Advertisement

Advertisement

TOPIC

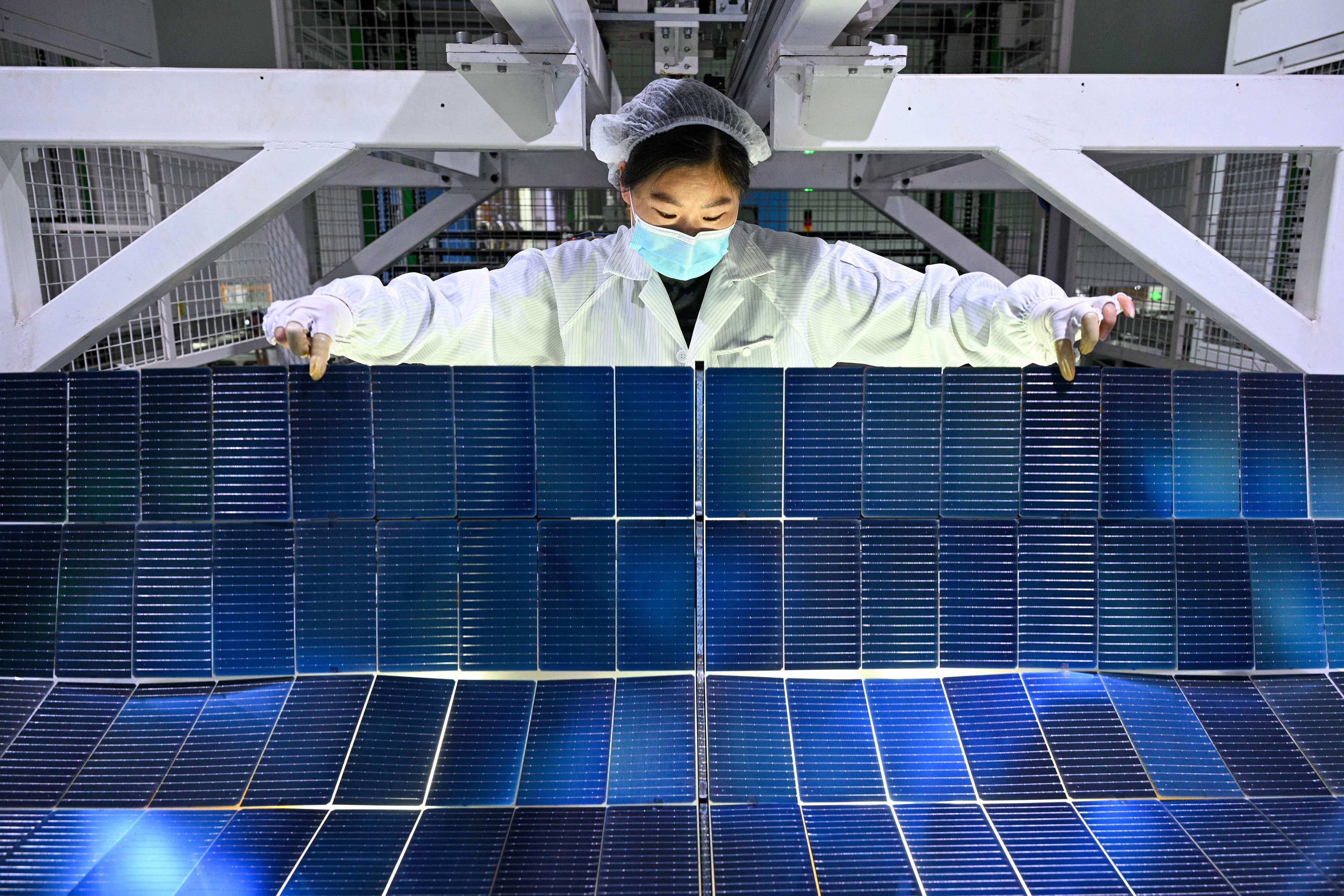

ESG investing

ESG investing

Latest news and analysis about investments that align with the principles of environment, social and corporate governance (ESG) investing.

Help preserve 120 years of quality journalism.

SUPPORT NOWAdvertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement