China Markets Live - Shenzhen shares end poorly, but Shanghai trims losses and Hong Kong settles up

US interest rate countdown on ahead of Fed meeting on Thursday, Shenzhen market sinks 6.65 per cent by close

Welcome to the SCMP's live markets blog. The intense volatility of recent weeks has every chance of remaining the core underlying theme of activity. Investors are increasingly focused the broader question of how this episode might affect the wider economy as many suspect the equity bubble has yet to fully deflate. We'll bring you the key levels, trading statements, price action and other developments as they happen.

Here’s a summary of market action today, with analyst views:

- Shanghai finishes 2.67 per cent weaker as market pares losses

- Shenzhen market drops 6.65 per cent by the close

- Hong Kong unmoved by Chinese shares, settles 57 points higher

- Market eyes US Federal Reserve verdict on rates this week

4:11pm: The Hang Seng Index finished 0.27 per cent higher, 57.23 points, at 21,561.9. The H-share index closed up 0.11 per cent, 10.44 points, at 9,728.72.

3:43pm: The Ontario Teachers' Pension Plan, one of the largest professional pension funds in Canada, today announced that Nicole Musicco has been appointed managing director for Asia-Pacific and head of the Hong Kong office. Teachers’ opened its Asia-Pacific office in Hong Kong in 2013 and has a diversified portfolio of assets in the region valued at C$12 billion as the end of last year.

“Nicole’s new role reflects our growing commitment to the Asia-Pacific market and its importance to the future of our fund,” said Ron Mock, chief executive officer and interim chief investment officer. “Her experience with our partners internationally and her knowledge of the Asia-Pacific region specifically made her the logical candidate for this important, newly created position.”

3:13pm: Chinese markets closed lower Monday with the Shanghai Composite down 2.67 per cent, 85.42 points, at 3,114.8.

The CSI 300 Index fell 1.97 per cent, 66.06 points, to 3,281.13.

3:13pm: The Shenzhen Composite finished 6.65 per cent lower, 118.46 points, at 1,662.89. The ChiNext Index fell 7.49 per cent, 154.29 points, to 1,906.21.

3:13pm: The Hang Seng Index is down 0.05 per cent, 10.99 points, at 21,515.36. The H-share index is trading 0.02 per cent lower, 1.46 points, at 9,719.74.

2:56pm: Kenneth Chan, global quantitative strategist of Jefferies said:

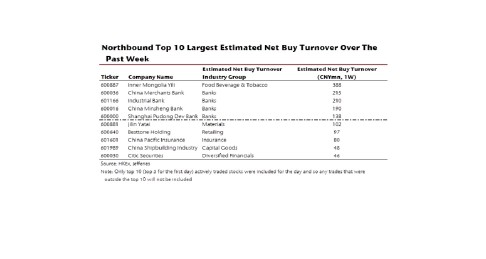

“The trading volume of Northbound trades averaged 2.3 billion yuan a day, down 27 per cent week on week. Overall net buying of 6.5 billion yuan turned from a net selling of 5 billion yuan in the previous week) was seen among Northbound trades for the week. The overall trading volume of Northbound trades continued to be higher than Southbound trades.

The trading volume of Southbound trades averaged HK$961million, up 12 per cent. A net buying of HK$1.6 billion (increased sharply from a net buying of HK$173 million in the previous week) was seen for the week. China Cinda topped the estimated net buy turnover among Southbound trades for the week. Ali Pictures continued to top since Shanghai Hong Kong stock connect was launched. During the week, Tsingtao Brewery newly entered the most active trades.”

Click to enlarge both charts.

2:42pm: Jefferies worries that money markets are exhibiting strange behaviours:

“Well before the Fed’s ‘lift-off’ in rates, there has been an ongoing dislocation in front-end money markets, caused by changes in regulations, that appears to be increasing volatility. The Fed’s GCF repo index has been steadily climbing while the US TED spread has also widened.

The unintended consequence of the rise in US short rates is overlapping with two other monetary dynamics. First, the US dollar on a real trade weighted basis is continuing to appreciate, which is effectively tightening US monetary policy even further. Moreover, the strong dollar is tightening monetary conditions in many emerging markets where a significant number of companies have borrowed in US dollars.

Secondly, investment grade and below US credit spreads have widened over the past two months as concerns over the impact of a falling crude oil price on energy issuers have intensified.

Fixed income investors are also at a loss to explain the changes in front-end rates. The bottom line is that equity investors are assuming that financial markets are discounting linear changes in Fed rate moves.

However, money markets are exhibiting unconventional behaviour. The uncertainty in money market rates may help explain some recent equity behaviour, yet the ongoing strength of the dollar and widening credit spreads are also playing a major part. Monetary conditions are tightening.

Last week, investors withdrew US$16bn from US equities, the second heaviest withdrawal year-to-date and a total of US$141bn since January. Market breadth deteriorated over the week, with more stocks making new lows than new highs. Unfortunately, the selling pressure does not appear to be exhausted yet.”

2:28pm: Christopher Wood, equity strategist of CLSA, does not expect the US will increase interest rates in the Fed meeting this Thursday as he does not believe US economic conditions and inflation support a rate raise.

“It depend on who is running the Fed. The US Fed chairwoman Janet Yellen does not favour raising the interest rate,” he said in the annual CLSA investment conference in Hong Kong. “I do not think the US will increase the interest rate this Thursday or this year.”

Wood believe China will have more interest rate cuts and the yuan would devalue a total of 5 per cent this year as China would like to see the yuan be more market driven and fit in with the criteria for admission into the Special Draw Rights of the International Monetary Fund as a reserve currency.

Regarding the market, he believes Shanghai is neutral as the market has fallen a lot and is cheap. He is underweight Hong Kong due to the weak economy situation. Around Asia, he is underweight Australia the most which he believe will be hard hit by the fall of commodity prices while overweight India where he is very positive about its outlook.

2:13pm: Banks and insurers were the only two sectors posting gains in mainland markets amid signs of state-buying. The Industrial and Commercial Bank of China and China Merchants Bank added 2.93 and 2.16 per cent respectively.

2:07pm: The Shanghai Composite Index trades at 3,080.01, down 3.76 per cent, or 120.22 points. The CSI300 index of Shanghai-Shenzhen large cap stocks trades at 3,218.98, down 3.83 per cent or 128.21 points.

2:07pm: The Shenzhen Composite Index trades at 1,668.30, down 6.35 per cent, or 113.05 points. The NASDAQ-style ChiNext Price Index slides 7.35 per cent, or 151.47 points to trade at 1,909.03.

2:02pm: The Hang Seng Index trades at 21,502.05, down 0.01 per cent or 2.32 points. The China Enterprises Index (H-share index), which track Hong Kong listed Chinese companies, trades at 9,711.80, down by 0.07 per cent or 6.48 points.

1:12pm: The Shanghai Composite Index trades at 3,086.32 point, down 3.56 per cent, or 113.91 points. The CSI300 index of Shanghai-Shenzhen large cap stocks trades at 3,225.26, down 3.64 per cent or 121.93 points.

1:12pm: The Shenzhen Composite trades at 1,695.56, down 4.82 per cent, or 85.79 points. The NASDAQ-style ChiNext Price Index slides 6.13 per cent, or 126.26 points to trade at 1,934.25.

12:04pm: Hong Kong’s benchmark Hang Seng Index lost 0.1 per cent, or 22.15 points to 21.482.22 as the market closed the morning session. The H-share index, tracking Hong Kong listed Chinese companies, fell 0.65 per cent, or 63.46 points, to 9,654.82.

12:00pm: The top five stocks with the biggest turnover in Hong Kong on Monday morning include HSBC Holdings, which gained 0.33 per cent to trade at HK$60.65, with turnover at HK$1.42 billion. Tencent came next as turnover hit $744.67 million. Its share price added 0.24 per cent to $127.7. Bank of China came third as turnover reached HK$632.42 million, and its share price fell 0.28 per cent to $3.56. China Construction Bank came fourth with turnover of $550.66 million. Its share price fell 0.74 per cent to $5.37. Industrial and Commercial Bank of China was down 0.21 per cent to $4.69. And its turnover was the fifth largest at $534.46 million.

11:56am: Capital Economics found bright spots beyond gloomy figures in China’s August industrial output.

“A closer look at the data shows an increasing divergence between activity among private firms, which grew at its fastest pace this year last month, and state sector activity, which continued to slow.

That said, there are some early signs of a recovery in heavy industry, where state firms have a strong presence – growth in electricity and cement output both edged up last month. Meanwhile, the industry data continue to indicate that foreign demand, while clearly subdued, may not be as weak as the headline export figures suggest.

Particularly encouraging is that the improvement in industry comes despite significant disruptions to factory activity in the Beijing-Tianjin-Hebei region last month as a result of the Tianjin blast and Victory Day parade preparations, which we think may have shaved up to half a percentage point of off nationwide industrial output growth.”

Click on charts below to enlarge.

11:37am: The Shanghai Composite Index closed the morning session at 3,097.71, down 3.2 per cent or 102.52 points. The CSI300 index of Shanghai-Shenzhen large cap stocks finished the morning at 3,229.76, down 3.5 per cent or 117.43 points.

11:37am: The Shenzhen Composite closed at the morning session at 1,700.64, dropped 4.53 per cent, or 80.71 points. The NASDAQ-style ChiNext Price Index plunged 5.98 per cent, or 123.23 points to trade at 1,937.28.

11:36am: The Hang Seng Index trades at 21,477.24, down 0.13 per cent or 27.13 points. The China Enterprises Index (H-share index), which track Hong Kong listed Chinese companies, trades at 9,646.86, down by 0.73 per cent or 71.42 points.

11:36am: China National Development and Reform Commission, the country’s central economic planner, said it will channel non-state capital to resources, logistics and telecommunications sectors, the official Xinhua News Agency reports citing the agency’s deputy chief.

11:34am: Consumer Discretionary is the biggest drag on the Hang Seng Index. Belle International fell 6.05 per cent to HK$6.99. Sands China dropped 4.13 per cent to trade at HK$25.55. Galaxy Entertainment was down 3.48 per cent to HK$22.2.

11:05am: Hong Kong dollar is trading Monday at 7.7501 against the US dollar. Euro/dlr is trading flat at 1.1344, stronger by 0.05 per cent. Dlr/yen at 120.46, weaker by 0.11 per cent. Pound/dlr stronger by 0.14 per cent to 1.5451. Australian dollar to US dollar strengthened by 0.30 per cent to 0.7113.

11:00am: Jefferies has lowered its China and Hong Kong stock market forecasts citing macro uncertainty:

“While the overall economy faces challenges and downward pressure, consumption and employment were the bright spots. We expect outlook to remain steady in the second half, and believe negatives have been largely priced in following the severe market sell-off."

Jefferies analysts expect a steady 2H15. In terms of near-term outlook, our analysts are positive on 11 out of 24 subsectors, neutral on 8 subsectors, and negative on 5 subsectors, as we believe negatives have been largely priced in given the severe market sell-off.

China Macro indicating weak momentum; expect more easing policies. August CPI grew 2 per cent yoy vs. 1.6 per cent in July owing to higher-than-expected food inflation. Meanwhile, PPI decline widened to 5.9 per cent yoy (vs. -5.4 per cent in July). China manufacturing PMI dropped to 49.7, the weakest level in the past three years.

August trade balance surged to US$60.2bn, due to sharp decline in imports (-13.8 per cent yoy) vs. a 5.5 per cent decline in exports. We believe poor macro data confirmed China’s manufacturing sector is losing steam, and export growth is facing tough challenges amid global uncertainties.

"With both A-share and H-share market in turmoil, many leading Chinese companies are trading at very attractive levels. In the near term, macro uncertainties and volatility may continue to test investor confidence; we expect A-share market to stabilize and consolidate, before a new uptrend can be resumed.

Longer term, we remain constructive on the outlook of A-shares, and expect H-shares to catch up, as fundamentals gradually improve. We revised our June-2016 target for SHCOMP Index to 4,300 (from 4,850), based on 18x 2016 P/E; and reduced our HSCEI Index target to 13,500 (from 18,500), based on 10x 2016 P/E.”

10:58am: ICBC Credit Suisse Asset Management International, the international arm of one of China's largest asset managers with more than 754 billion yuan in assets under management, today announced that it has named Elvin Yu , as Head of International Sales and Client Relationships.

In this role, Elvin reports to Richard Tang , the Chief Executive Officer, and will oversee all sales, marketing and client relationship functions outside China .

Yu has more than 16 years of experience in the asset management industry. Prior to joining ICBC Credit Suisse Asset Management, Yu was the managing director and head of institutional business for Greater China and SE Asia at Allianz Global Investors. Elvin has also held senior roles at Baring Asset Management and AXA Rosenberg, and was responsible for institutional business development in the Asia region.

10:57am: KTL International, a local jewellery dealer, surged 19 per cent to trade at HK$9.44 by 10:40 am on Monday morning, leading the Hong Kong market.

The company said in a filing to the HKEx last Friday night that it proposed a share subdivision, according to which it would subdivide each existing issued and unissued share of HK$0.01 of the company into two subdivided shares of HK$0.005 each.

10:49am: ING forecast on yuan revised:

"Assuming the press reports about the PBOC intervening in the offshore market are correct, the authorities are doing more than talk the talk. In addition to intervening, they’re stabilizing USDCNY. We expect the PBOC to stabilize USDCNY at its current level with the aim of reducing depreciation expectations as priced into the offshore market and we have revised our year-end USDCNY forecast to 6.40 from 6.55.

There were few signs that the economy was responding positively to policy stimulus in the August activity data released yesterday. Year-over-year industrial production growth was a disappointing 6.1 per cent."

10:49am: ING on China's retail sales, money and credit data:

"The message from retail sales was better: year-over-year and sequential growth both accelerated, the former to 10.8 per cent from 10.5 per cent and the latter to 0.86 per cent from 0.79 per cent. On the other hand, year-over-year and sequential growth of fixed asset investment both decelerated in August, the former to 10.9 per cent YTD – the weakest growth ever – from 11.2 per cent and the latter to 0.73 per cent from 0.75 per cent.

The money and credit data reinforced the sense that consumers were resilient to the turmoil in financial markets. New mortgage loans increased by 51 per cent YoY. Unlike consumers, the corporate sector is suffering; new long-term loans contracted by 50 per cent (-51 per cent in July).

Bottom line: The August data were better than we expected. The trends that were present before the July-August financial market turmoil persist: resilient consumer spending, including spending associated with home buying, fiscal stimulus coming through infrastructure spending and a deteriorating manufacturing sector.

10:49am: ING on SOE reform:

Xinhua reported that the State Council yesterday put some flesh on the bones of the SOE reform plan announced last week. Firms will be grouped into commercial – for-profit – and strategic – non-profit – and would be encouraged to list their shares and have diversified ownership.

Among last week’s announcement were turning state shares into preference shares, exploring options for employee shareholding and encouraging private participation in SOE reform.

Bottom line: Because SOE reform relies heavily on the capital market, the stock market crash will reinforce the consensus view that SOE reform has been disappointingly slow.”

10:42am: State-owned heavy industrials posted solid gains, with China Communication Construction jumping 6.19 per cent to 13.20 yuan, China State Shipbuilding lifting 2.78 per cent to 37.38 yuan, and China Oilfield Services Limited climbing 1.97 per cent to 17.10 yuan.

10:38am: The Shanghai Composite Index trades at 3,190.56 points, weaker by 0.3 per cent or 9.67 points. The CSI300 index of Shanghai-Shenzhen large cap stocks trades at 3,323.51, down 0.71 per cent or 23.68 points.

10:38am: The Shenzhen Composite Index trades at 1,767.64, down 0.77 per cent, or 13.71 points. The NASDAQ-style ChiNext Price Index slides1.79 per cent, or 36.78 points to trade at 2023.72.

10:36am: DBS Morning Call:

“China plans to allow foreign central banks to participate in its onshore foreign exchange market, premier Li Keqiang said at the World Economic Forum last week. The decision will further help Beijing’s push for the yuan to join the IMF’s SDR basket. In a recent report, the IMF stated that deviations between the offshore (CNH) and onshore (CNY) yuan exchange rates raise potential operational issues.

The two exchange rates have been converging due to increasing cross-border flows, but deviations occur due to remaining capital controls and external shocks. Owing to the yuan depreciation expectation, for instance, the CNH recorded a discount of 1,138 pips on 7 September; a level not seen since late 2011. Deviations between the two rates imply that the CNH cannot be a perfect hedge for CNY-based exposures.

Opening the onshore fx market would therefore mitigate the impact of any divergence on potential SDR users. On the other hand, Li also said that the cross-border yuan payment system will be completed by the end of this year. According to the PBOC’s statement, the first phase of the China International Payment System will begin in Shanghai to handle deals in Asia, Oceania and Europe; facilitating cross-border deals such as trade settlement and direct investments.”

10:33am: The Hang Seng Index trades at 21,672.40, up 0.78 per cent or 168.03 points. The China Enterprises Index (H-share index), which track Hong Kong listed Chinese companies, trades at 9,816.27, up 1.01 per cent or 97.99 points.

10:25am: Broker shares weighed on the benchmark Shanghai Composite Index. All but one companies recorded losses with Haitong Securities and Guangfa Securities the top laggards, dropping 4.89 per cent and 4.57 per cent respectively.

CSRC said last Friday it fined five brokers including Huatai Securities, Haitong Securities, Guangfa Securities, Founder Securities and Zheshang Futures for failure to verify their clients’ identities and flawed risk controls.

10:17am: Centrally-owned China Railway Construction Corporation shares rallied 6.55 per cent to 14.27 yuan in early trading in Shanghai, while China Communications Construction leapt 4.99 per cent to 13.05 yuan.

Shares of their peers China Railway Corp and its unit China Railway Erju were suspended in Shanghai on the back of a major asset restructuring between the two companies. China’s State Council, or cabinet, on Sunday issued SOE reform guidelines that include plans on mergers of a number of SOEs.

9:45am: Onshore yuan trades at 6.3714 to the dollar, stronger by three per cent from the previous day's close. Offshore yuan trades at 6.4085 to the dollar, weaker by 12 basis points from the previous close.

9:38am: The Shanghai Composite Index opens at 3,228.09 point, up 0.87 per cent, or 27.86 points on Friday’s close. The CSI300 index of Shanghai-Shenzhen large cap stocks opens at 3,378.82, up 0.76 per cent or 25.63 points.

9:38am: The Shenzhen Composite Index trades at 1,784.84, up 0.2 per cent, or 3.49 points. The NASDAQ-style ChiNext Price Index trades at 2,061.9, up 0.07 per cent, or 1.39 points.

9:37am: The Hang Seng Index opens at 21,678.88, up 0.81 per cent or 174.51 points. The China Enterprises Index (H-share index), which track Hong Kong listed Chinese companies, opens at 9,781.93, up by 0.65 per cent or 63.65 points.

9:26am: PBOC sets mid-price at 6.3709 to the dollar, stronger by 10 basis points from the mid-price on Friday at 6.3719 and compared to Friday’s onshore yuan close at 6.3749.

9:22am: The SG morning call:

“The long-awaited September FOMC meeting is finally upon us. Our baseline scenario is of a rate hike but only as the first move of a very gradual and limited tightening cycle . The dots are likely to show only one rate increase this year, implicitly suggesting that the initial hike will be followed by a long pause.

Admittedly, wobbly financial conditions represent a significant risk to our view as the Fed may choose to wait until the fog lifts. However, if there is no hike, we would expect the accompanying message to be hawkish, suggesting a strong possibility of an October lift-off. Bottom line: hike or no hike, do not expect a dovish outcome.

Chinese property prices ought to have continued their recovery, albeit at drastically different speeds across different tiers. A setback in this recovery would be a serious concern. Elsewhere, Japan is likely to confirm that it is among the very few economies experiencing rising exports, albeit helped by currency effects — and the trade balance is expected to maintain a marginal deficit. Inflation in India is likely to have been little changed at a rate well below the RBI’s 6 per cent target, keeping the prospect of RBI rate easing alive. ”

9:13am: The Hang Seng Index futures spot September contract gains 0.37 per cent or 155 points to 21,530 in the pre-opening session.

9:11am: No Shanghai listed A-share company will resume trading today and four companies applied for voluntary suspension in the trading of their shares. The number of companies in trading suspension in Shanghai is 118 on Friday, representing 11.01 per cent of the total.

Seven Shenzhen listed A-share companies resume trading today while one company suspended trading in its shares. The number of suspended companies in Shenzhen is 196 on Friday, representing 11.86 per cent of the total.

8:44am: UBS report:

"Although August industrial production posted slightly better year-on-year growth, it was due to last year's low base and weaker than expected. Property destocking came in sharper than expected, and exports continued to contract. These have more than offset the modest buffers from stronger infrastructure and solid retail sales.

Credit growth remained solid in August, though driven more by debt rollover than investment impulse. Despite the rebounding food prices, a sharper decline of PPI, along with tepid non-food inflation, points to persistent deflationary pressures.

The worsening downward pressure on the economy related to the property downturn as well as soft global demand requires intensified policy support, especially through infrastructure investment.

The lowering of capital ratio requirement on investment, along with 'special financial bond' for policy banks, could help support infrastructure investment in the coming months. We continue to expect GDP growth ratcheting down in Q3 and Q4 2015, and maintain our 2015 GDP growth forecast of 6.8 per cent."

Click on chart below to enlarge.

8:33am: China International Capital Cooperation research report:

CICC economists said China’s economy is facing bigger challenges. The company has downgraded expected GDP year-on-year growth for quarter three to 6.5 per cent from 7 per cent, while quarter four at 6.6 per cent from 7.2 per cent. CICC said monetary easing will continue, and expect two RRR cuts, each time by 50 basis points, as well as one cut on the benchmark saving interest rate within the year.

7:30am: Steve Wang, research director and chief China economist of Reorient said:

"Following Premier Li Keqiang’s keynote address to the summer forum on early Thursday revealing that foreign central banks will soon be allowed to participate in China’s onshore FX market, reports came in late afternoon that the People's Bank of China (PBOC) mobilized agency banks to push up the offshore renminbi (CNH) “at all costs” in a bid to eradicate the price spread vis-àvis the onshore yuan (CNY), which had blown out since the August 11 currency devaluation amid shaky investor confidence on China’s economic outlook.

Given such a stronghold at the recent trading level of 6.35 to 6.40, the now stepped-up intervention campaign will surely deliver another blow to the FX reserves, withdrawing even more liquidity from China’s banking system. Inevitably, the PBOC must compensate by boosting domestic credit supplied by its banking system.

Professor Huang Yiping and Premier Li both seemed to hint but stopped short of declaring RMB6.4 as the “new equilibrium” for the USD/CNY rate, repeating the official line that the renminbi has no basis for continuing depreciation.

Instead, officials are pointing to the fact that China continues to rake in a healthy dose of current account surplus, circa US$75 billion of per quarter since second quarter of 2014. Clearly, this is good to know but doesn’t stand against the fact that the FX reserve balance is falling and public enthusiasm for migrating money abroad is mushrooming."

Click to enlarge both charts.

7:25am: Onshore spot yuan (CNY) closed at 6.3749 on Friday, versus the previous day's close of 6.3772. The offshore yuan (CNH) traded at 6.4139, against the Thursday close at 6.4260. The mid-price fix set by the People's Bank of China Friday was at 6.3719.

7:20am: One week chart of the mainland Chinese stock indexes last week. Shanghai Composite Index (yellow), Shenzhen Composite Index (purple), CSI300 Index (green) of big cap shares in Shanghai and Shenzhen, and ChiNext (blue). Click to enlarge the chart.

7:18am: One week chart of Hang Seng Index (yellow) and H-shares index (purple). Click to enlarge the chart.

7:15am: One week graph for onshore yuan (CNY) and offshore yuan (CNH) during last week. Click to enlarge both charts.