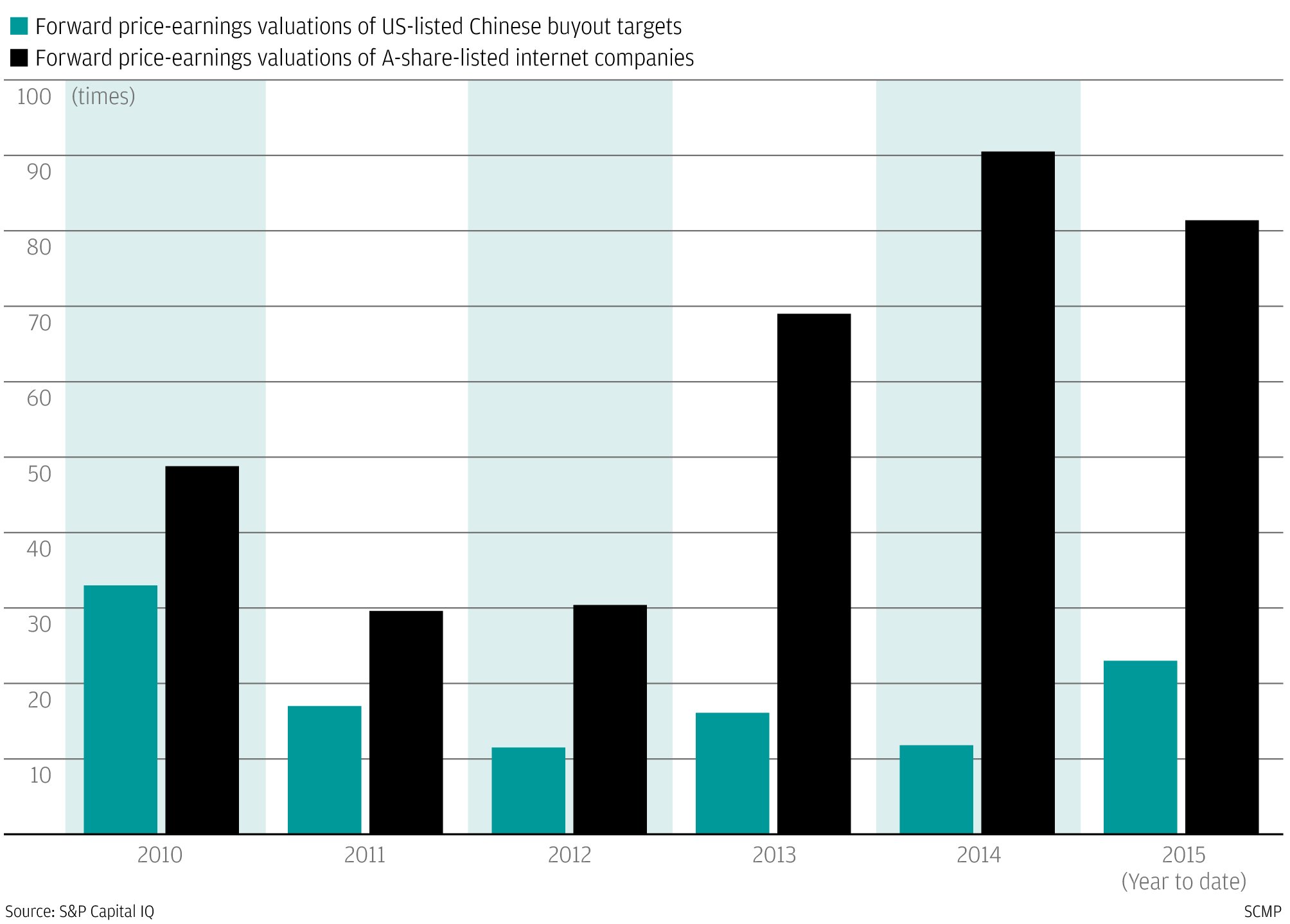

Some 25 US-listed mainland firms have had privatisation offers so far this year, with 22 of them announced before the end of June as the Shanghai and Shenzhen stock markets were imploding.

Flick through the presentation slides Tidjane Thiam and his team ran through with investors when the newly installed Credit Suisse chief executive unveiled second-quarter earnings and it quickly becomes apparent why his first trip two weeks later is to Asia - it is his golden goose and he makes no bones about it.

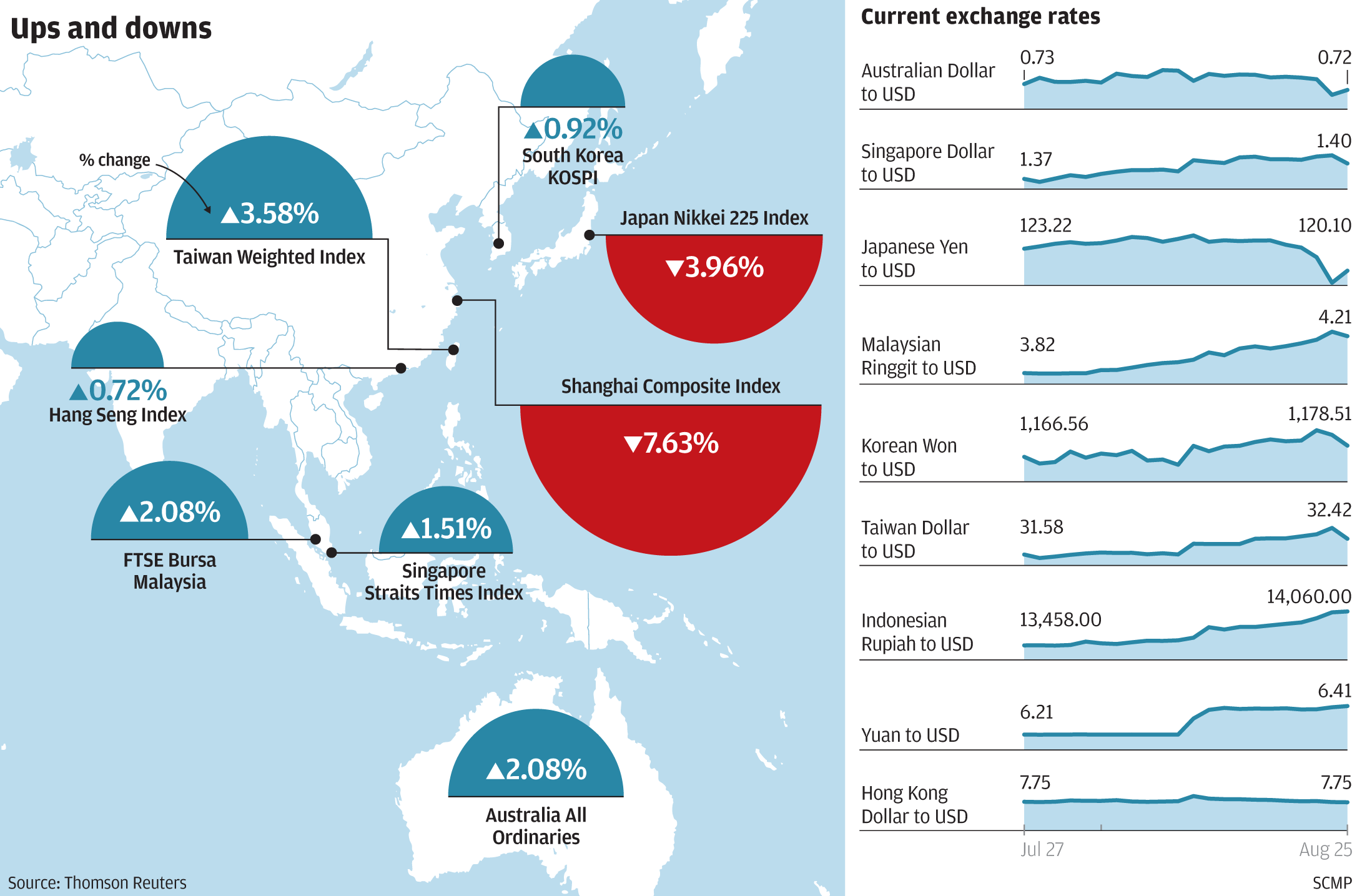

Beijing cut interest rates and eased bank lending limits yesterday in a bid to stop panic selling in mainland stock markets that smashed them to eight-month lows, even as equities elsewhere in the world began to recover from the previous day's rout which investors termed "China's Black Monday".

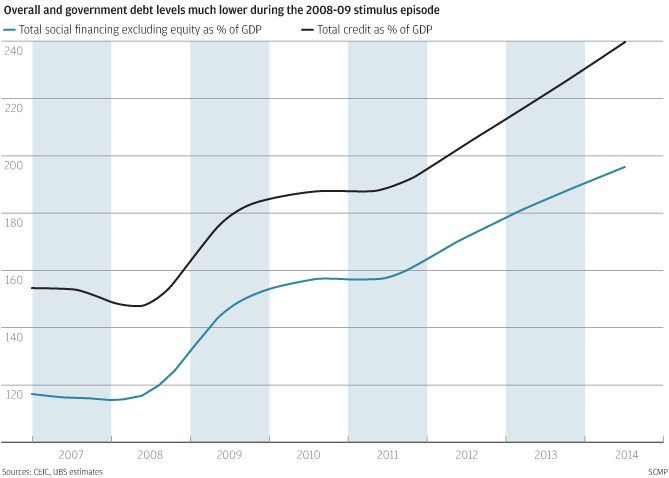

The intense volatility of recent weeks has every chance of remaining the core underlying theme of activity. Investors are increasingly focused the broader question of how this episode might affect the wider economy as many suspect the equity bubble has yet to fully deflate.

The intense volatility of recent weeks has every chance of remaining the core underlying theme of activity. Investors are increasingly focused the broader question of how this episode might affect the wider economy as many suspect the equity bubble has yet to fully deflate.

The intense volatility of recent weeks has every chance of remaining the core underlying theme of activity. Investors are increasingly focused the broader question of how this episode might affect the wider economy as many suspect the equity bubble has yet to fully deflate.

The intense volatility of recent weeks has every chance of remaining the core underlying theme of activity. Investors are increasingly focused the broader question of how this episode might affect the wider economy as many suspect the equity bubble has yet to fully deflate.

China's bid to play a bigger role in the management of the global financial system has been in train since it helped draw up the rules that created the International Monetary Fund in 1944.

Clement Kwok King Man has had a busy 12 months. In that time, the Hongkong and Shanghai Hotels chief executive has opened a new Peninsula hotel in Paris, signed a €300 million (HK$2.55 billion) deal to develop one in Istanbul and submitted a planning application for a landmark site in London.

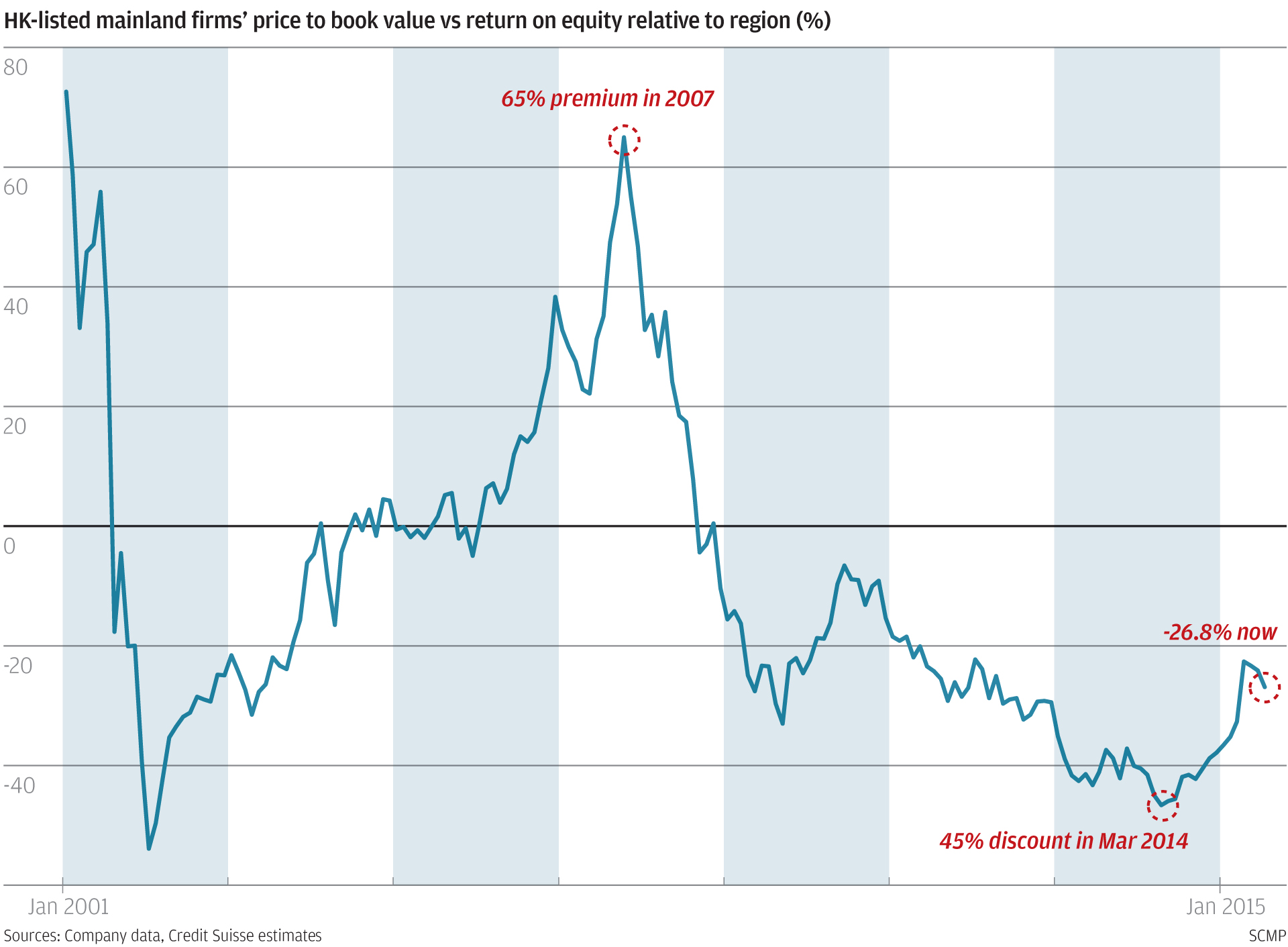

The fall in Chinese stock prices has pushed Hong Kong-listed mainland firms back into the Credit Suisse "Cheapest Four" trading basket. Being overweight, the components of the Cheapest Four basket have outperformed the MSCI Asia Ex-Japan Index by 1.9 per cent in the year to date.

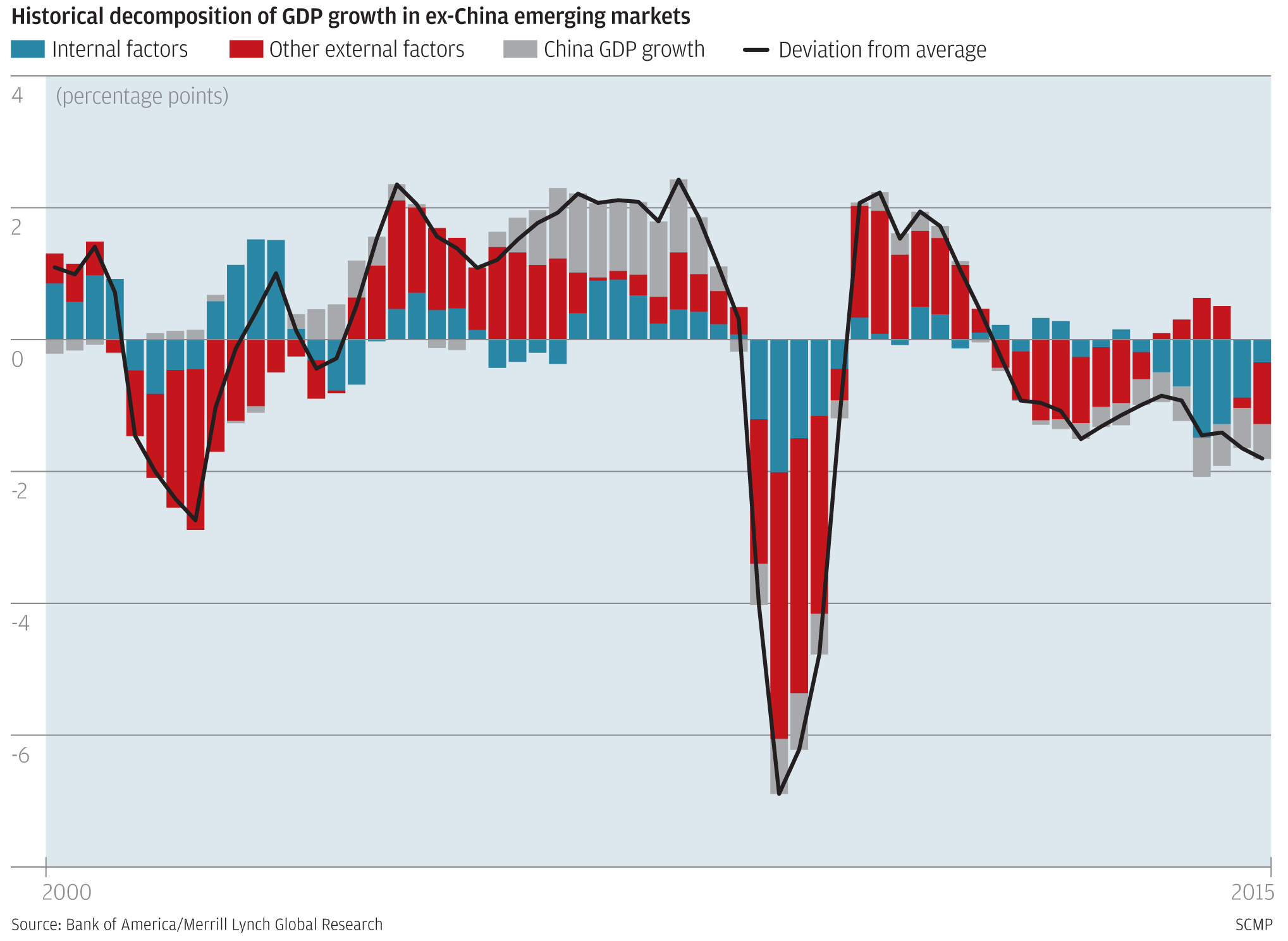

The drop in the mainland equity market strikes a sombre tone, particularly in terms of the potential downside risks it poses to the economic growth in emerging markets.