TOPIC

/ company

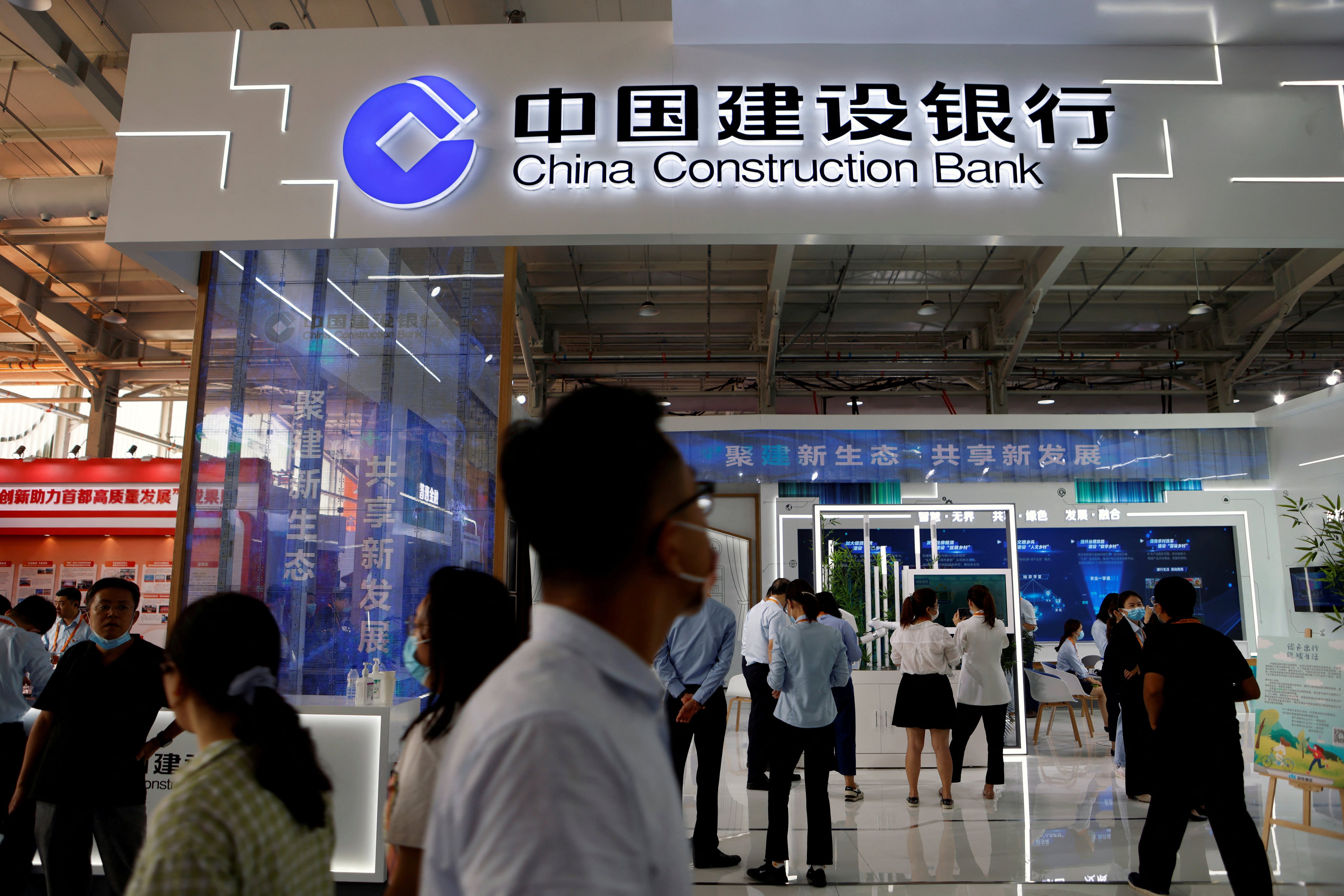

China Construction Bank

(中国建设银行)

China Construction Bank

中国建设银行

Founded in 1954 as the People’s Construction Bank of China, China Construction Bank is one of the 'big four' banks in the People's Republic of China. The other three are Industrial and Commercial Bank of China, Bank of China and Agricultural Bank of China.

Chairman / President

Zhang Jianguo

CEO / Managing Director

Zhang Jianguo

Industry

Banking, Financial Services, Fund & Asset Management

Website

ccb.com

Headquarters Address

Beijing, China

Stock Code

SSE: 601939

SEHK: 939

IDX: MCOR

SEHK: 939

IDX: MCOR

Year Founded

1954

Help preserve 120 years of quality journalism.

SUPPORT NOWAdvertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement