A total of 376 industrial properties in Tsuen Wan were sold in July, according to commercial real estate agency Ricacorp (CIR) Properties, up 89 per cent from the 199 transactions in May and 80 per cent higher than the 208 sales in June.

China Overseas Land & Investment, the Hong Kong-listed mainland developer, raised its annual sales target by a fifth yesterday as it announced the possible injection of its parent company's real estate businesses into the firm.

HKR International, the developer of Discovery Bay, teamed up with Nan Fung Development to outbid 10 other developers and acquire a site in Sha Tin's Kau To for HK$1.22 billion, or HK$9,071 per square foot, at the lower end of market expectations.

Billionaire Li Ka-shing's Cheung Kong (Holdings) has agreed to sell its shopping mall in Tin Shui Wai for about HK$5.85 billion, a move which analysts say aims to boost earnings affected by the government's housing policies.

The survey, conducted by property consultancy Colliers International, polled companies predominantly based in Europe with more than 1,000 staff. It also found that Asia was seen as the best place for enterprises to expand their business in the next two years.

Under the brand "Office Plus", the privately run developer will offer about 250 offices for lease by the end of this year for small companies, at monthly rents ranging from HK$9,000 to HK$55,000.

Hutchison Whampoa, the flagship conglomerate controlled by Li Ka-shing, is expected to report an increase in first-half net profit this week of about 7 per cent, analysts say.

Land prices on the mainland may continue to set new highs despite government cooling measures, property analysts said after Beijing sold a luxury residential site for a record price this week.

Latest research by Centaline Property Agency, which tracks newly signed leasing contracts at 85 large private housing estates, revealed that average monthly rents decreased by 0.4 per cent from May to HK$22.40 per square foot of gross floor area in June - the lowest level seen in the past seven months.

The most common question is whether now is the best time to buy a flat, but a 29-year-old man asked me recently whether he should spend his HK$1 million in savings on buying a home or starting up a new business.

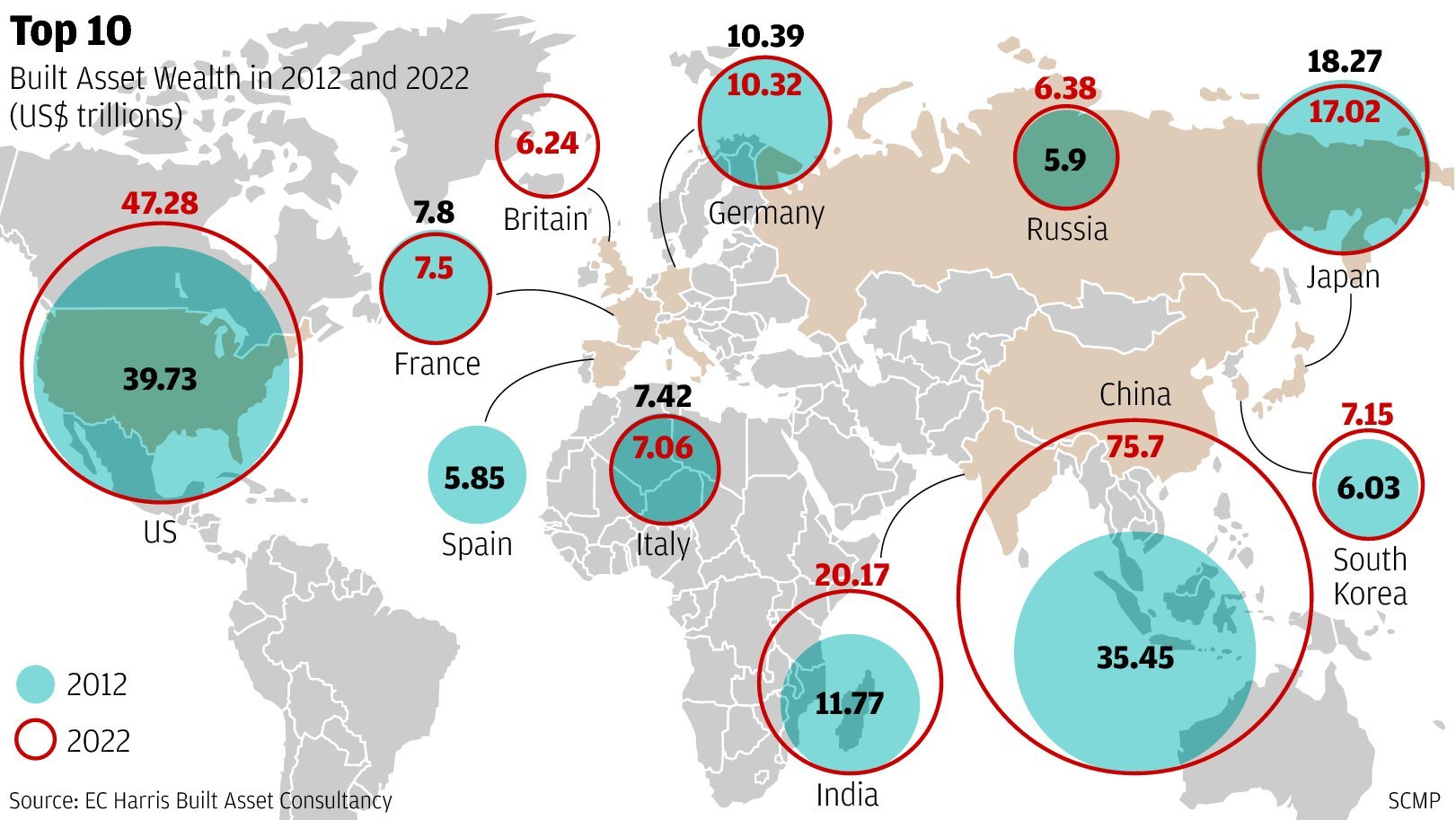

China has been ranked as the second-wealthiest country in built assets and it is set to surpass the United States by next year, according to the latest research.

Analysts named four mainland-listed developers - Shanghai Waigaoqiao Free Trade Zone Development, Shanghai Lujiazui Finance & Trade Zone Development, Shanghai Zhangjiang Hi-Tech Park Development and Shanghai Jinqiao Export Processing Zone Development - as the biggest winners after the free-trade zone was announced on July 3.

Home prices could fall as much as 45 per cent over the next three to five years amid higher property taxes, rising interest rates and a bleak outlook for commercial property, says one real estate agent.

Small lump-sum prices and hopes of high investment returns continue to lure Hong Kong investors into buying subdivided units at mainland shopping malls, despite their poor record.

Fortune Real Estate Investment Trust is looking to acquire shopping malls while its gearing and interest rates remain low, the reit's manager said yesterday.

Hong Kong Education International, which runs tuition schools, announced its plan to buy a 47 per cent stake in tertiary education service provider Seasoned Leader for HK$47 million.

New World Development's latest residential project in Yuen Long will test buying sentiment in the mid-range market in the New Territories amid subdued demand as a result of the government's cooling measures.

Bank of China (Hong Kong) has from today raised its rate under the scheme to 2.65 per cent per annum from 2.4 per cent for borrowers opting to lock in their interest rate for the first five years of their loan.

Estate agent Angel Law, who heads the new luxury residential department at property consultancy Knight Frank, believes knowledge of global property markets is essential for her team to survive in the local sector, which has been hit by the government's cooling measures.

A developer from Seychelles, the island nation where Prince William and his wife, Kate, spent their honeymoon, hopes to lure Hong Kong and mainland property investors into buying homes on the tropical island located off the east coast of Africa.

The government has little chance of meeting its target of selling enough residential sites to yield 13,600 new flats this financial year, analysts say.

The recent cash crunch on the mainland may have caused some banks to slash discounts on home mortgage rates, but market watchers believe the impact on the nation's property market will be minimal.

Chinachem bought the 283,115 square foot site near Evangel College for HK$3 billion, or HK$3,653 per square foot. The 10 sites sold in the area since 2010 ranged in price from HK$3,810 to HK$4,917 per sq ft.

It is quite common for Hongkongers to want to move out of their parents' homes for more space, if not more freedom, after working for a few years. "Space is definitely a problem," a female friend, who graduated from university almost five years ago, complained recently

The commercial tower at 60 Gloucester Road has 27 floors and a basement, with a total gross floor area of about 95,557 square feet. The price works out to HK$16,618 per square foot.

"Asking prices of public housing flats have surged by 30 to 50 per cent in the last two months," Fullmark Property Agency sales manager Kim Chan Shek-kam said. "Sellers are setting prices as if they want to try their luck by winning the Mark Six jackpot, despite the fact they can hardly find any buyers at those prices."

The hotel trust, NW Hotel Investments - which includes the Grand Hyatt Hong Kong, the Renaissance Harbour View Hotel and the Hyatt Regency Hong Kong, Tsim Sha Tsui - had a valuation of HK$21.4 billion on March 31, a prelisting document said.

The plan for the Hong Kong conglomerate The Wharf (Holdings) to have half of its total assets on the mainland may not be achievable in the near future, the company's chairman warned shareholders.

The Link Real Estate Investment Trust is paving the way to sell some of its assets by evaluating its portfolio, including shopping centres and car parks in public housing estates.