Advertisement

Advertisement

James A. Dorn

James A. Dorn is a senior fellow and China specialist at the Cato Institute. From 1984 to 1990, he served on the White House Commission on Presidential Scholars. He has been a visiting scholar at Fudan University. He holds a PhD in economics from the University of Virginia.

James A. Dorn is a senior fellow and China specialist at the Cato Institute. From 1984 to 1990, he served on the White House Commission on Presidential Scholars. He has been a visiting scholar at Fudan University. He holds a PhD in economics from the University of Virginia.

Languages Spoken:

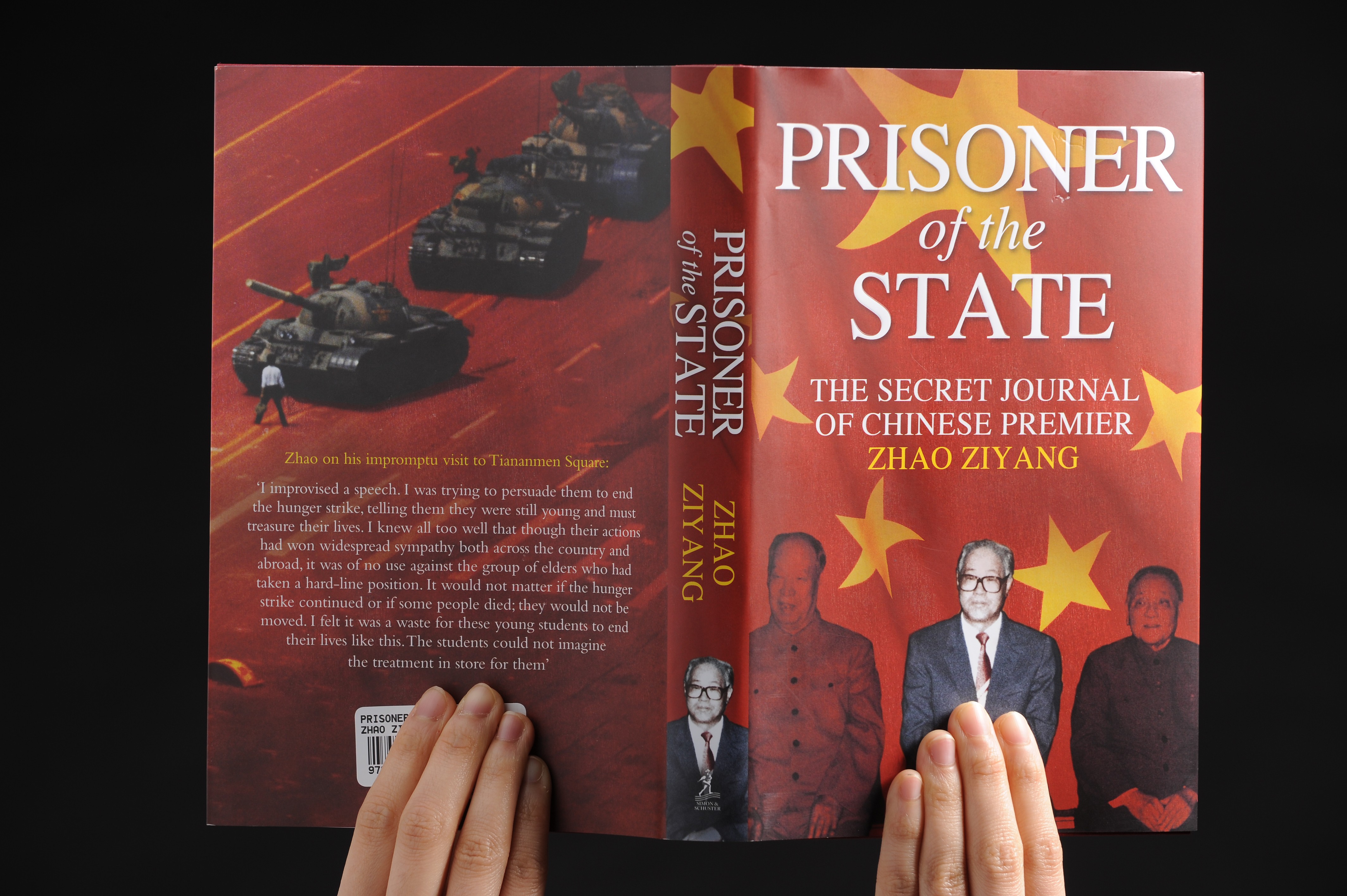

EnglishChina must recall how a lack of openness in goods and ideas handicapped development in the Mao era. This is also a good time to remember those such as Zhao Ziyang, who recognised the need for political and economic reform.

A long-term strategy would be to show China that a free market in ideas is far superior to “socialism with Chinese characteristics”. The moral force of the voices of freedom and limited government should not be underestimated.

Beijing's decision to allow more flexibility in the daily trading band for the yuan-dollar exchange rate, along with the announcement that the People's Bank of China will soon allow banks to pay higher interest rates on deposits, are positive signs that the leadership is serious about giving markets more play. Ending financial repression, however, will require political as well as economic reform.

People's trust in government erodes when there is no genuine rule of law to limit the power and scope of the ruling elite. The latest breach of trust in China is the discovery that more than 40 per cent of the rice supply in Guangzhou was tainted with cadmium, a toxic metal. The socialist idea that "power resides in the people" is a mantra without substance.

Advertisement