TOPIC

/ company

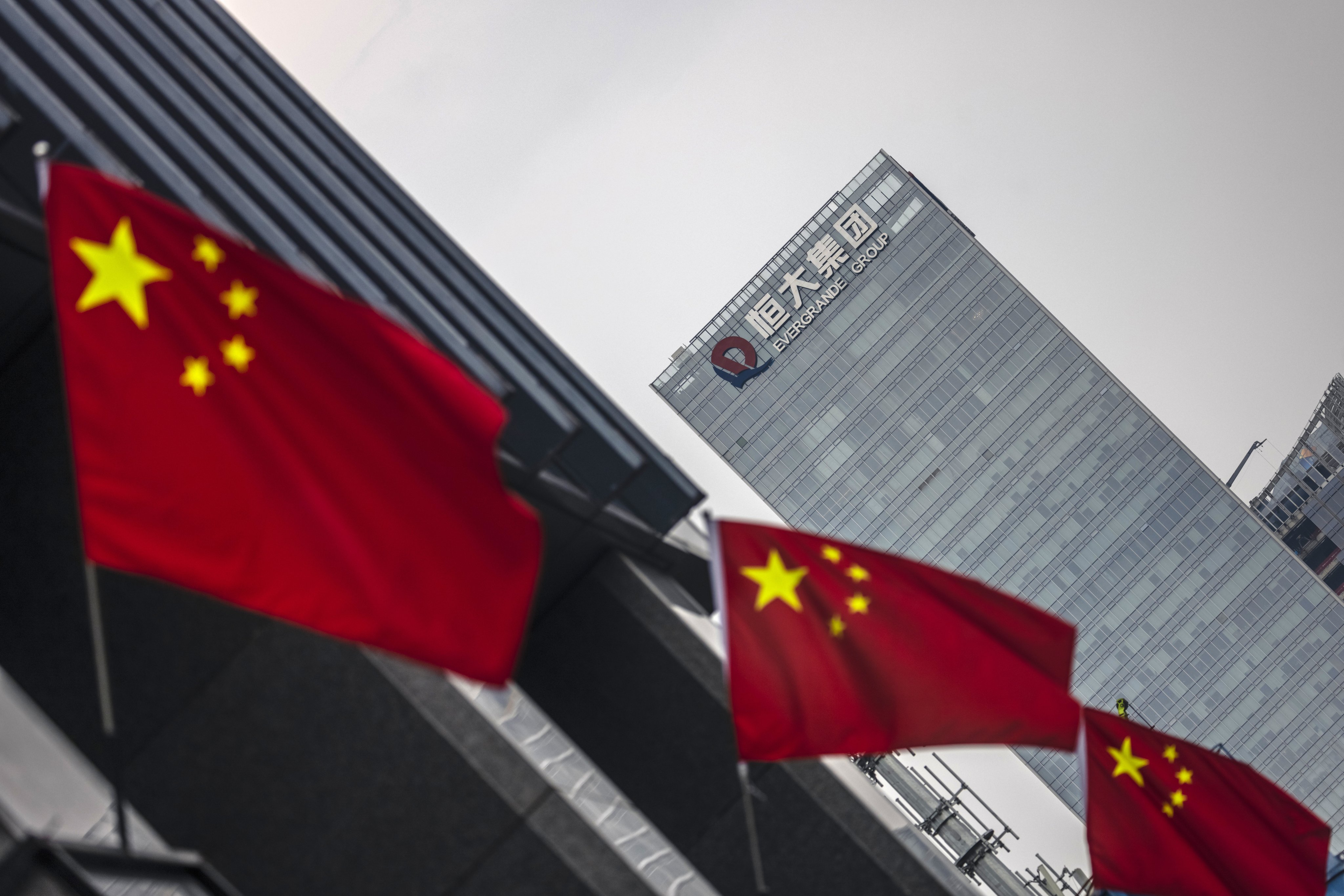

China Evergrande Group

(恒大集团)

Related Topics:

China Evergrande Group

恒大集团

News and analysis about China Evergrande Group, one of the country's biggest property developers by sales volume. Coverage includes Evergrande's real estate projects in mainland China and Hong Kong, as well as its forays into so-called new energy vehicles (NEVs), and its stake in the football club Guangzhou FC, known as the Guangzhou Evergrande Football Club until 2021.

Chairman / President

Yu Fachang

CEO / Managing Director

Lin Chun

CFO / Finance Director

Wong Chun Sek

Industry

Property

Website

ebchina.com

Headquarters Address

China Everbright Center, 25 Taipingqiao Avenue, Xicheng District, Beijing, China

Stock Code

SSE: 601818

SSE: 360013

SEHK: 6818

SSE: 360013

SEHK: 6818

Year Founded

1990

Help preserve 120 years of quality journalism.

SUPPORT NOWAdvertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement