TOPIC

/ people

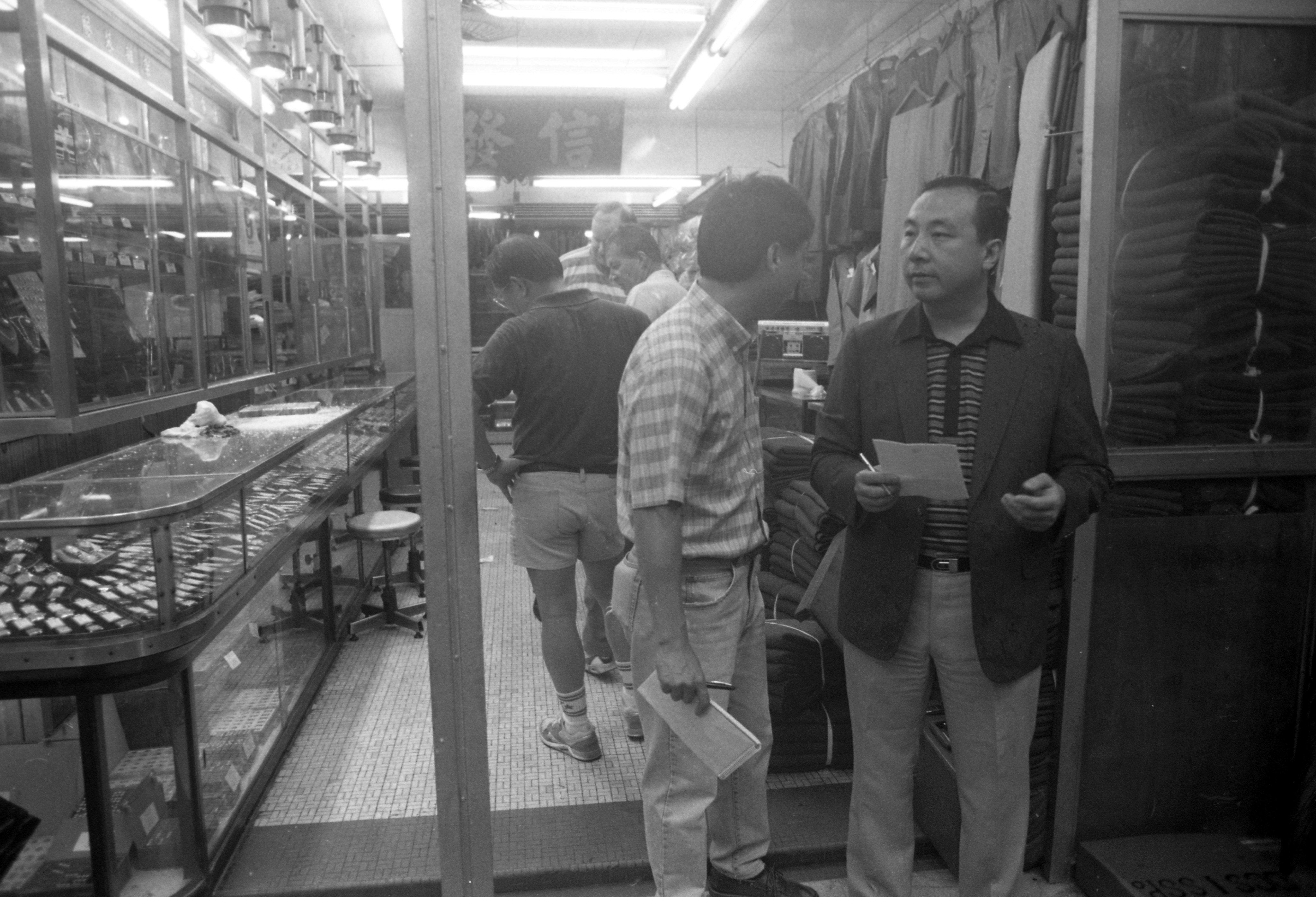

Victor Li

Related Topics:

Victor Li

Victor Li Tzar-Kuoi is the elder son of Li Ka-shing, a rags-to-riches tycoon known as “Superman” in Hong Kong, his adoptive home. Li Ka-shing in 2012 anointed Victor Li to follow him at the helm of flagship property developer Cheung Kong (Holdings) Ltd, and Hutchison Whampoa Ltd, a conglomerate whose activities span ports, telecoms retailing, energy and infrastructure. His younger brother is Richard Li Tzar-kai, chairman of phone, pay-television and Internet company PCCW Ltd, formerly Hongkong Telecom.

Born

1 Aug 1964

Industry

Business

Job Title

Businessman

ParknShop imports mainland goods as Hongkongers hunt for bargains in Shenzhen

The supermarket chain is importing more products from mainland China in a bid to lure Hongkongers who have taken to travelling to Shenzhen and other mainland cities where they can shop and dine for cheaper, says chairman of CK Hutchison.

Advertisement

Advertisement

Advertisement

Help preserve 120 years of quality journalism.

SUPPORT NOWAdvertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement