Advertisement

Advertisement

TOPIC

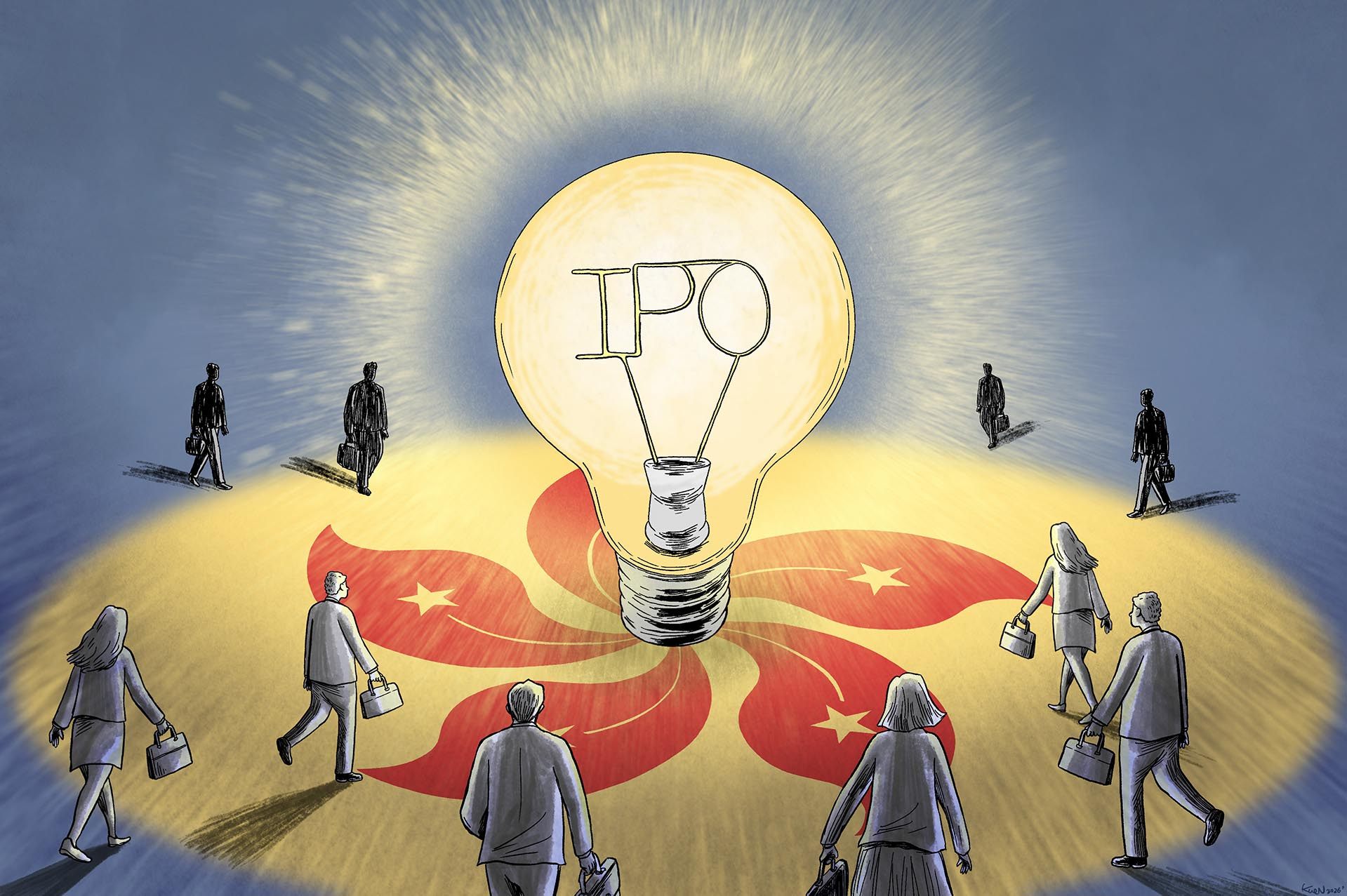

Banking & finance

Related Topics:

Banking & finance

News about the global financial industry with a focus on developments in Hong Kong and China.

Help preserve 120 years of quality journalism.

SUPPORT NOWAdvertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement