TOPIC

/ company

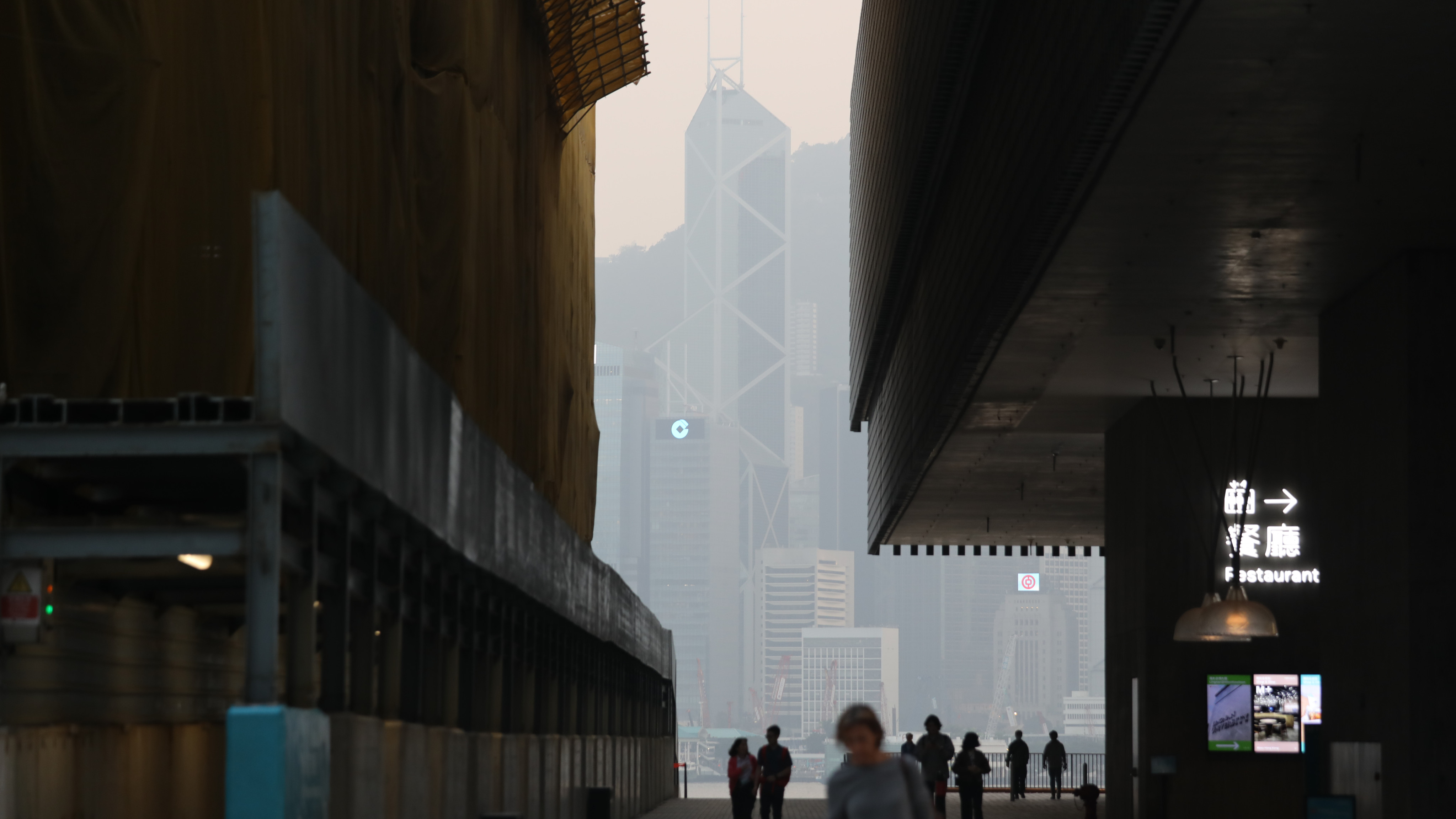

Industrial and Commercial Bank of China (ICBC)

Industrial and Commercial Bank of China (ICBC)

Founded in 1984, Industrial and Commercial Bank of China (ICBC) is one of China's 'Big Four' state-owned commercial banks - the other three are Bank of China, Agricultural Bank of China, and China Construction Bank.

Advertisement

Advertisement

Advertisement

Help preserve 120 years of quality journalism.

SUPPORT NOWAdvertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement