Advertisement

Advertisement

David McBain

David is a technical strategist at Absolute Strategy Research, with a focus on sentiment, positioning and momentum analysis across global asset classes. David previously worked for 18 years at NatWest Markets / Deutsche Bank as a market strategist in their top ranked UK Strategy team, followed by a spell working for one of Europe's largest hedge Funds. David was ranked among the Top 10 for Technical Analysis in the 2011 and 2013 Reuters Extel surveys.

David is a technical strategist at Absolute Strategy Research, with a focus on sentiment, positioning and momentum analysis across global asset classes. David previously worked for 18 years at NatWest Markets / Deutsche Bank as a market strategist in their top ranked UK Strategy team, followed by a spell working for one of Europe's largest hedge Funds. David was ranked among the Top 10 for Technical Analysis in the 2011 and 2013 Reuters Extel surveys.

Advertisement

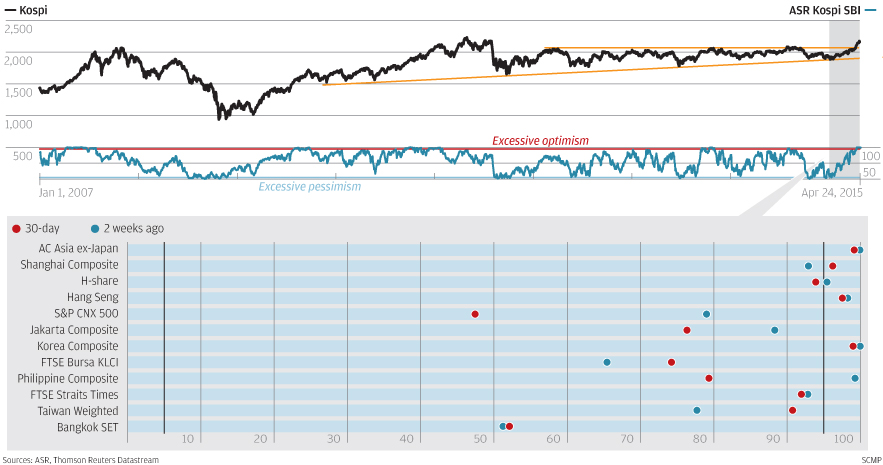

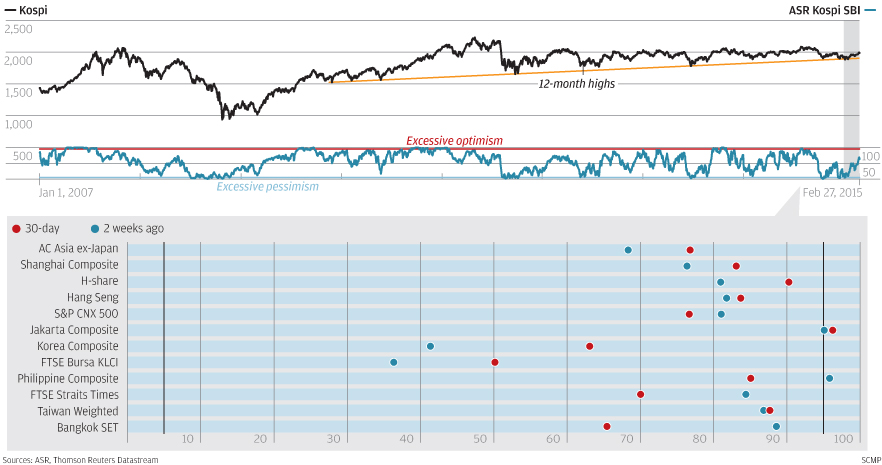

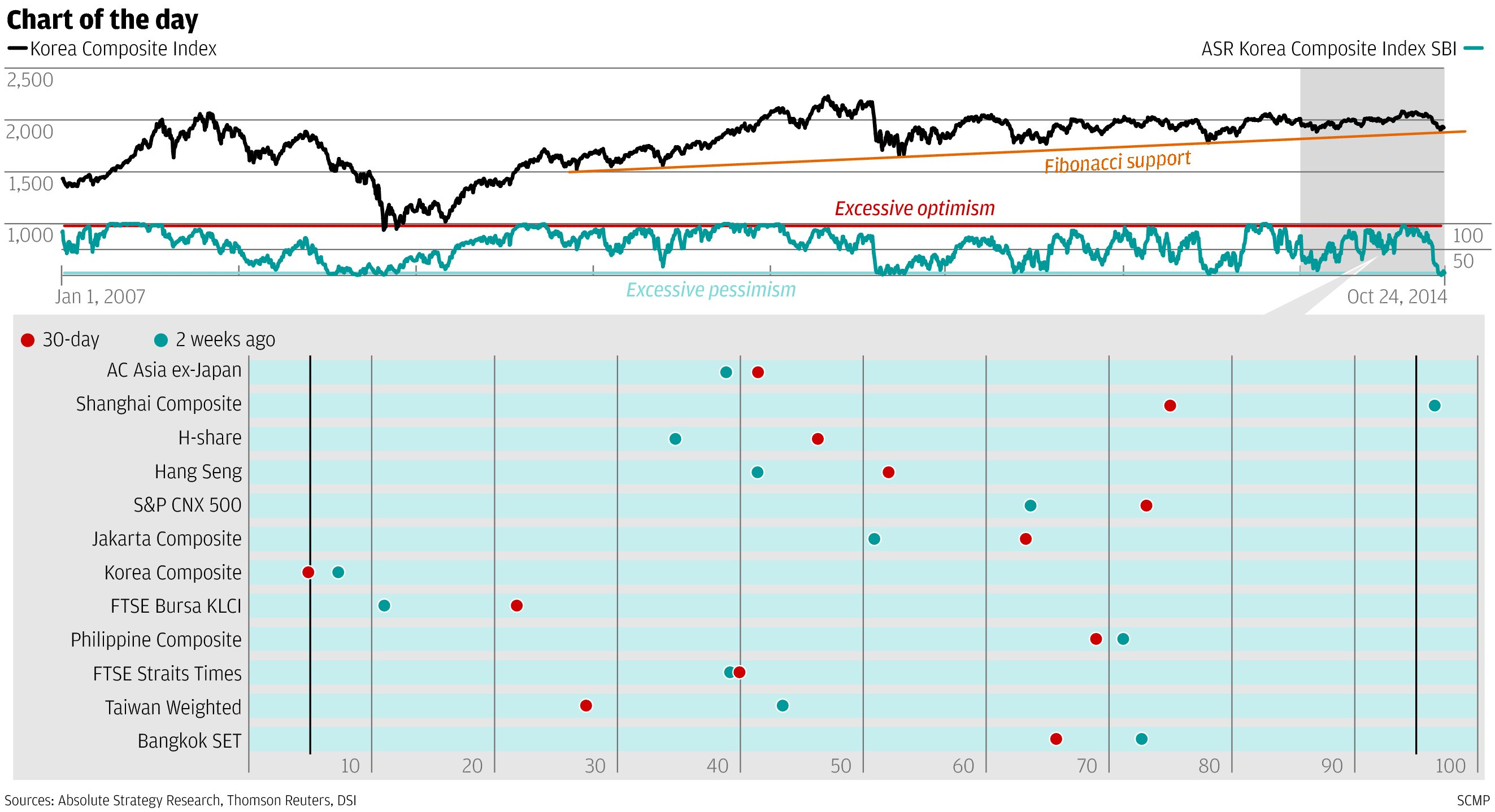

In the wake of its 10 per cent rally over the past two months, the Kospi Sentiment Barometer Indicator has moved into an extended optimism condition.

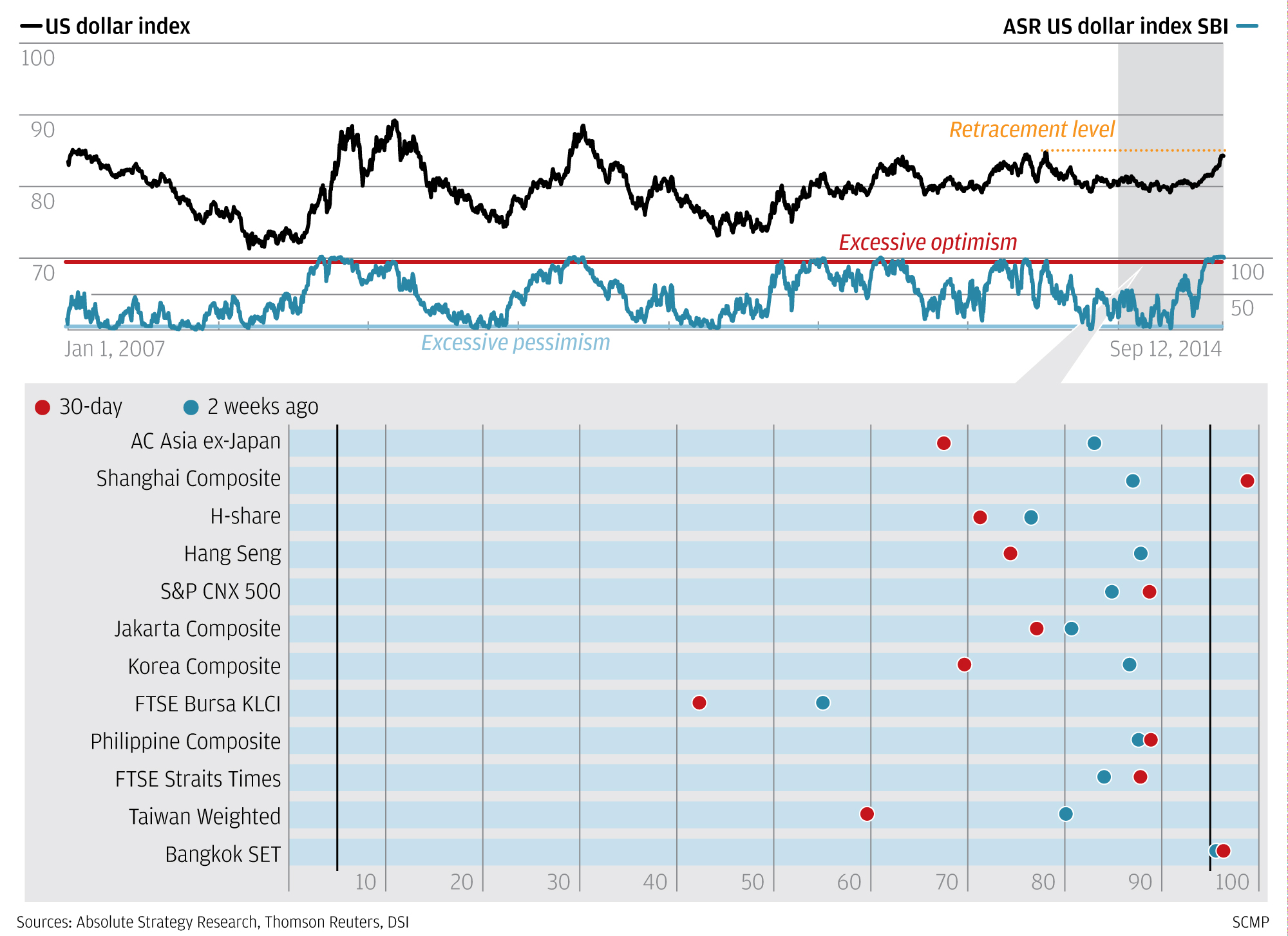

Chart of the day: Investors keep faith in dollar

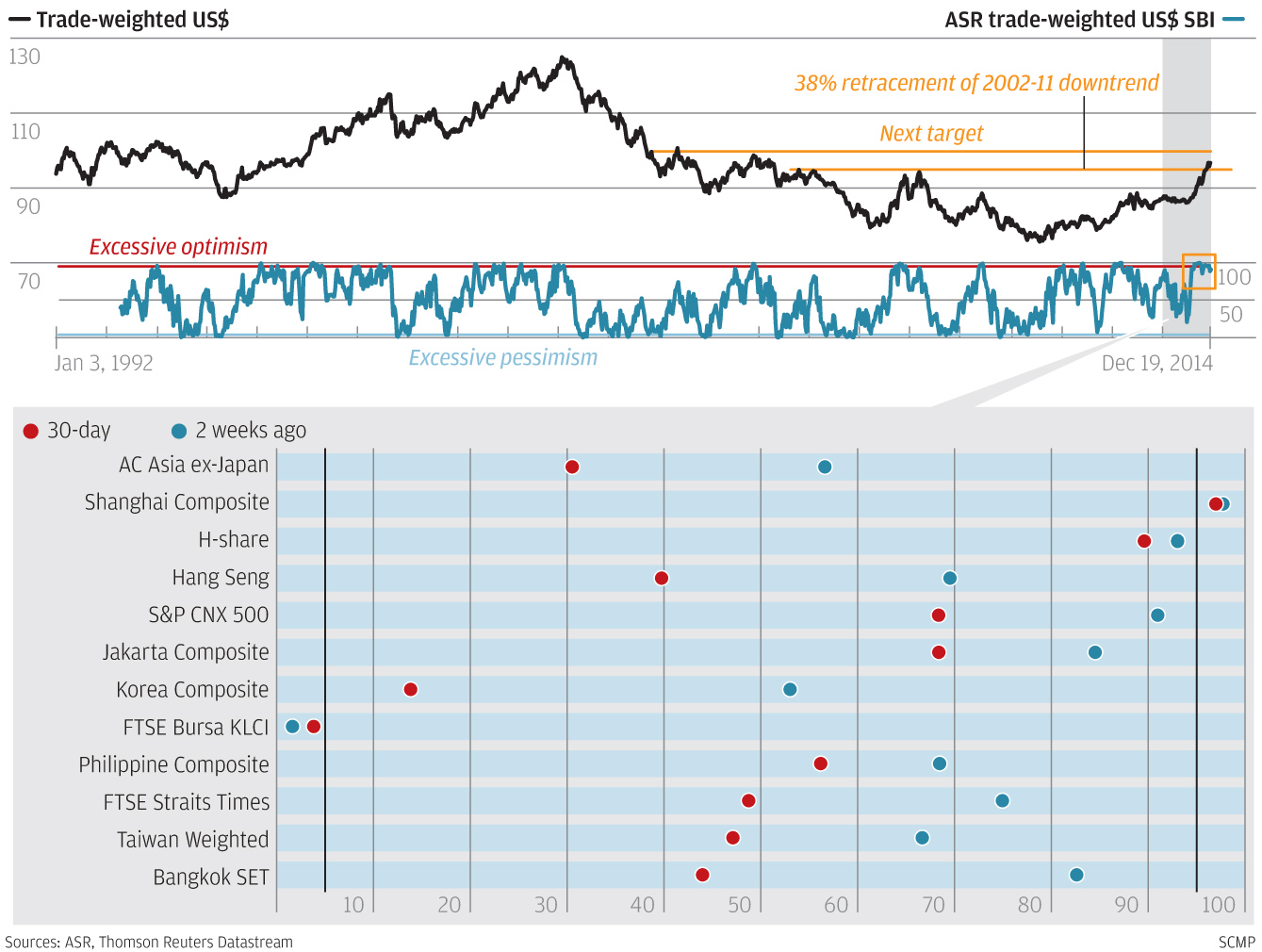

The US dollar is ending the year on a high note. This month's ASR-Extel year-ahead survey reveals that a net 73 per cent of respondents believe the trade-weighted US dollar will end next year at higher levels.

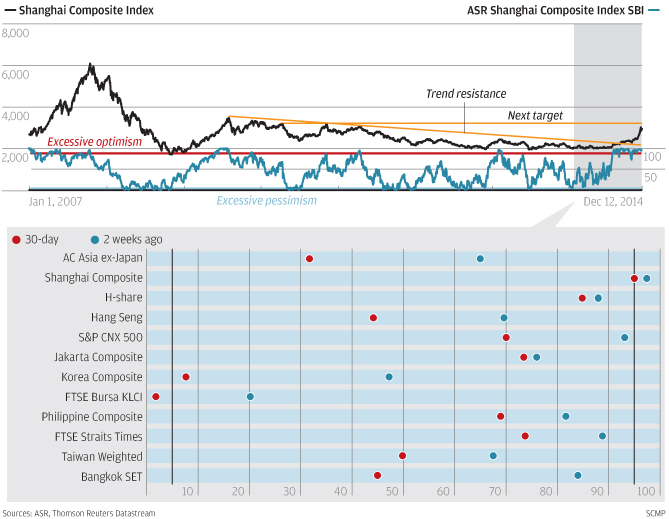

Where next for the Shanghai Composite Index is a question best answered by a look at historical performance.

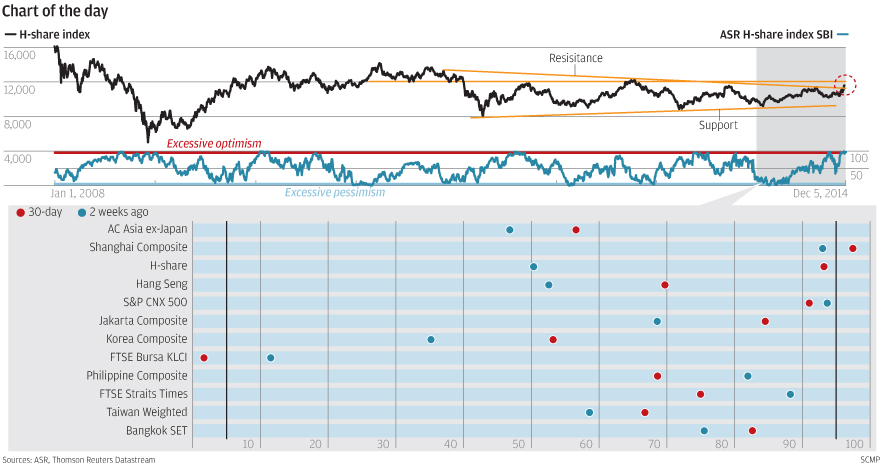

The H-share index has been living in the shadow of the Shanghai Composite Index. But H-share momentum may be beginning to improve.

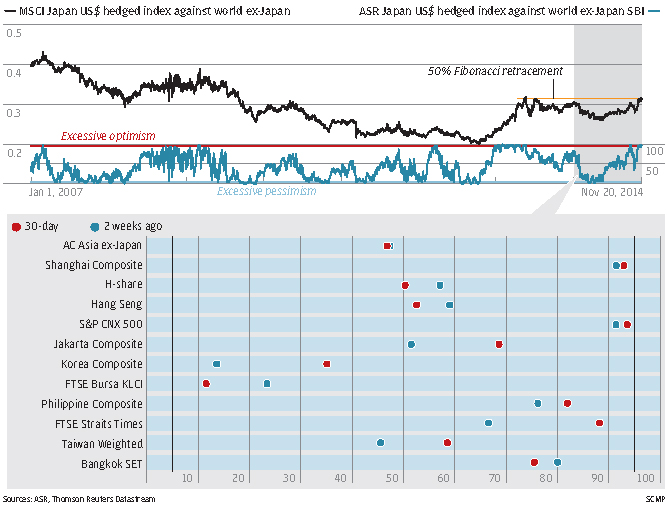

While yen weakness may help corporate Japan, it has been bad news for US dollar-based investors in Japanese equities.

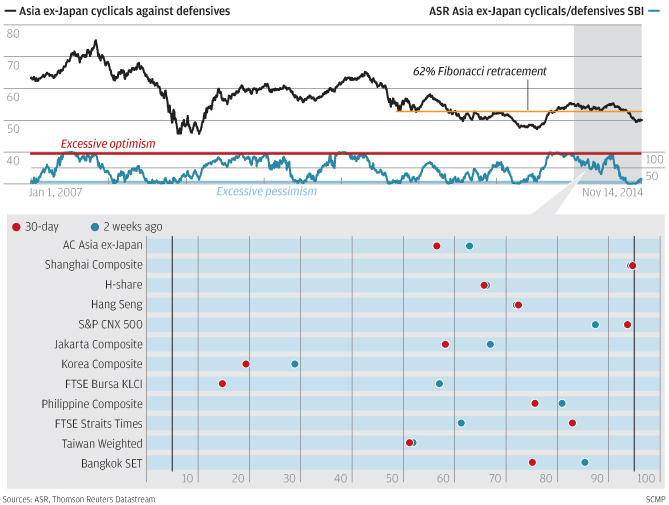

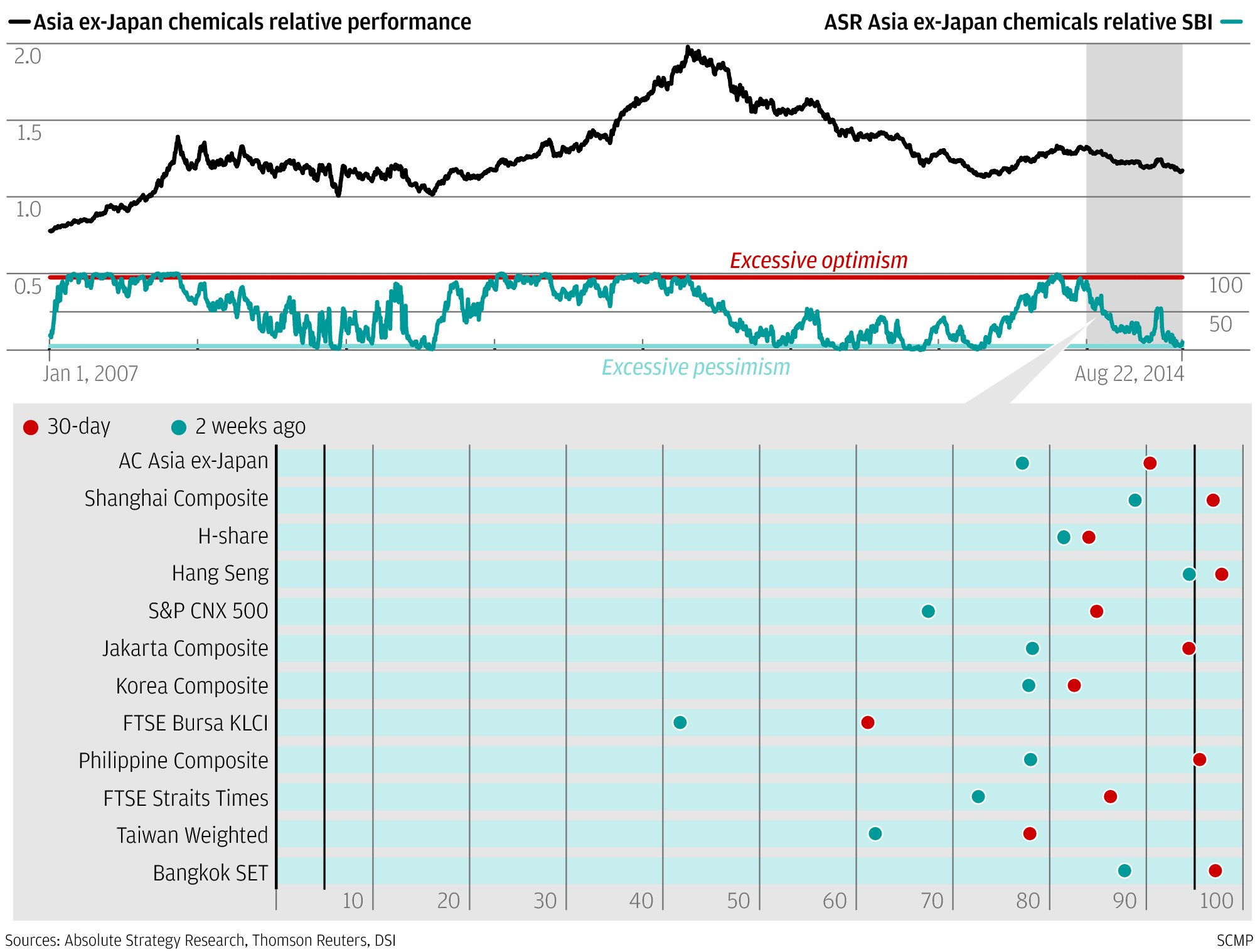

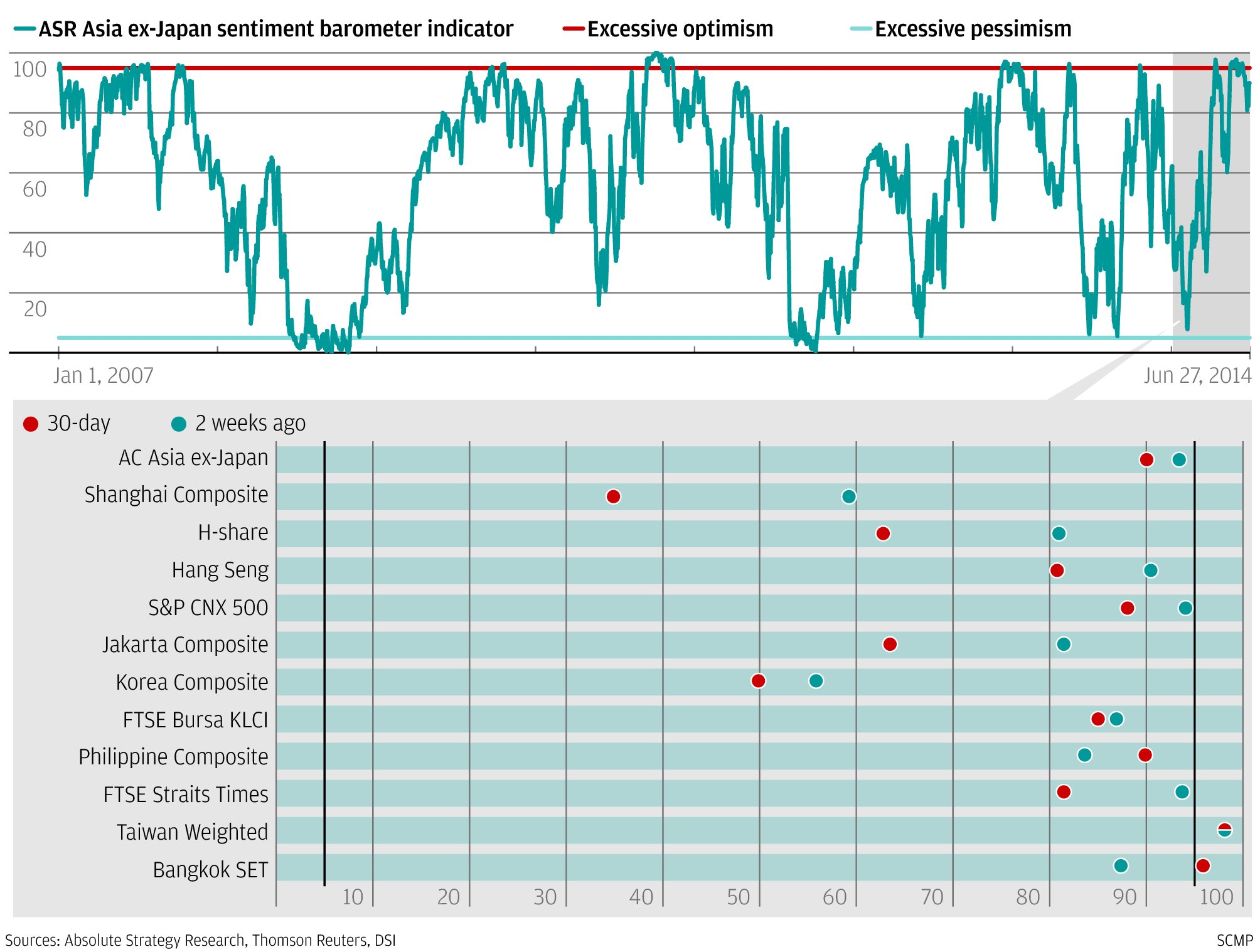

Cyclicals have stabilised against defensives in Asia, excluding Japan, since the middle of last month.

The yen's sharp reversal has taken centre stage on the foreign exchange front in recent weeks.

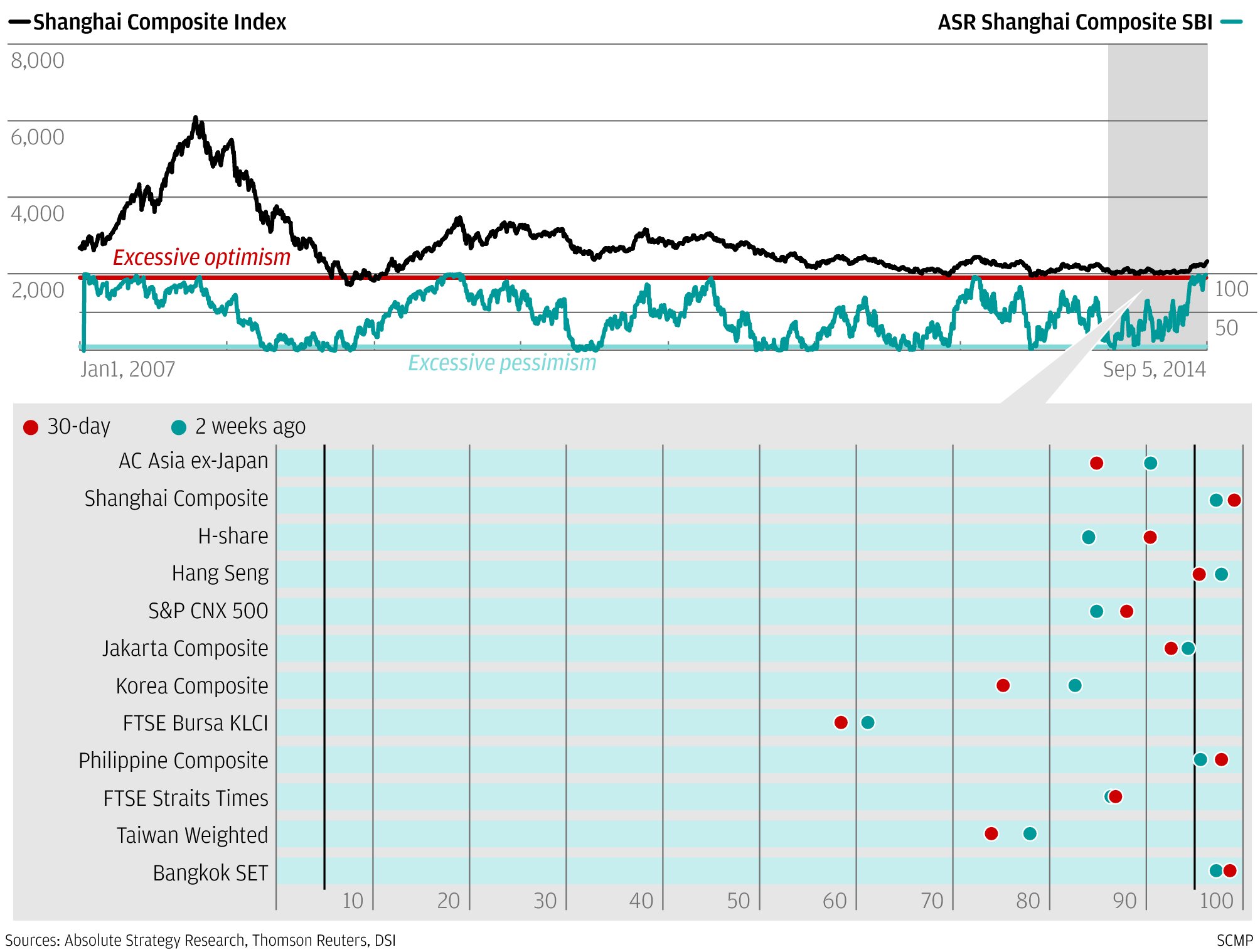

Mainland equities enter November on a rising tide of optimism, but the Shanghai Composite Index faces near-term sentiment headwinds as it tries to sustain a break above its 2013 high point.

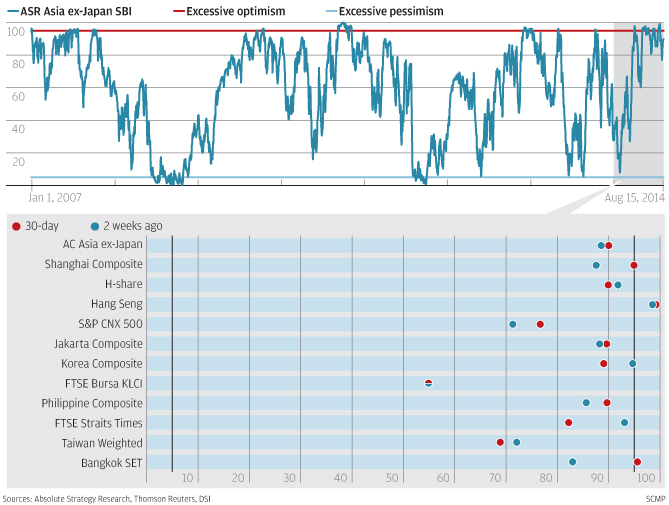

A torrid week for global equities did not leave the Asia-Pacific region unscathed, though in relative terms the region was almost tranquil.

China's equity market seems to march to its own beat, unaffected by the global growth concerns that have undermined indices elsewhere across the globe.

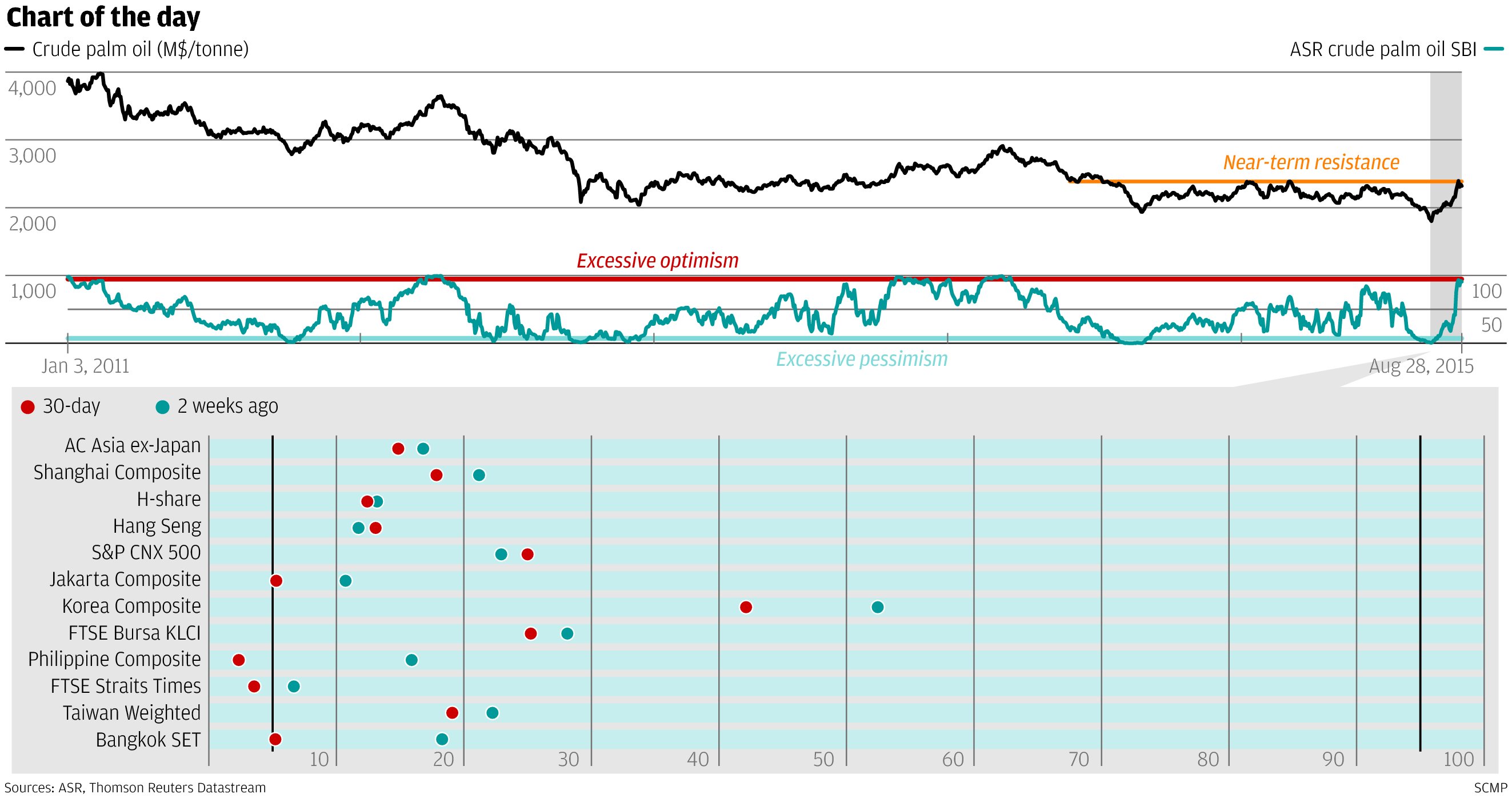

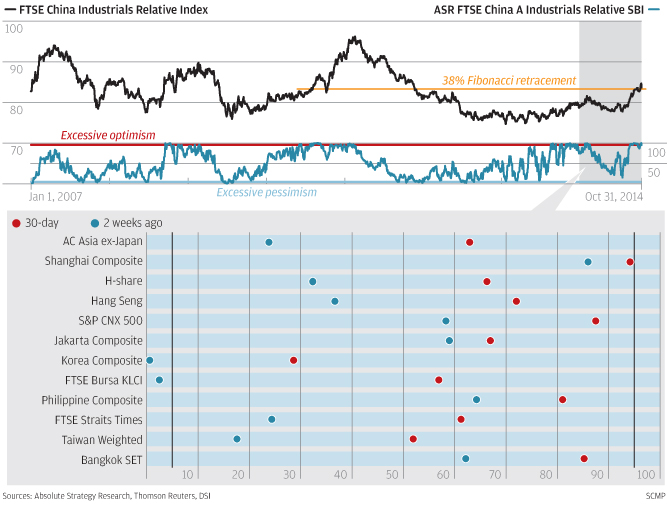

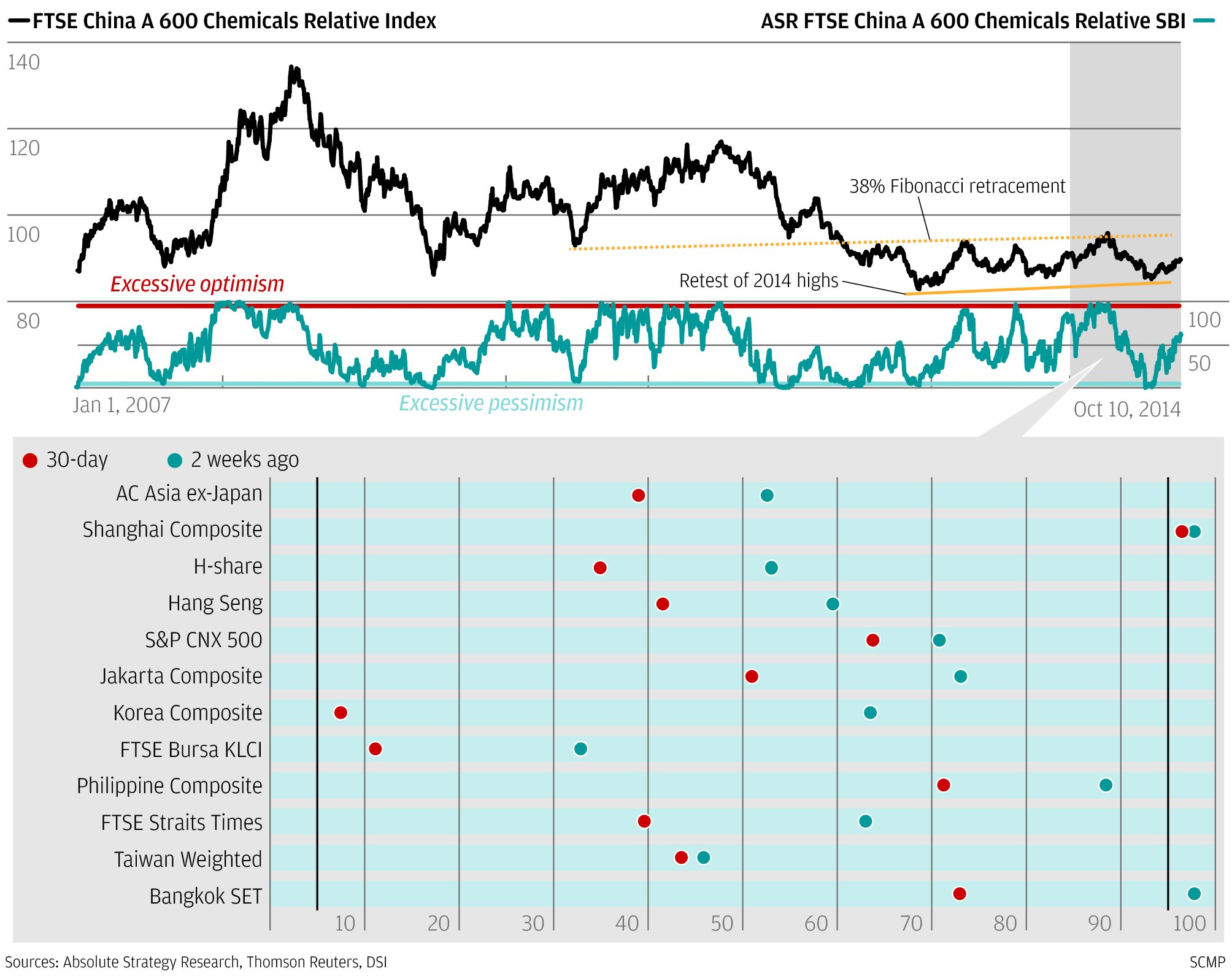

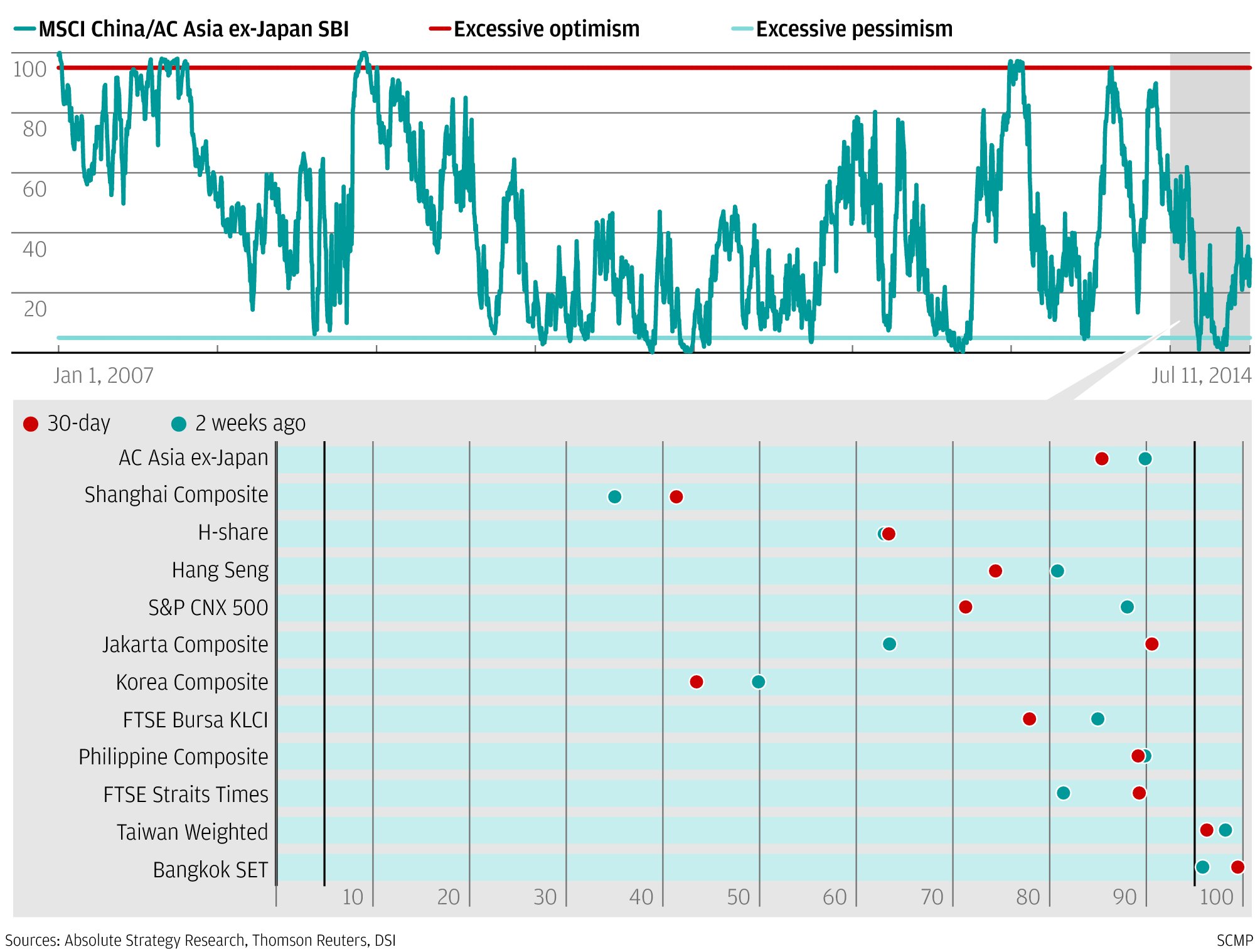

Optimism towards Asian equity markets has eased in the past week as a number of indices have retreated, leaving the likes of the Shanghai Composite and the Bangkok SET as sentiment bright spots.

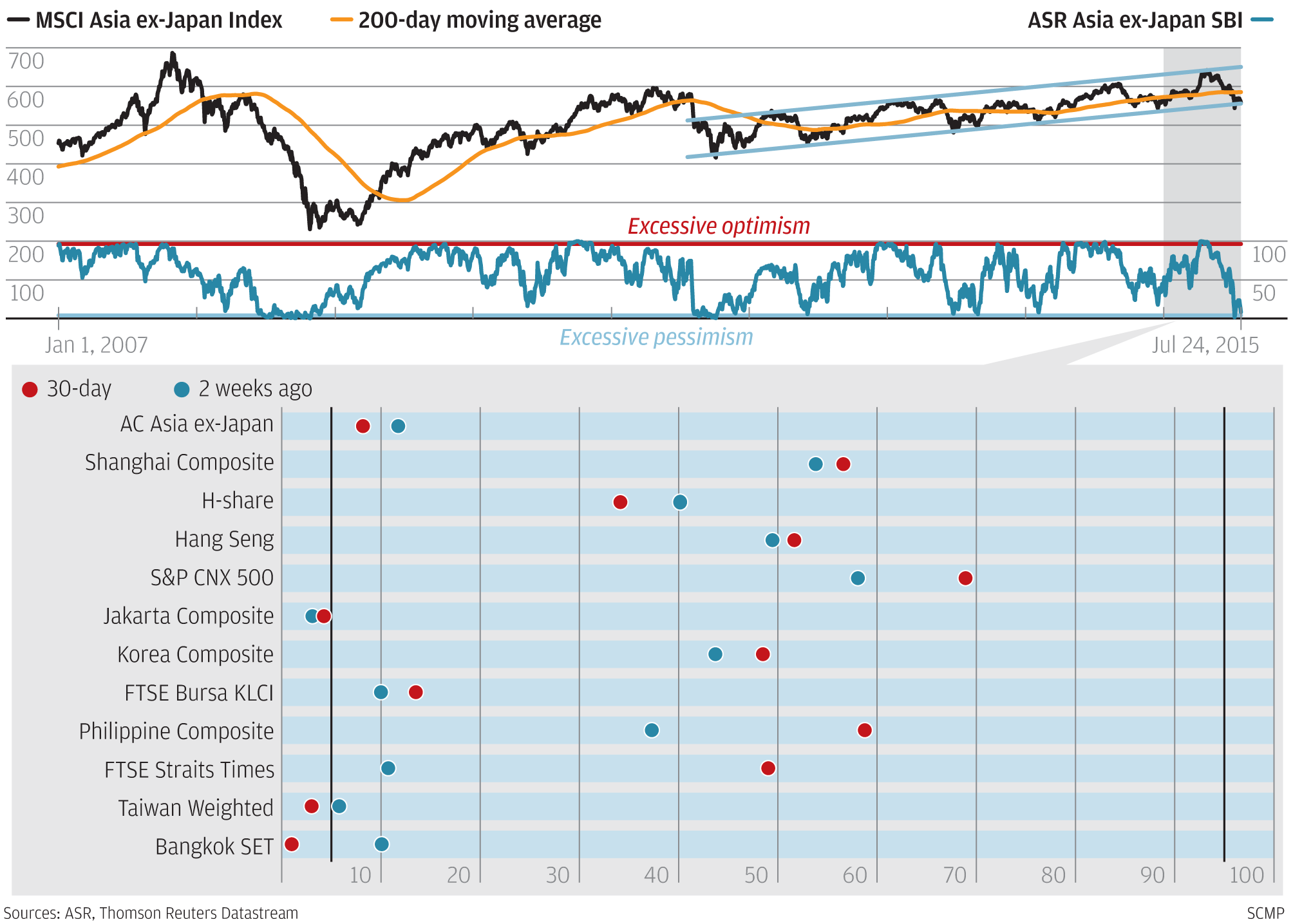

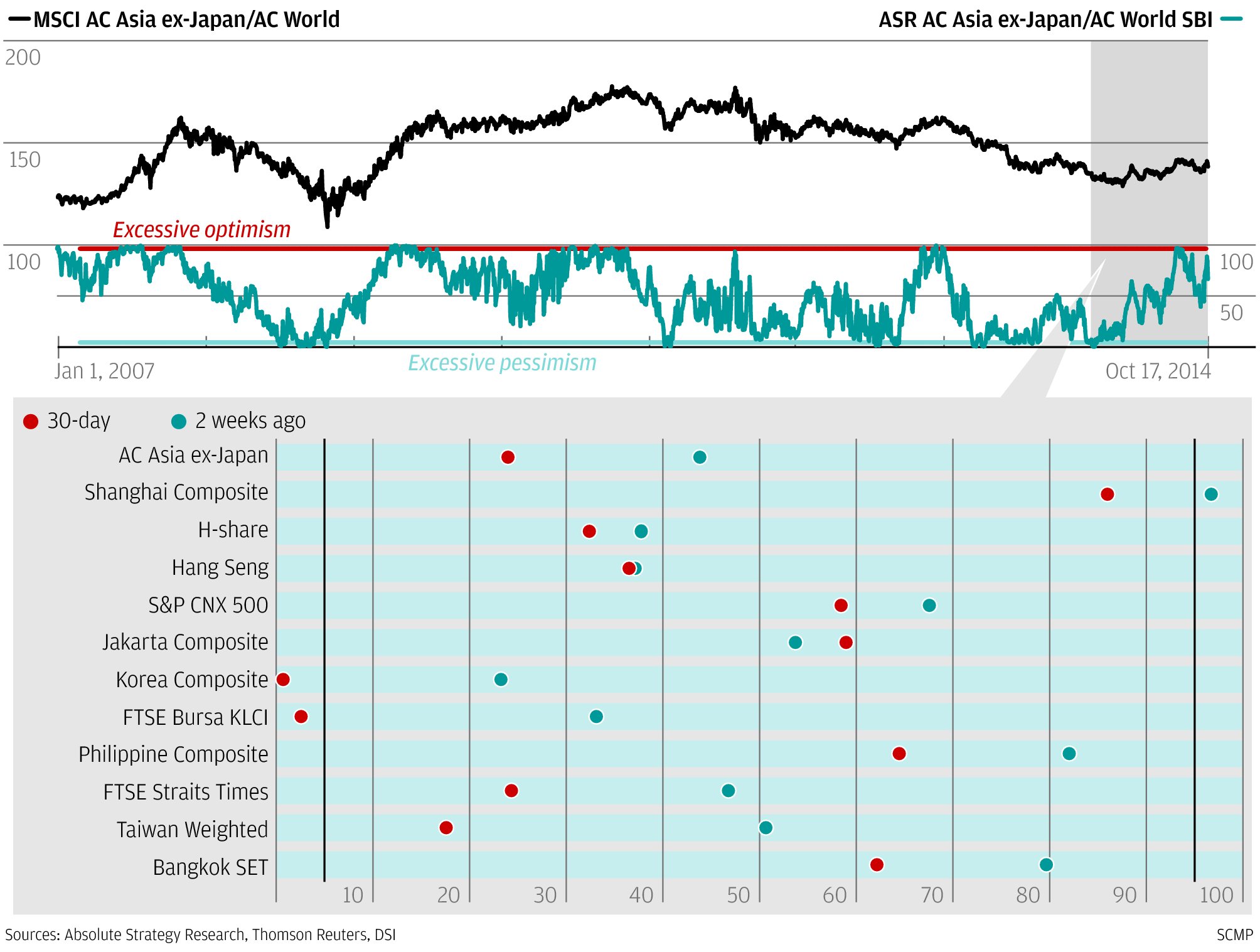

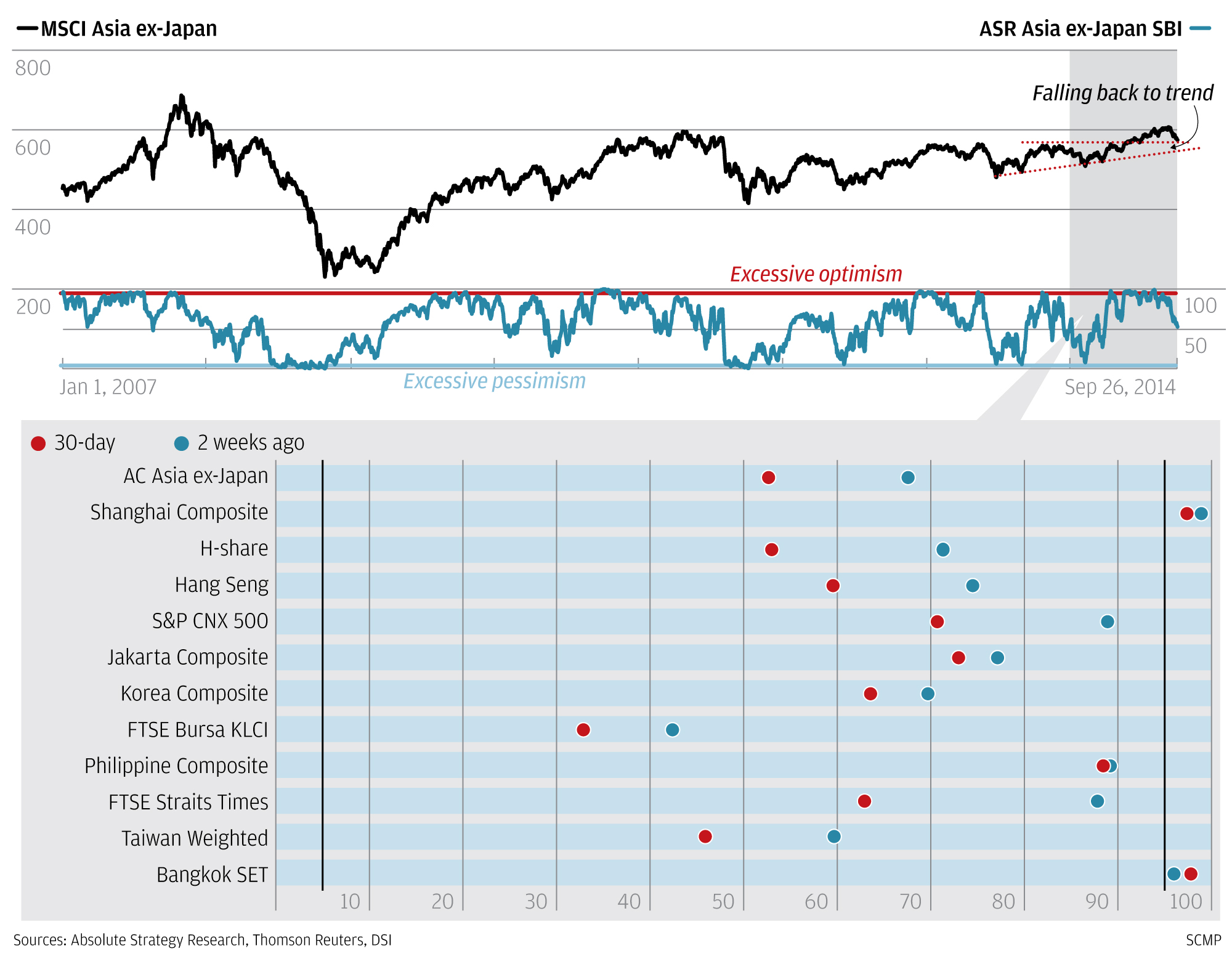

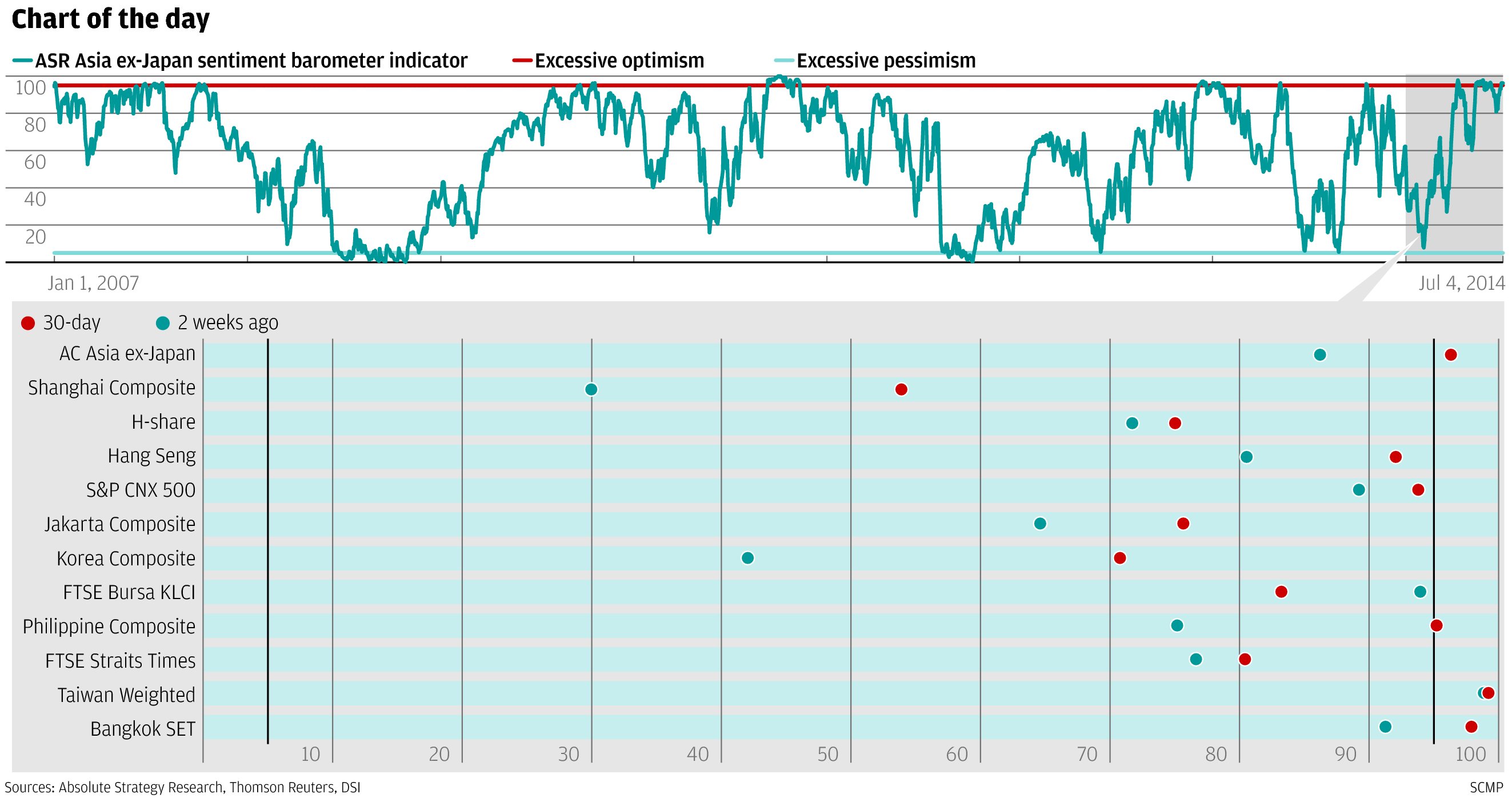

Sentiment towards Asian equities has broadly weakened over the past two weeks.

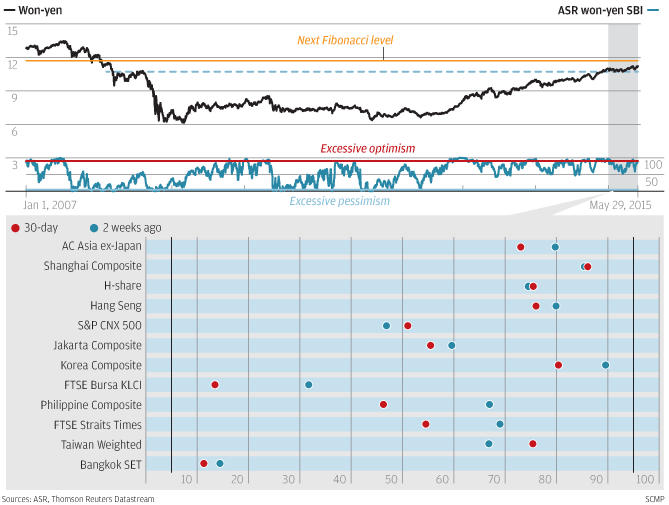

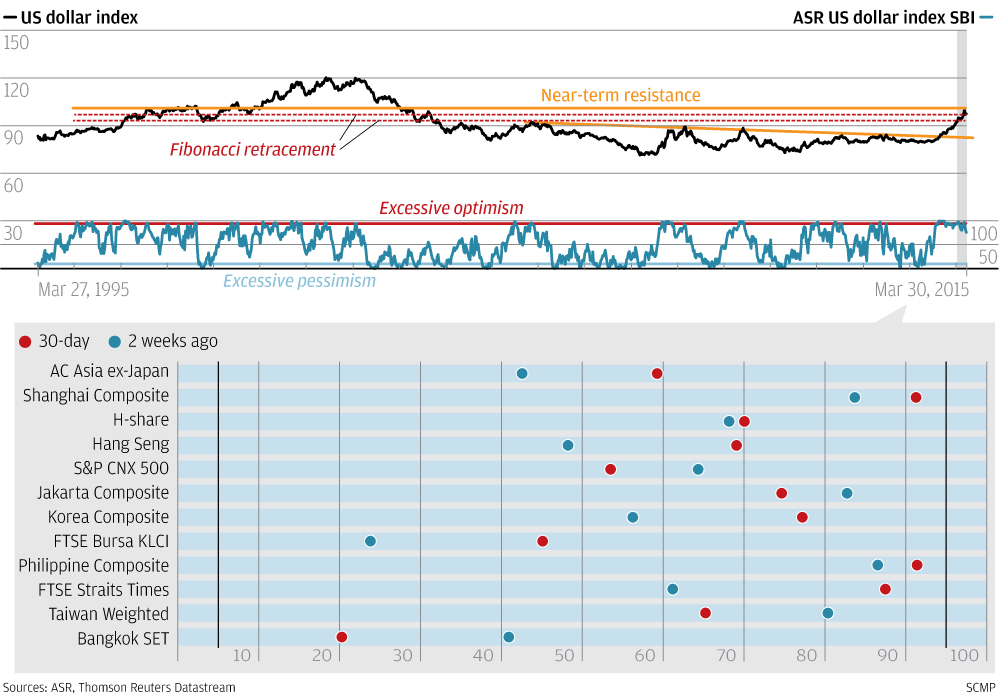

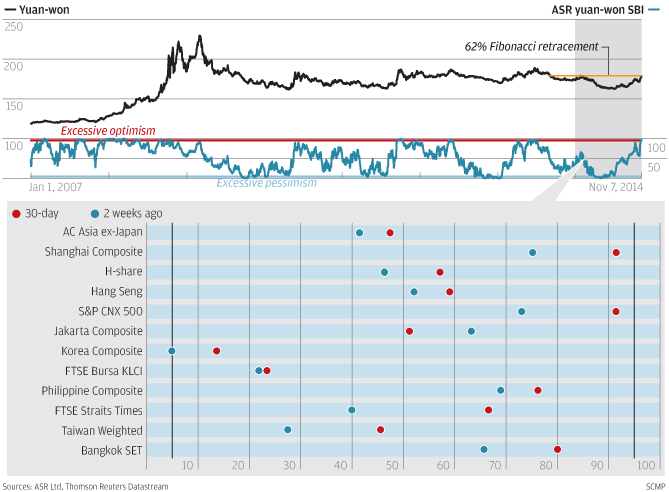

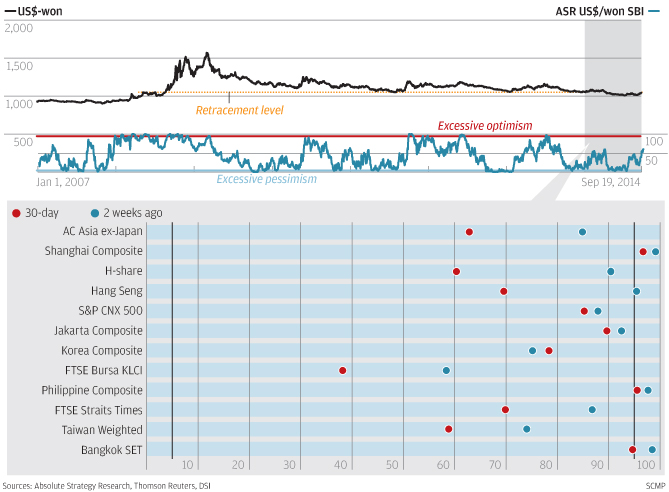

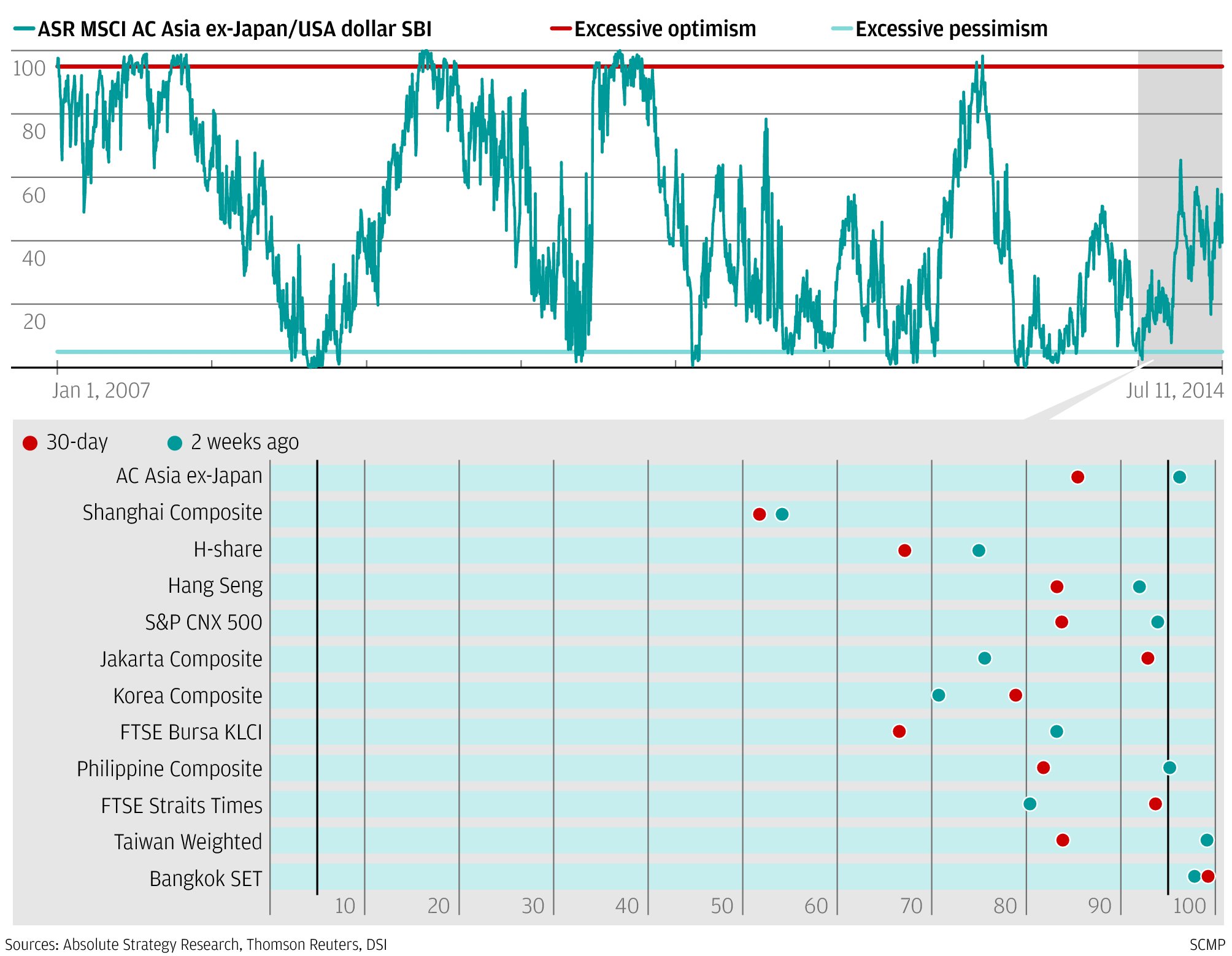

Foreign exchange developments have stepped into the sentiment spotlight.

Mainland equities have moved into the sentiment spotlight in the past week, with both the Shanghai Composite and Hang Seng indicators pushing into extreme optimism territory.

Sentiment indicators are at the high end of their historic ranges, with emerging markets and energy-related plays such as Norway and Canada to the fore as liquidity-driven risk trades and geopolitical developments dominated.

Related Topic

Chart Book