Advertisement

Advertisement

TOPIC

Stocks

Stocks

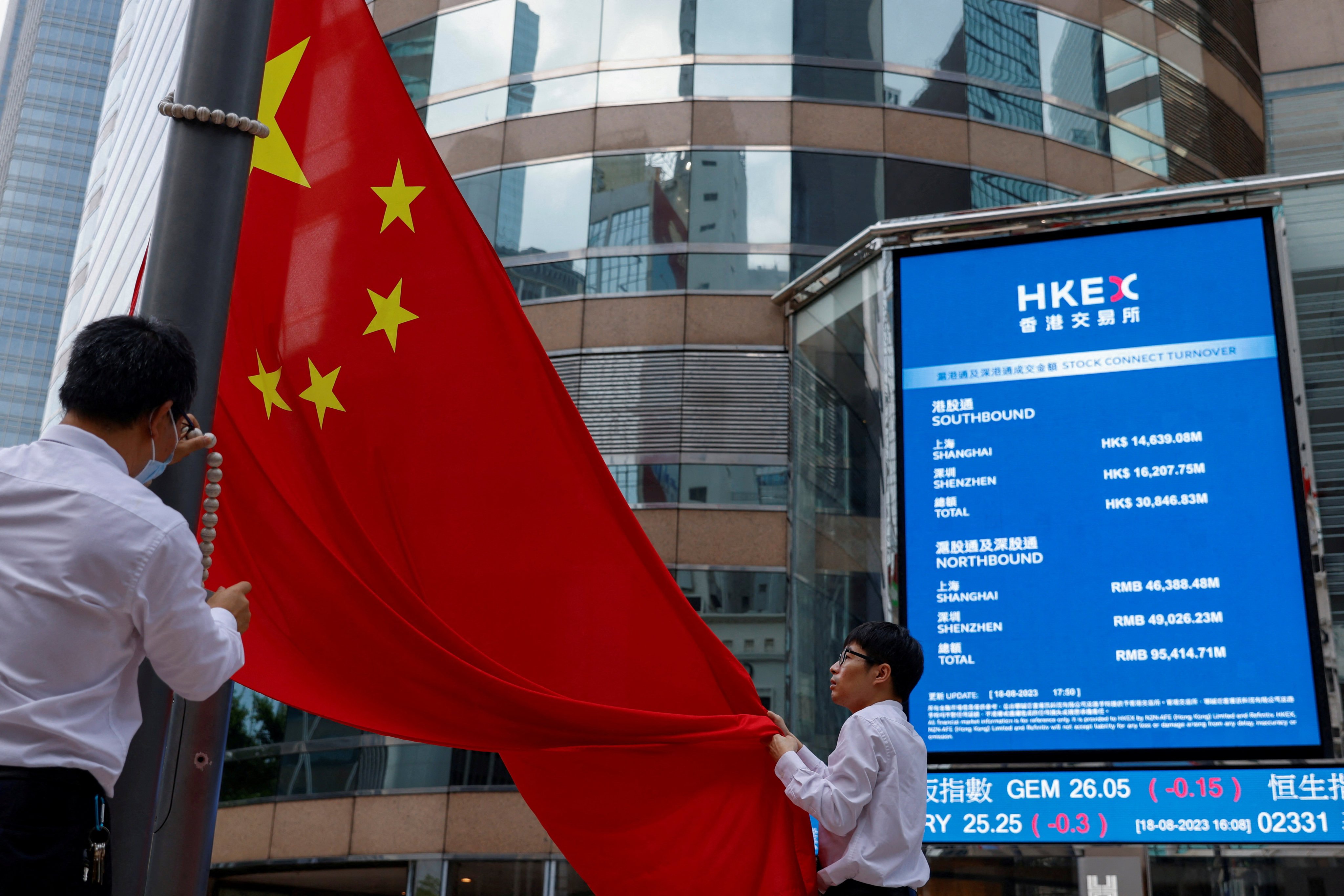

Stock market action from around the world, with a focus on Hong Kong, China and the rest of Asia.

Stocks fall, Xi-Trump-Putin calls, Japan election

This week: Chinese and Hong Kong stocks tumble in global sell-off, Xi speaks with Trump and Putin, CK Hutchison pursues arbitration after losing Panama ports case. Next week: Japan voters head to the polls on Sunday, world leaders attend the Munich Security Conference, January inflation figures come out and more.

Help preserve 120 years of quality journalism.

SUPPORT NOWAdvertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement