Advertisement

Advertisement

TOPIC

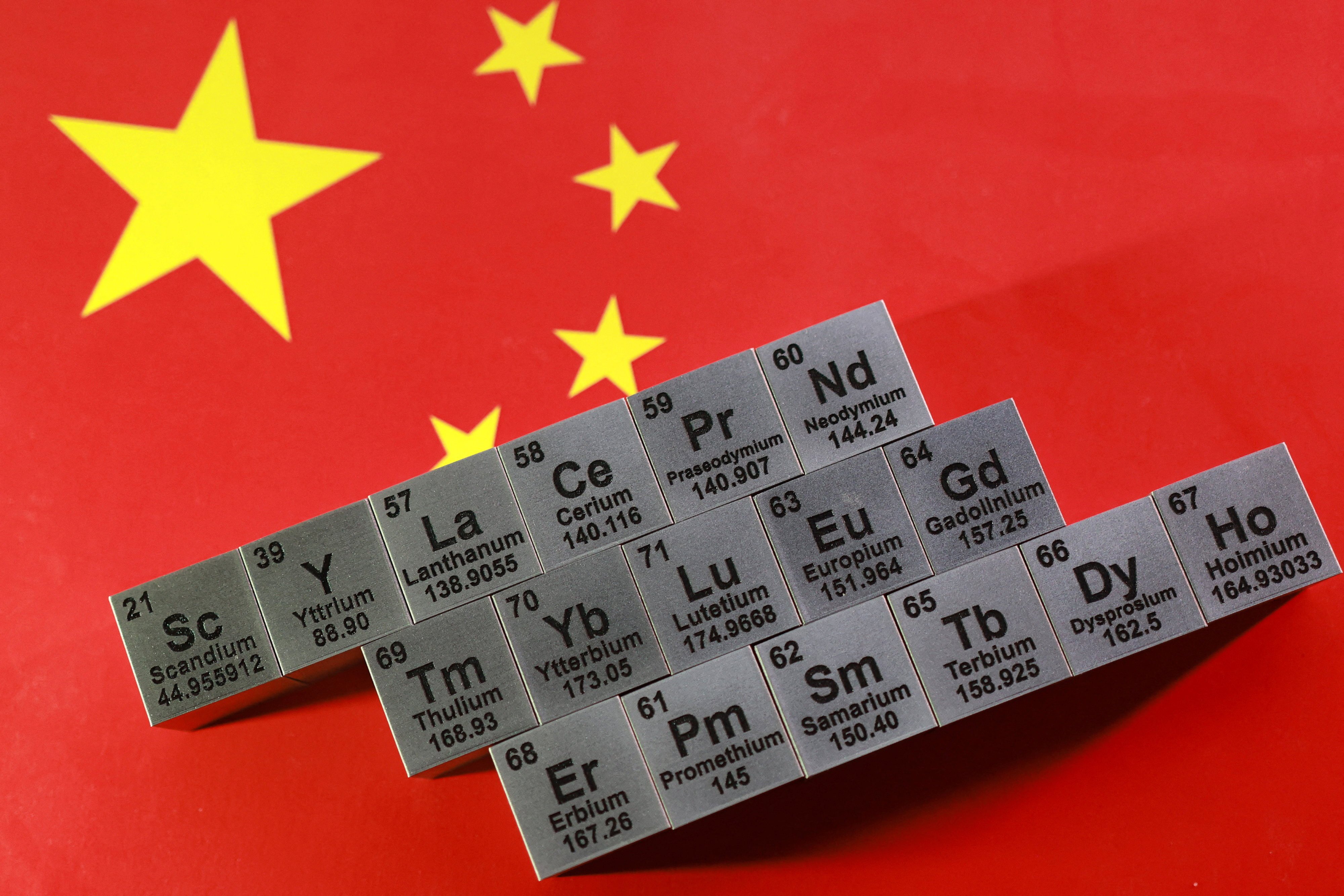

Commodities

Commodities

Commodity market action from around the world with a focus on the commodities that matter most to investors in Hong Kong and China.

Help preserve 120 years of quality journalism.

SUPPORT NOWAdvertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement