Asia-Pacific is new ‘ground zero’ for cybercrime as scammers stay ahead of law: ‘they’re sophisticated’

- The ‘attack rate’ in the Asia-Pacific is ‘well above’ the global average, with fake jobs, love scams and non-existent investment schemes among common activities

- Scammers have become more sophisticated, with the use of advanced technology and rise in e-commerce facilitating access to sensitive data, analysts say

Businesswoman Jane Li had just arrived home in Auckland from an overseas trip when she received a call from New Zealand’s immigration department.

Having anticipated a call about a visa issue raised at the airport, she spoke to an “officer” who told her instead she had been implicated in a money-laundering scheme in China. The Mandarin-speaking officer transferred her call to “Shanghai police” so she could “cooperate with the authorities”.

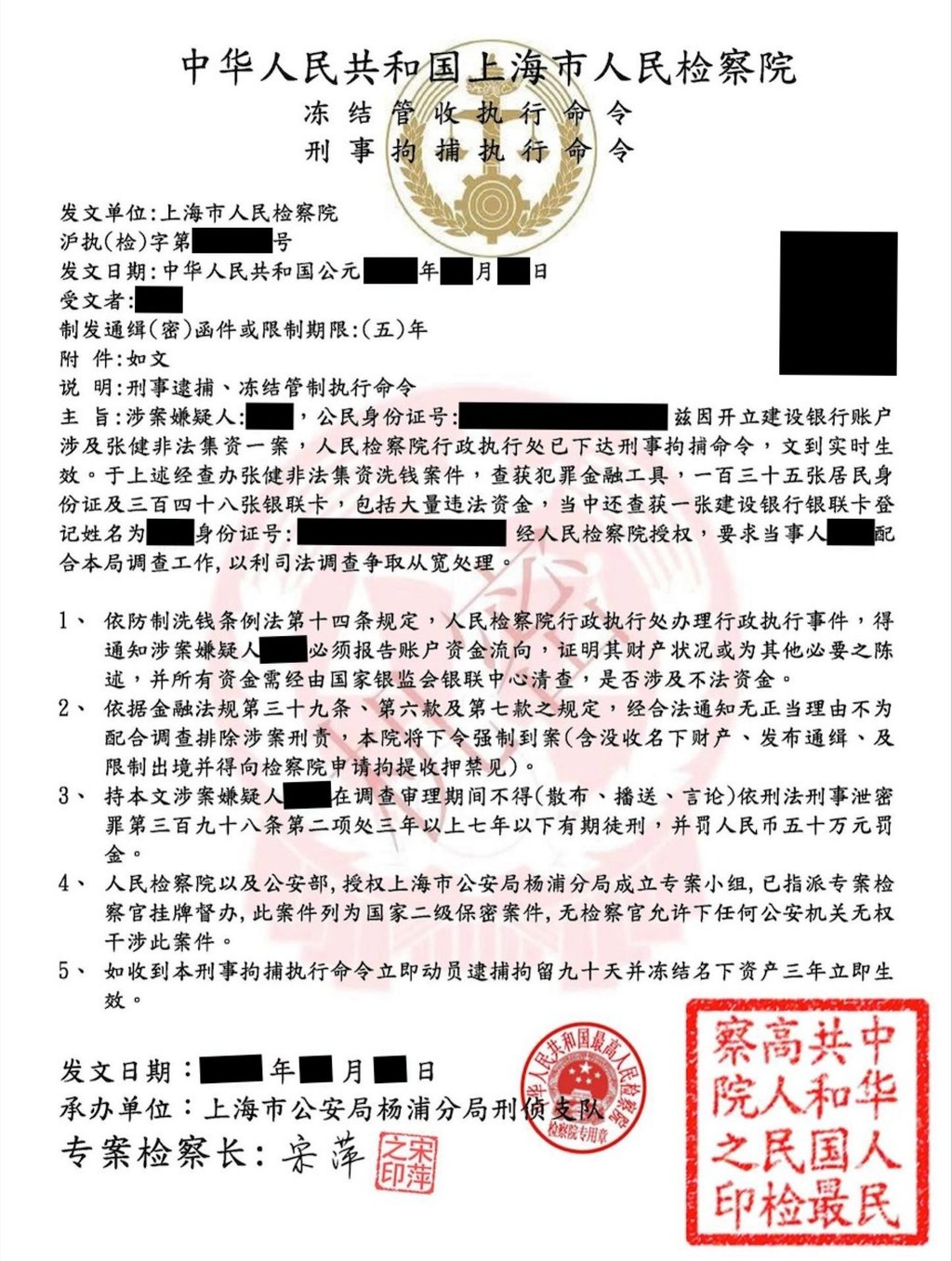

Over the next three days, scammers used authentic-looking “official documents” containing Li’s personal details and photograph in a staged video call featuring police officers in front of a “Shanghai police” logo, and told Li she would be arrested unless she paid a “bail” of 2.37 million yuan (US$334,000).

Li blocked the calls following the demand but grew concerned about how the scammers were able to glean her personal details and circumstances.

While Li did not lose money, she said the mental anguish she experienced from being interrogated was harrowing and wanted authorities to do more to clamp down on such activity.