Advertisement

Advertisement

William R. Rhodes

William R. Rhodes, a former chairman, CEO and president of Citibank, is president and CEO of William R. Rhodes Global Advisors, LLC, and author of Banker to the World: Leadership Lessons from the Front Lines of Global Finance.

William R. Rhodes, a former chairman, CEO and president of Citibank, is president and CEO of William R. Rhodes Global Advisors, LLC, and author of Banker to the World: Leadership Lessons from the Front Lines of Global Finance.

Languages Spoken:

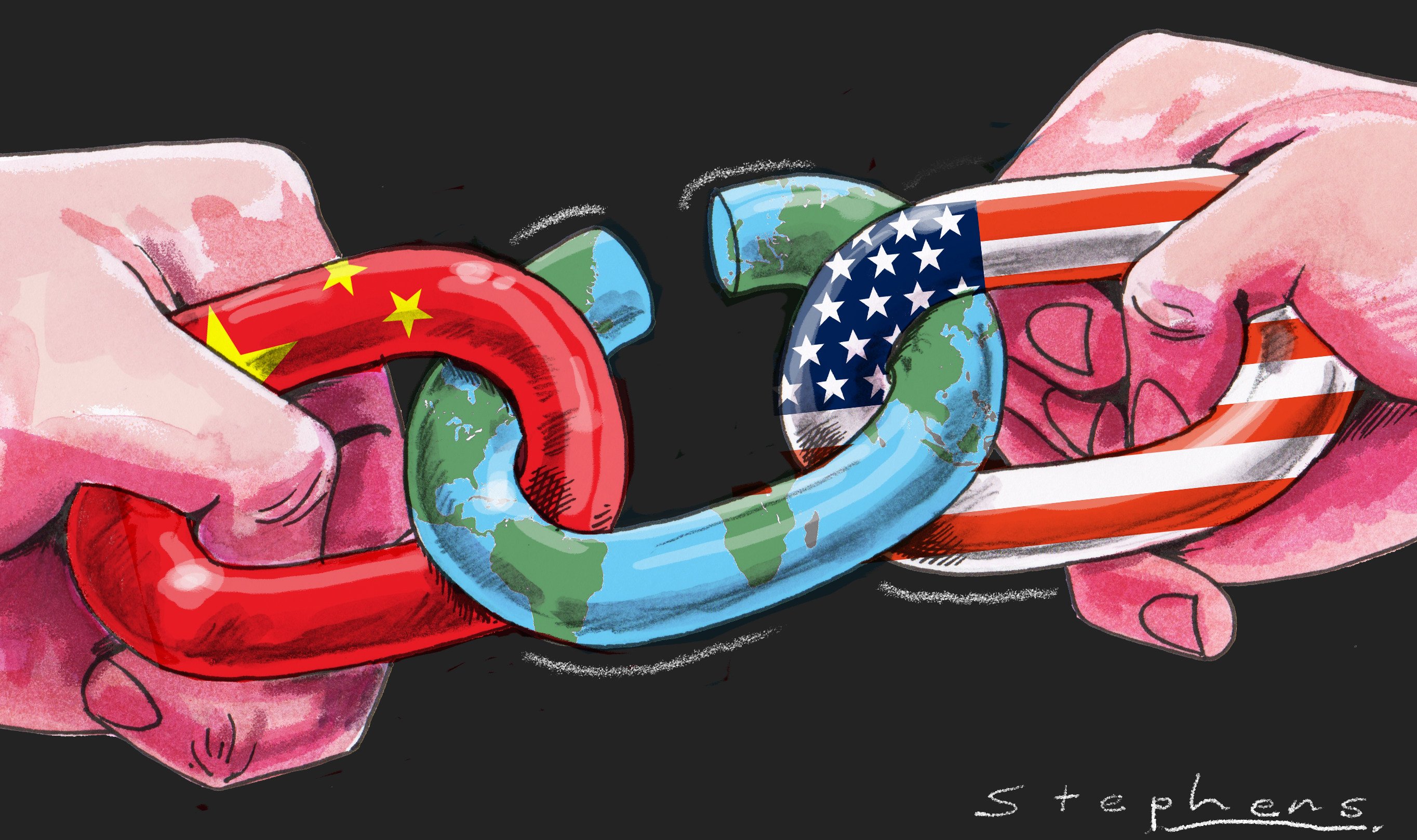

EnglishBrics has become an alternative power base outside the reach of the US and its allies, and a rising counterweight to US influence globally.

Beijing must let unsalvageable developers fail and, crucially, avoid saddling banks with bad loans. Short-term pain is preferable to infecting finance and creating a deeper, longer economic downturn.

Politically and economically, China is superior to Russia in an unequal alliance that has seen growing Russian dependence. If Xi can craft an exit from war in Europe, China’s geopolitical stock will rise further.

As China looks to reform its banking regulations, it can avoid US pitfalls, such as letting regional banks lend excessively to one sector or allowing skewed boards. Importantly, the siren call of lobbying for looser banking rules and regulations must be ignored.

Advertisement