Topic

JPMorgan Chase is the largest bank in the United States, and one of the world’s largest public companies.

Key data for May proves disappointing and many challenges remain, but China still has some tools in the shed to turn things around.

US lender was not insolvent, but it could not produce the capital to survive a bank run, showing once again that there is virtue in preparing for a rainy day.

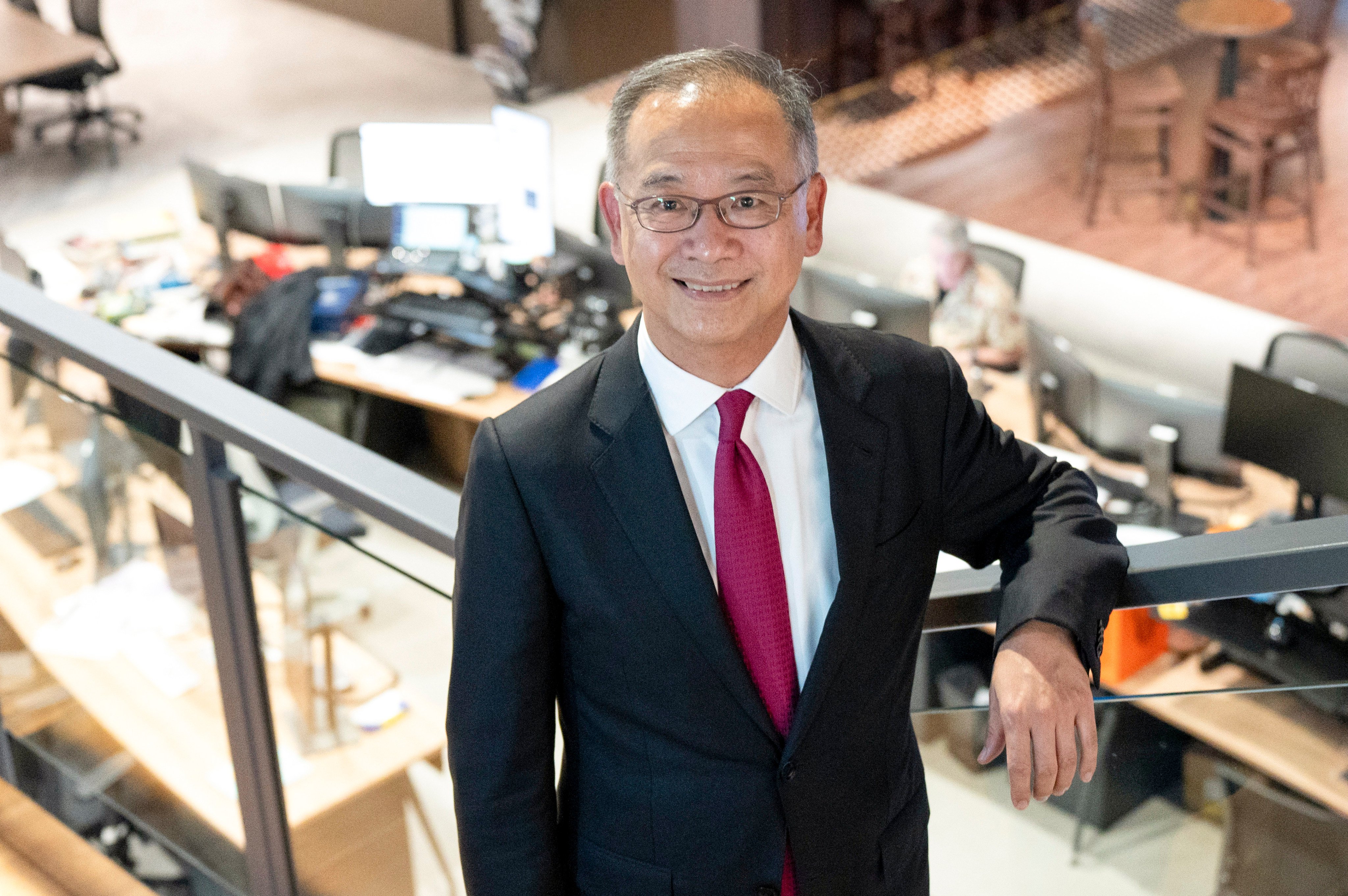

Nicolas Aguzin’s appointment as the first non-Chinese to run HKEX raised some eyebrows, given the continuing importance of attracting Chinese companies. While his experience guiding JPMorgan’s expansion into China would have weighed with the board, the question facing him now is, what next?

- Stock benchmarks in Hong Kong and Shanghai have risen 26 per cent and 15 per cent respectively from their lowest levels this year

- IPO pipelines signal better market outlook as companies become more comfortable with valuations, US bank says

Earlier this year, Dimon, 68, moved some of his top lieutenants into new senior roles, positioning them for more experience running the bank’s operations as he prepares potential successors.

Hamdan Azhar said asset manager fired him after he objected to a colleague’s self-dealing, and was forced to shut down search engine that monitored client discussions on illegal investments, including in China.

Hong Kong’s tax breaks and immigration policies to attract tycoons to set up family offices have been quite successful, as they have piqued the interest of many billionaires over the past year, banker says.

The mainland’s e-commerce sector achieved a 12 per cent overall growth in the March quarter, according to data from JPMorgan.

The bank has ‘quite an active pipeline’ of loans based on such collateral owned by ultra-high-net-worth individuals, who are often asset-rich but liquidity-constrained, private banker says.

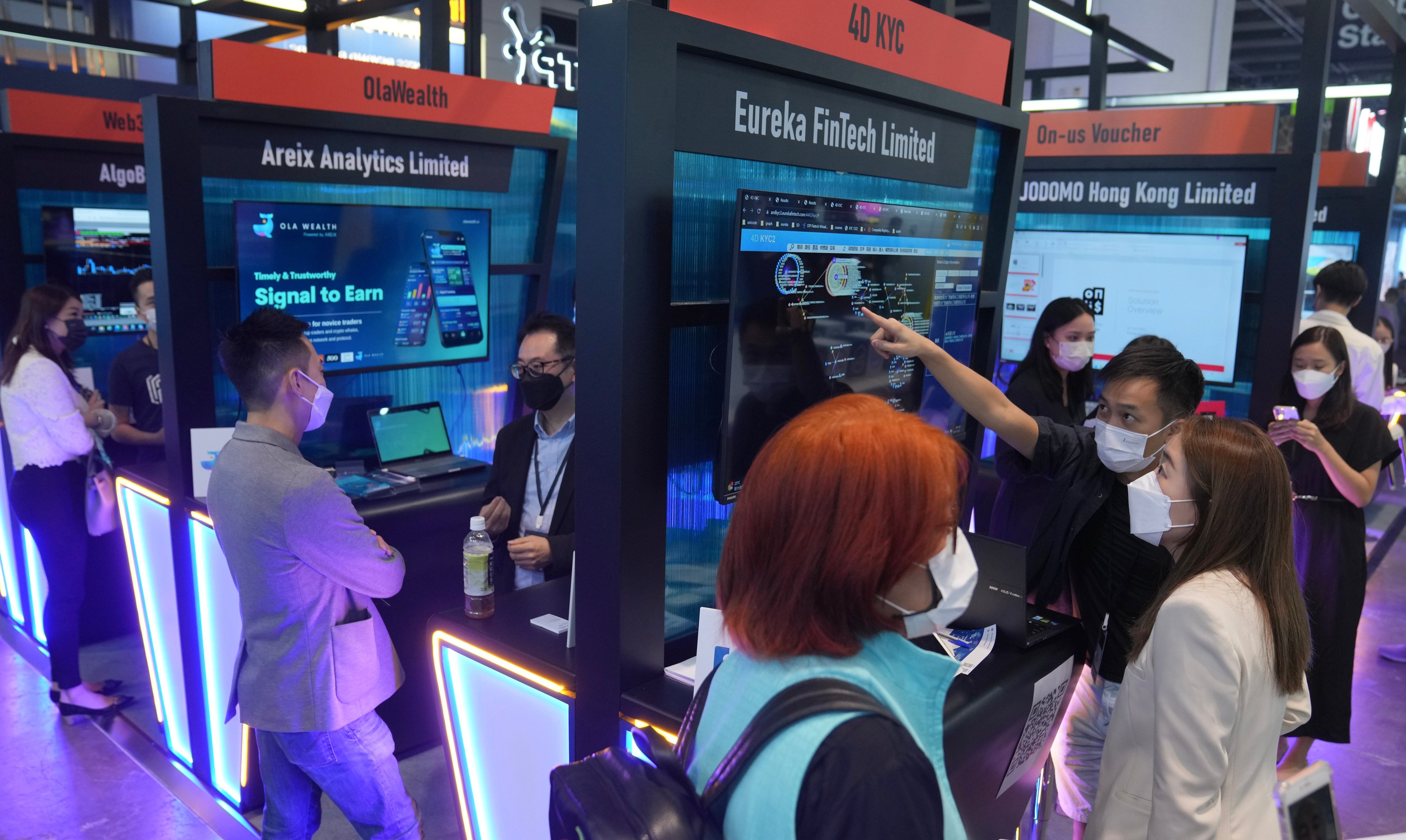

Blockchain made up about 15 per cent of the talks at Money20/20 Asia this year, just slightly below the proportion of talks on AI, as interest remains high in Asia.

BNP Paribas marks its re-entry into China’s market with hires, at a time when Morgan Stanley, Goldman Sachs and JPMorgan have all made rounds of job cuts in Hong Kong and China

AI is likely to make dramatic improvements to workers’ quality of life, but as with every new technology, some jobs will also be lost, Dimon says.

More than 40 of the 50 jobs the Wall Street firm plans to cut will be from Hong Kong and mainland China. Morgan Stanley joins a host of banks that have laid off bankers this year.

At a time when the global euphoria about AI has propelled a three-fold surge in Nvidia’s stock, investors are pointing toward emerging markets for better value and a bigger pool of options.

The New York-based bank will continue to invest in Hong Kong, betting that the city where it has been doing business for a century can recover when the economic cycle turns, and live up to its potential as the financial centre of the world’s second largest economy.

San Francisco-based Matthews International, which had fewer than 10 people in the Shanghai office, will centralise its regional research business in Hong Kong.

Artificial intelligence will become an important part of Reddit’s business, the San Francisco-based social media company says.

CEO Jamie Dimon reiterated his view that the US economy was steady, but warned that inflation could be more persistent than expected and rates higher for longer.

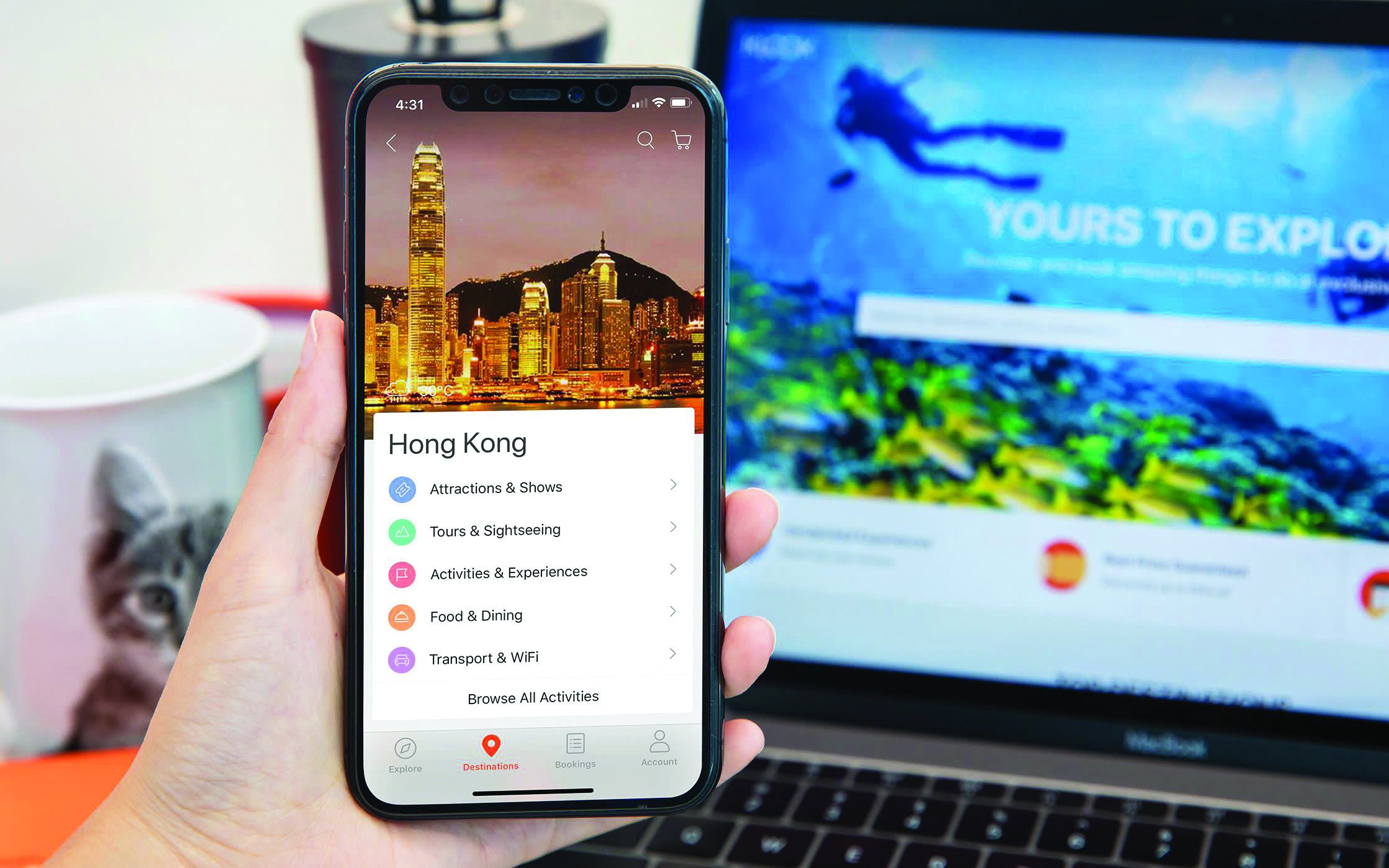

The online travel start-up, which became a unicorn in 2018, says it will use the newly raised capital to expand product offerings and boost AI adoption.

The Climate transition, wealth management and digitalisation of the financial sector will be among key drivers of Asia’s economy, a conference organised by BIS and the HKMA heard on Tuesday.

Valued at more than US$60 billion, Shein is expected to become the most valuable China-founded company to go public in the US since Didi Global’s debut in 2021 at a US$68-billion valuation.

If China allows lenders to issue loans to some developers, it ‘would be negative for banks as it would raise concerns about national service risk and credit risk in the medium term’, JPMorgan analysts say.

‘Hong Kong is probably going to be one of the biggest wealth centres in the world, and Singapore is catching up very quickly,’ says Harshika Patel.

Leaders from the world of finance and business convened in Riyadh issued a warning on Tuesday about the many perils the world currently faces, including geopolitical conflicts, economic uncertainties, high inflation and climate issues.

Invest Hong Kong’s five-day event, including a two-day conference, is set to explore a ‘new era’ as fintech innovations make their way into real-world use on a broad scale, says the city’s acting secretary for financial services.

China Resources Longdation, a property arm of state-owned conglomerate China Resources, plans to raise between US$500 million and US$1 billion in a Hong Kong initial public offering (IPO), according to three sources with direct knowledge of the matter.

About 90 top-level executives such as CEOs and chairmen are expected at this year’s event, more than double last year’s attendance.

The settlements conclude the final pieces of litigation in a saga involving women who said Epstein sexually abused them, and which embroiled some of the world’s most powerful figures in finance and business.

Strong corporate earnings and robust economic growth are drawing investors even as they flee other Asian markets including China.

The semiconductor design firm did not disclose proposed terms for the sale, but it is expected to seek a valuation of US$60 billion to US$70 billion.

China’s biggest property developer Country Garden cancelled a HK$2.34 billion (US$300 million) share placement, IFR reported, citing a message sent to investors.

Hong Kong universities’ business and commerce students have voted JPMorgan and HSBC the top two employers for the second straight year, while those studying for engineering and natural sciences picked the city’s government for the fourth consecutive year.