Advertisement

Advertisement

TOPIC

Xinjiang cotton

Xinjiang cotton

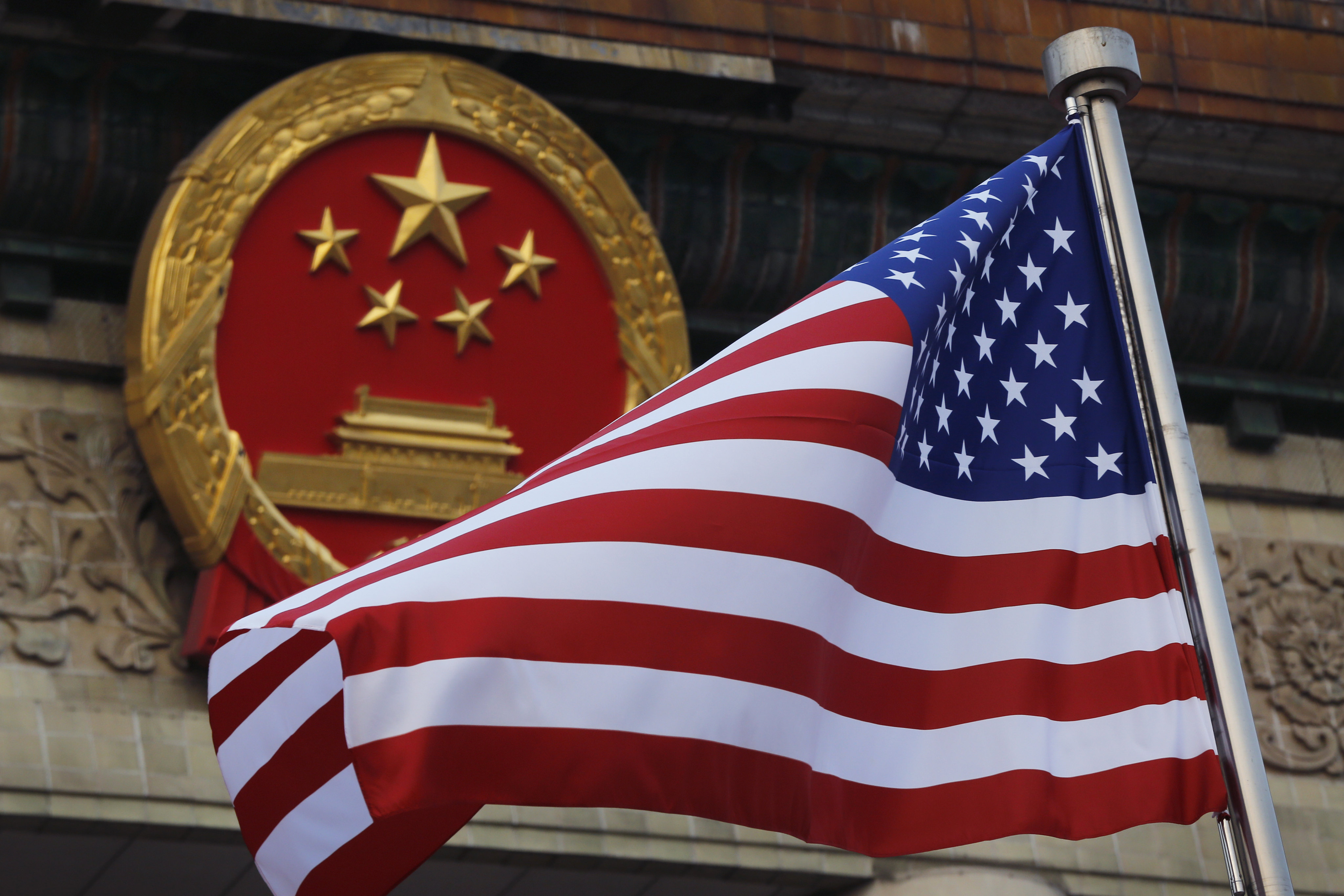

In March 2021, Chinese social media began to buzz with the news that European fashion companies such as H&M had publicly disavowed the use of cotton produced in China's Xinjiang Uygur autonomous region, citing allegations that forced labour was being used in its production. Although some of these statements had been made the previous year, the rise in awareness led to public boycotts of the brands, and some of the products being removed from Chinese-owned online marketplaces.

Inflation, 20-point services action plan and more

This week: China’s inflation rose more than expected, while exports missed estimates, the State Council plans to boost services consumption and Black Sesame’s open fizzles. Next week: China releases a slew of economic data, property developers are back in court and more.

Advertisement

Advertisement

Advertisement

Help preserve 120 years of quality journalism.

SUPPORT NOWAdvertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement