Advertisement

Advertisement

TOPIC

/ company

Nio

Related Topics:

Nio

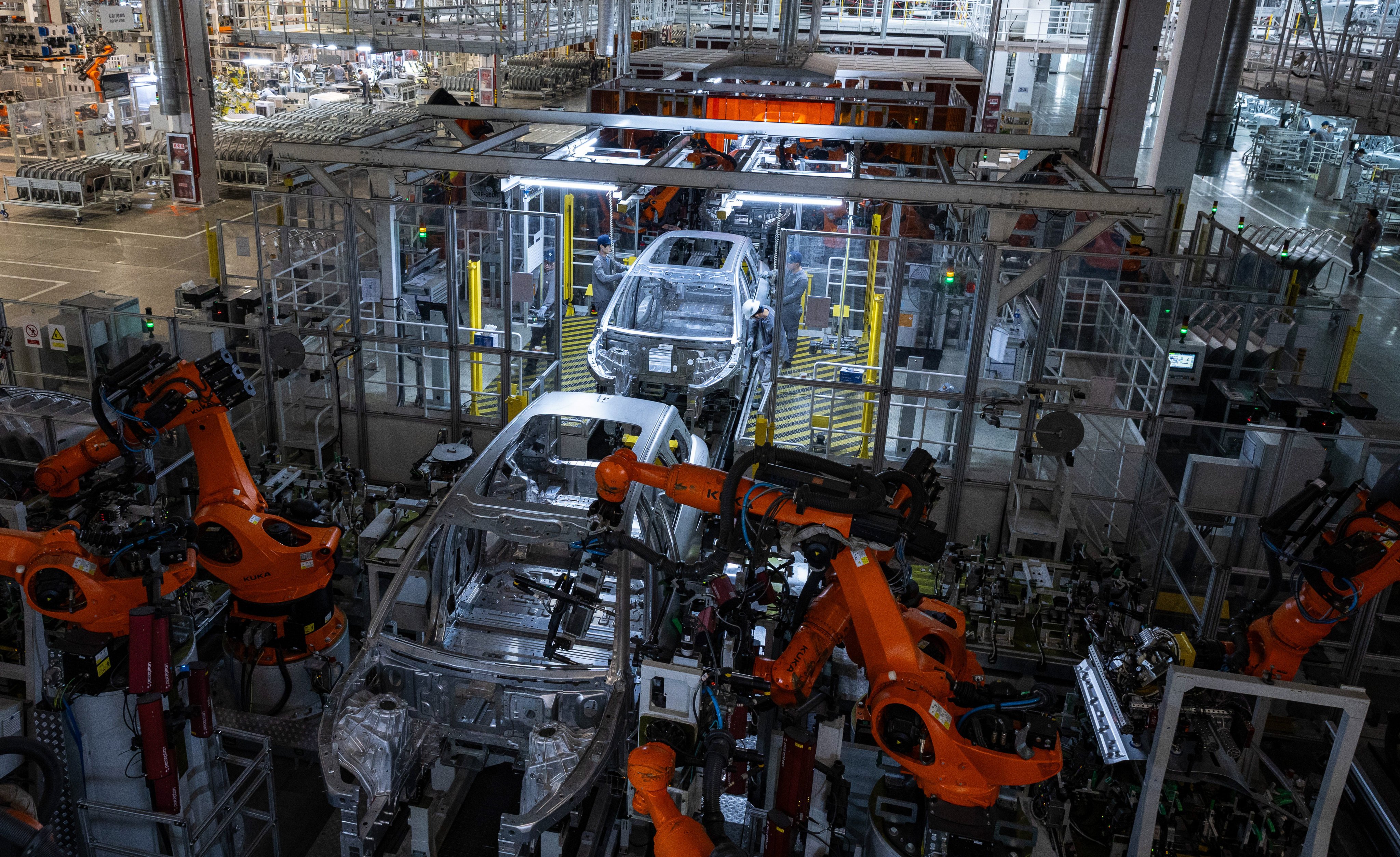

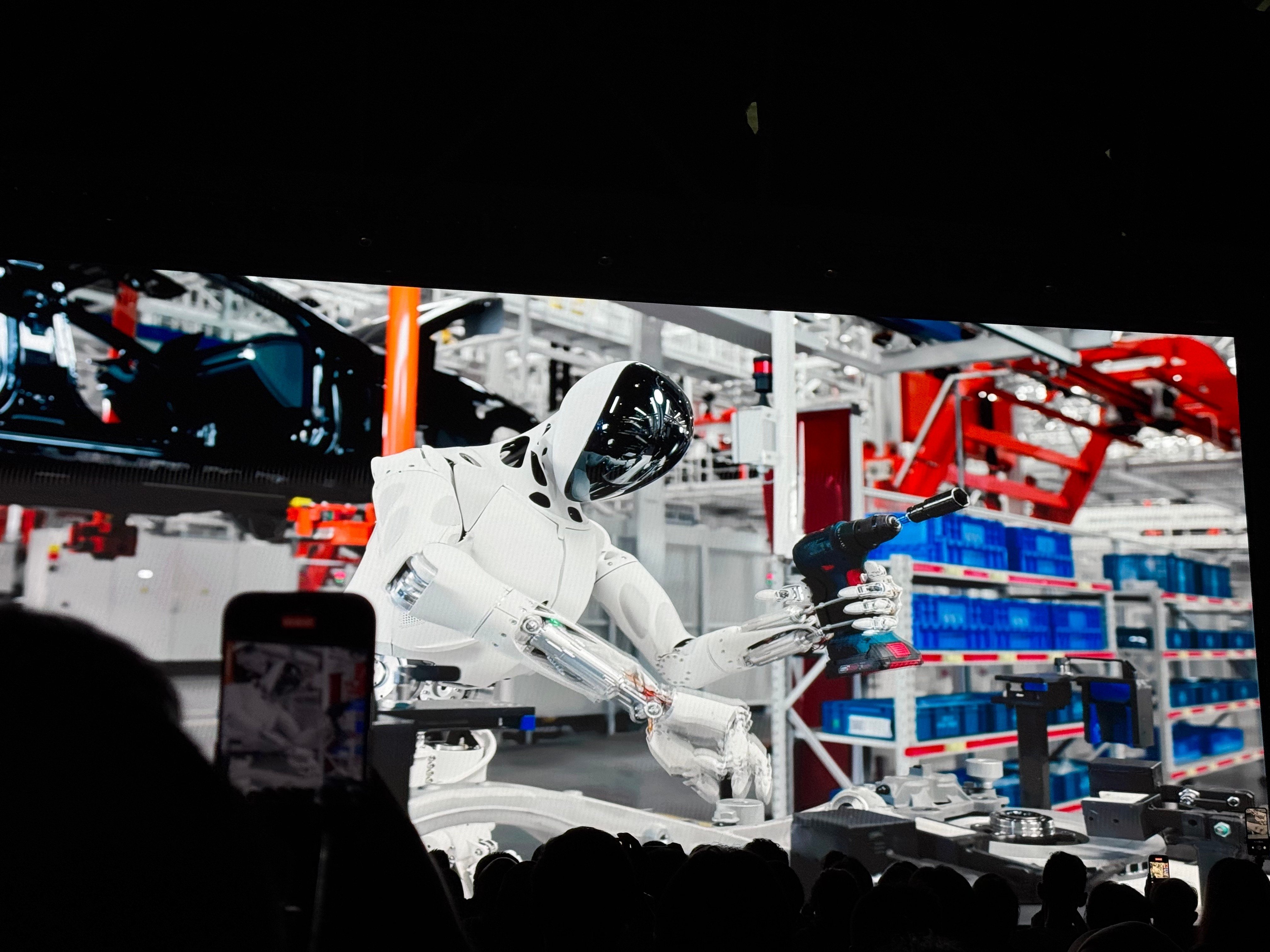

Nio builds premium electric vehicles in China. The company’s EVs feature swappable batteries that allow drivers to get back on the road minutes after pulling into battery-swap stations. It has signed partnership agreements with other carmakers, Zhejiang Geely and Changan Automobile, to build cars with the technology and expand the country’s network of swap stations. It operates two plants, both in Hefei, the capital of Anhui province.

Chairman / President

Li Bin

CEO / Managing Director

Li Bin

CFO / Finance Director

Qu Yu

Industry

Automotive, Electric Vehicles

Website

nio.com

Headquarters address

Nio House, No. 399, Kaiqing Road, Jiading District, Shanghai, China

Stock Code

NYSE:NIO

SEHK:9866

SEHK:9866

Year founded

2014

Help preserve 120 years of quality journalism.

SUPPORT NOWAdvertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement