Some Macau cash points deserted as face recognition technology kicks in at ATMs

Ban on use of UnionPay cards at ATMs without new technology meant to hasten roll-out of new policy to stem capital flight from mainland China

A ban on withdrawls from hundreds of ATM machines in Macau left some previously busy cash points deserted on Tuesday as analysts sought to allay fears that the latest move in the crackdown on capital flight and money laundering would hit casino takings in the world’s biggest gaming hub.

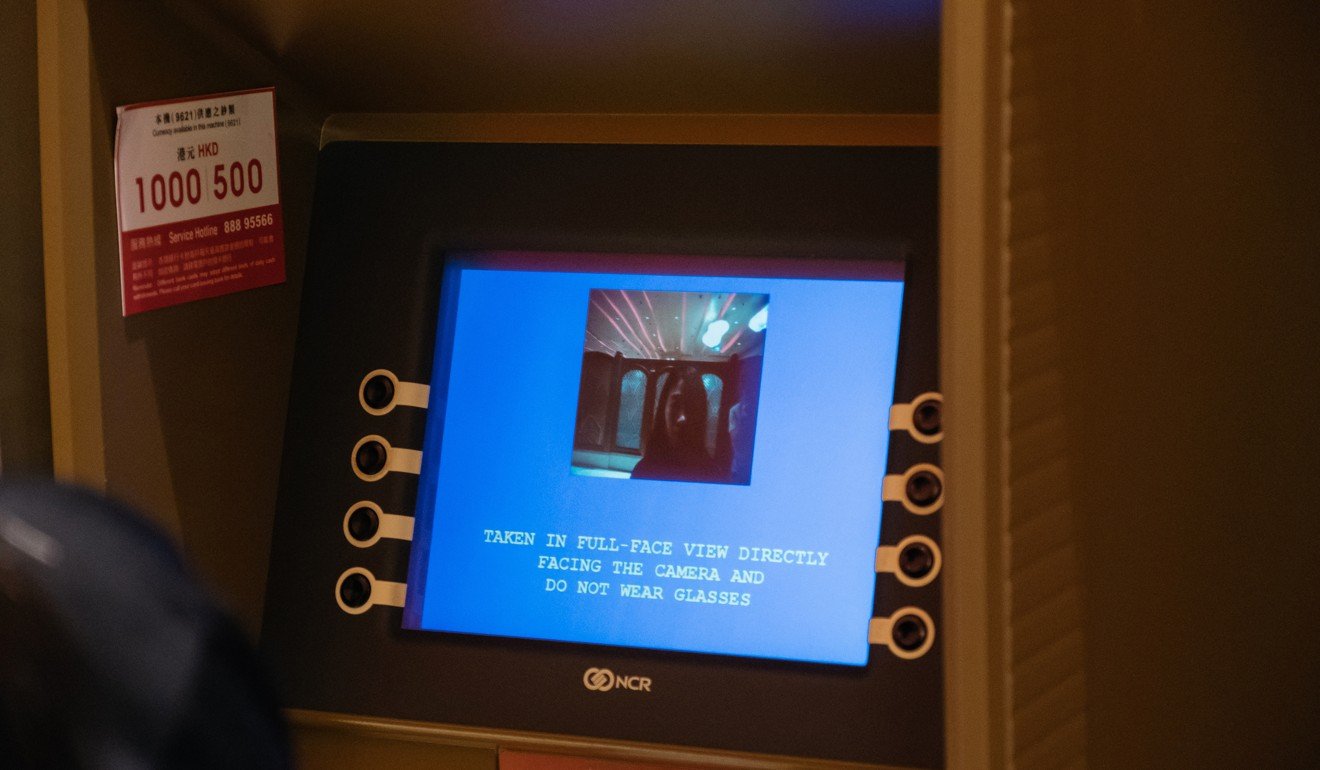

From Tuesday, holders of mainland-issued China UnionPay bank cards were blocked from using machines not yet fitted with new facial recognition technology.

So far, 834 of Macau’s 1,300 ATMs have been fitted with what the Macau Monetary Authority has dubbed “Know Your Customer” technology.

One casino employee, who works near an ATM which previously had long queues, said: “I used to see lots of people lining up at the ATMs before but they have vanished since the new machines were installed. Everyone must have gone looking for those without the cameras.”

Reported casino revenue dropped sharply in the last week of June – a month after the move to facial recognition technology began – which has led some to suggest a connection between the two.

However, Grant Govertsen, an analyst at Union Gaming Securities Asia, believed the technology was not aimed directly at casino customers.

“We believe they are an addition to ongoing capital flight controls from mainland China, which will have the largest impact on those who come to Macau for the purpose of withdrawing and then holding Hong Kong dollars from their renminbi-denominated mainland bank accounts,” Goverston told the gaming website GGRAsia.

On Monday, the monetary authority said the move was designed to “protect the legal interests of financial institutions and mainland China UnionPay cardholders” and to “ensure the effectiveness of measures to monitor ATM cash withdrawals”.

It said it had been asking banks to speed up implementation of the technology and strive “to cover all ATMs in Macau, including those inside casinos and in their surrounding areas” by the end of the year.

But the authority reiterated that holders of Macau bank cards or those of banks in other jurisdictions could “carry out ATM cash withdrawals as usual”.

It added that thetechnology would be extended to other mainland Chinese bank cards “at a later stage”.

The Macau roll-out is the first widespread consumer use of facial recognition security programmes in the country.

People from the mainland make up the vast majority of visitors to Macau. Of 30 million visitors in total to the city last year, 20 million were from the mainland.

Earlier this year, the Post reported that withdrawals from Macau’s ATMs had surpassed HK$10 billion per month and that special measures would be introduced to ensure they never run out of bank notes.

The Hong Kong Monetary Authority has already confirmed it is “looking at” a range of measures to tighten and secure the integrity of the city’s financial institutions as Beijing’s crackdown on money laundering and capital flight presses on.