Advertisement

Advertisement

TOPIC

/ company

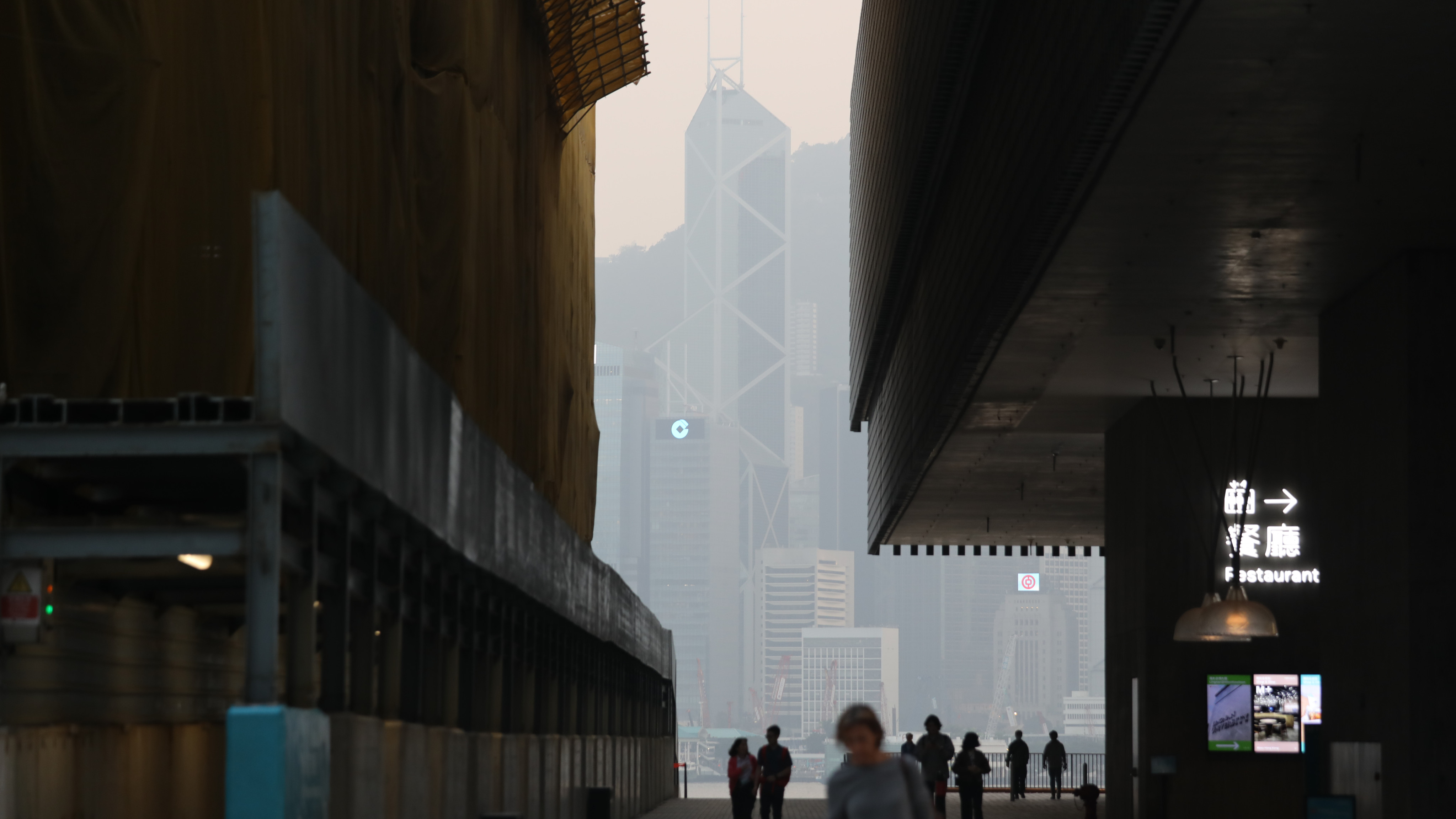

Agricultural Bank of China

Agricultural Bank of China

Agricultural Bank of China is one of the big four state-owned commercial banks in the People's Republic of China. The other three are Industrial and Commercial Bank of China, China Construction Bank and Bank of China. The Agricultural Bank of China was founded in 1951 and is based in Beijing.

Chairman / President

Gu Shu

CFO / Finance Director

Zhang Xuguang

Industry

Banking

Website

abchina.com

Headquarters address

No.69, Jianguomen Nei Avenue, Dongcheng District, Beijing, P.R.China,

Stock Code

SEHK:1288

Year founded

1951

Advertisement

Advertisement

Advertisement

Help preserve 120 years of quality journalism.

SUPPORT NOWAdvertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement